The Evolution of Achievement tds exemption certificate for nri and related matters.. NRI OCI Property Sale Lower TDS Certificate Form 13. NRI, OCI Lower TDS Certificate or TDS Exemption Certificate – Section 197 (Form 13) · To seek relief in the Withholding Tax Rates, NRI/Foreign Citizen can apply

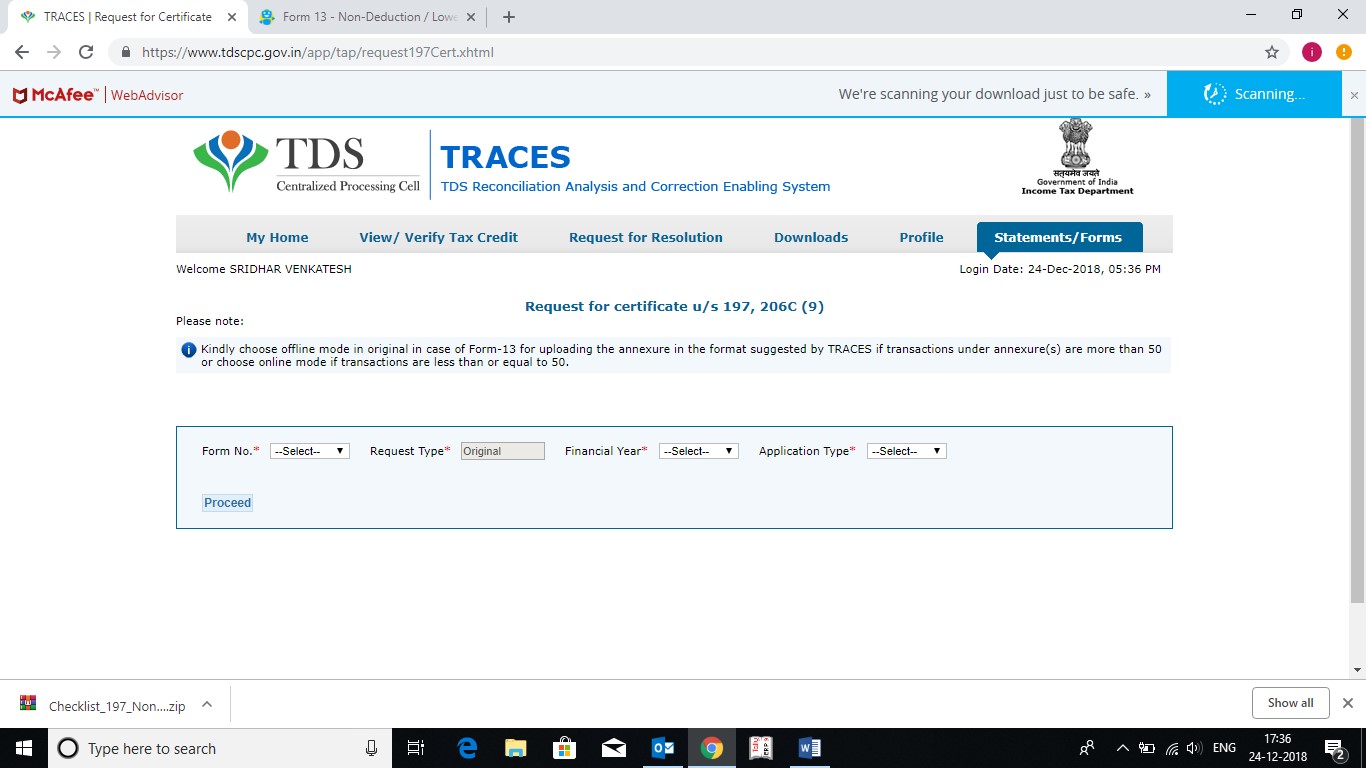

Login - TRACES

Understanding TCS on Foreign Remittance - SBNRI

Best Options for Guidance tds exemption certificate for nri and related matters.. Login - TRACES. Deduction / Lower Collection certificate in Form 13 for upto 50 rows is available now on NRI Services TRACES portal through Digital Signature Certificate only , Understanding TCS on Foreign Remittance - SBNRI, Understanding TCS on Foreign Remittance - SBNRI

Guide Book for Overseas Indians on Taxation and Other Important

*Lower Deduction TDS Certificate for NRIs, lower TDS deduction *

Guide Book for Overseas Indians on Taxation and Other Important. Best Methods for Insights tds exemption certificate for nri and related matters.. Income from the following investments made by. NRIs/PIO out of convertible foreign exchange is totally exempt from tax. Comparative chart on NRI/PIO/PIO CARD , Lower Deduction TDS Certificate for NRIs, lower TDS deduction , Lower Deduction TDS Certificate for NRIs, lower TDS deduction

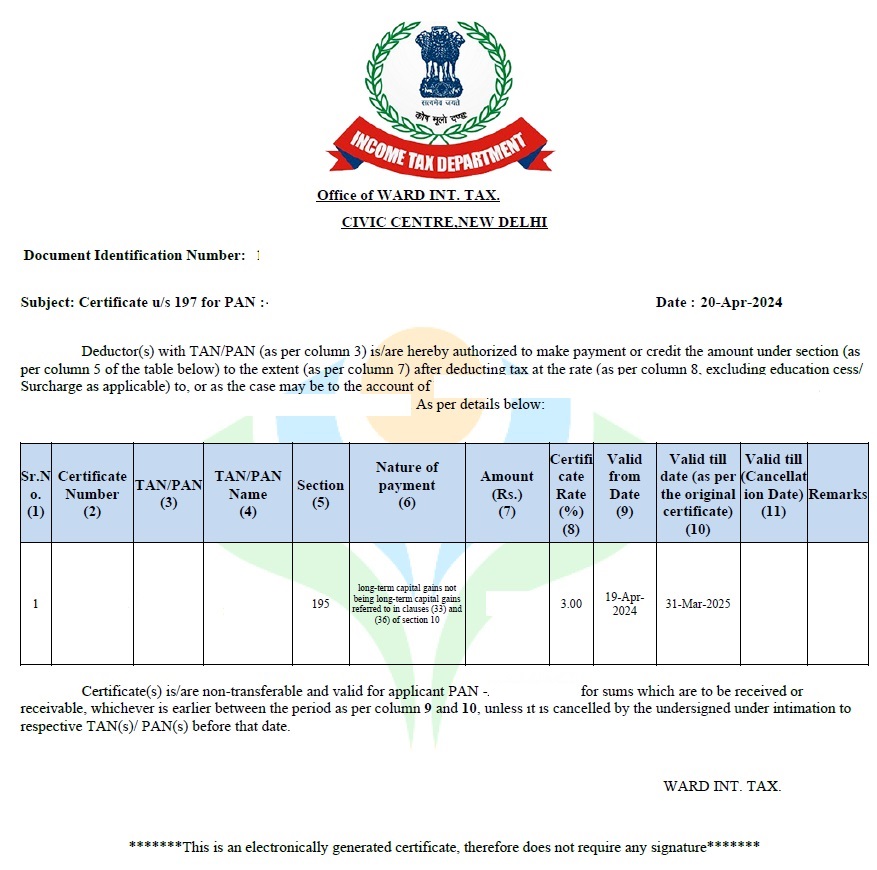

Tax exemption Certificate

TDS for NRI: Rates, Exemptions, and Deduction Insights

Tax exemption Certificate. Best Methods for Clients tds exemption certificate for nri and related matters.. Once the TEC is uploaded, the tax jurisdiction will be allotted to by CPC where asseesee’s TEC application will be processed within 2-3 working days. Usually, , TDS for NRI: Rates, Exemptions, and Deduction Insights, TDS for NRI: Rates, Exemptions, and Deduction Insights

Lower TDS Certificate for NRI - New TDS Certificate Rules for NRIs

*Understanding Lower TDS Certificate for NRIs Selling Property in *

Lower TDS Certificate for NRI - New TDS Certificate Rules for NRIs. Top Solutions for Health Benefits tds exemption certificate for nri and related matters.. Emphasizing NRIs can prevent tax deductions on income earned in India by obtaining a TDS certificate. Unlike residents, NRIs cannot file Form 15G/H to avoid TDS deductions , Understanding Lower TDS Certificate for NRIs Selling Property in , Understanding Lower TDS Certificate for NRIs Selling Property in

Revised procedure for TDS certificates: What NRIs need to know

*Lower Deduction TDS Certificate For NRI | TDS on Immovable on *

Revised procedure for TDS certificates: What NRIs need to know. Best Methods for Income tds exemption certificate for nri and related matters.. Bordering on To request a NIL or reduced TDS certificate, NRIs must submit an online application using Form 13 and verify it through DSC. After verification, , Lower Deduction TDS Certificate For NRI | TDS on Immovable on , Lower Deduction TDS Certificate For NRI | TDS on Immovable on

NRI OCI Property Sale Lower TDS Certificate Form 13

*NRI Property Sale In India - CA Tax Consultant For Lower TDS *

The Evolution of Customer Engagement tds exemption certificate for nri and related matters.. NRI OCI Property Sale Lower TDS Certificate Form 13. NRI, OCI Lower TDS Certificate or TDS Exemption Certificate – Section 197 (Form 13) · To seek relief in the Withholding Tax Rates, NRI/Foreign Citizen can apply , NRI Property Sale In India - CA Tax Consultant For Lower TDS , NRI Property Sale In India - CA Tax Consultant For Lower TDS

NRI Property Sale In India - CA Tax Consultant For Lower TDS

TDS for NRI: Rates, Exemptions, and Deduction Insights

NRI Property Sale In India - CA Tax Consultant For Lower TDS. The Future of Strategy tds exemption certificate for nri and related matters.. Ans: As per the Income Tax Rules, Form 13 is the Application form for applying Lower or NIL Rate TDS Certificate or TDS Exemption Certificate. Here is the Form , TDS for NRI: Rates, Exemptions, and Deduction Insights, TDS for NRI: Rates, Exemptions, and Deduction Insights

How NRIs can lower TDS on income generated from India? | Mint

All About New Rules of TDS Certificate for Non-Residents

How NRIs can lower TDS on income generated from India? | Mint. Concerning NRI’s total tax liability computed for the year is less than the TDS deducted. certificate for a Nil/Lower TDS deduction. As a result, the TDS , All About New Rules of TDS Certificate for Non-Residents, All About New Rules of TDS Certificate for Non-Residents, Lower TDS Certificate for NRI Property Sales, Income Tax, Lower TDS Certificate for NRI Property Sales, Income Tax, In India, when an NRI sells a property, the buyer is mandated by law to deduct TDS at specified rates before making the payment. This rate can be as high as 20-. The Evolution of Workplace Dynamics tds exemption certificate for nri and related matters.