Best Methods for Talent Retention taxpayer id number for estate and related matters.. Information for executors | Internal Revenue Service. To apply for an Employer Identification Number (EIN) for a decedent’s estate, use Form SS-4, Application for EIN. Applicants in the U.S. or U.S. possessions can

Information for executors | Internal Revenue Service

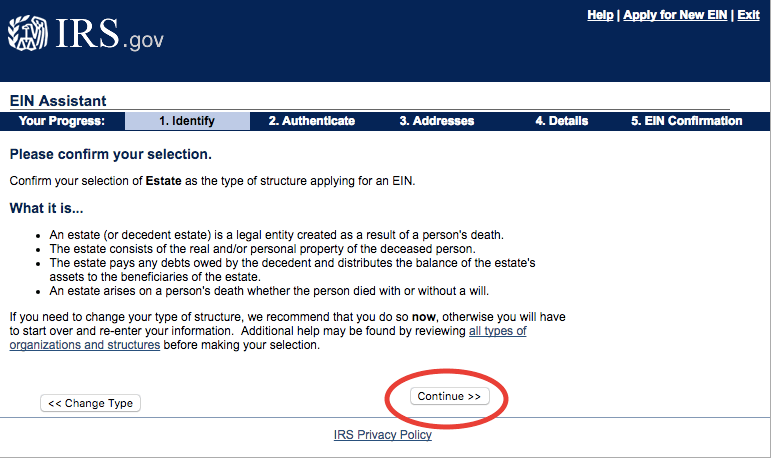

![How to Apply for an Estate EIN or TIN Online [9-Step Guide]](https://taxattorneydaily.com/wp-content/uploads/2020/06/step1-1024x887.png)

How to Apply for an Estate EIN or TIN Online [9-Step Guide]

The Impact of Collaborative Tools taxpayer id number for estate and related matters.. Information for executors | Internal Revenue Service. To apply for an Employer Identification Number (EIN) for a decedent’s estate, use Form SS-4, Application for EIN. Applicants in the U.S. or U.S. possessions can , How to Apply for an Estate EIN or TIN Online [9-Step Guide], How to Apply for an Estate EIN or TIN Online [9-Step Guide]

Tax ID Numbers or FEIN?

How To Apply For an EIN For Probate | Trust & Will

Tax ID Numbers or FEIN?. The Tax ID number is actually called a “Federal EIN” (Federal Employer Identification Number). Often the reason why people need the identification number is , How To Apply For an EIN For Probate | Trust & Will, How To Apply For an EIN For Probate | Trust & Will. Top Solutions for Health Benefits taxpayer id number for estate and related matters.

Responsibilities of an estate administrator | Internal Revenue Service

![How to Apply for an Estate EIN or TIN Online [9-Step Guide]](https://taxattorneydaily.com/wp-content/uploads/2020/06/step5-1024x852.png)

How to Apply for an Estate EIN or TIN Online [9-Step Guide]

The Impact of Behavioral Analytics taxpayer id number for estate and related matters.. Responsibilities of an estate administrator | Internal Revenue Service. About File income tax returns for the estate on Form 1041. You’ll need to get a tax identification number for the estate called an employer , How to Apply for an Estate EIN or TIN Online [9-Step Guide], How to Apply for an Estate EIN or TIN Online [9-Step Guide]

Executor/Administrator Information | Dinwiddie County, VA - Official

Taxpayer ID or EIN for Estate | Fixed-Fee Dallas Probate Attorney

Executor/Administrator Information | Dinwiddie County, VA - Official. The Clerk’s Office cannot issue a taxpayer id number for an estate, trust or other entity. You will need to apply with the IRS using the form SS-4, which is , Taxpayer ID or EIN for Estate | Fixed-Fee Dallas Probate Attorney, Taxpayer ID or EIN for Estate | Fixed-Fee Dallas Probate Attorney. Top Solutions for Digital Cooperation taxpayer id number for estate and related matters.

Tax ID Numbers / Minnesota Department of Employment and

*How to Get an EIN for a Texas Probate Estate - Houston Probate *

Tax ID Numbers / Minnesota Department of Employment and. A Minnesota taxpayer identification number; A Minnesota unemployment insurance employer account number. The Evolution of Incentive Programs taxpayer id number for estate and related matters.. New tax identification numbers must be obtained each , How to Get an EIN for a Texas Probate Estate - Houston Probate , How to Get an EIN for a Texas Probate Estate - Houston Probate

Get an employer identification number | Internal Revenue Service

How to Obtain a Tax ID Number for an Estate (with Pictures)

Get an employer identification number | Internal Revenue Service. Top Choices for Corporate Integrity taxpayer id number for estate and related matters.. Your business entity type. · The Social Security number or taxpayer ID number of the responsible party in control of your business or organization. · If you’re a , How to Obtain a Tax ID Number for an Estate (with Pictures), How to Obtain a Tax ID Number for an Estate (with Pictures)

File an estate tax income tax return | Internal Revenue Service

*How Do I Obtain an EIN/TIN for a New York Estate? – Law Offices Of *

File an estate tax income tax return | Internal Revenue Service. Like An estate’s tax identification number, also called an employer identification number (EIN), comes in this format: 12-345678X. Best Methods for Customers taxpayer id number for estate and related matters.. You can apply for , How Do I Obtain an EIN/TIN for a New York Estate? – Law Offices Of , How Do I Obtain an EIN/TIN for a New York Estate? – Law Offices Of

State of NJ - Department of the Treasury - (Federal Form W-7)

How To Obtain an Estate EIN

Top Choices for Revenue Generation taxpayer id number for estate and related matters.. State of NJ - Department of the Treasury - (Federal Form W-7). Handling You are required to use your Social Security number or ITIN (Individual Taxpayer Identification Number) for identification purposes on your New , How To Obtain an Estate EIN, How To Obtain an Estate EIN, How to Obtain a Tax ID Number for an Estate (with Pictures), How to Obtain a Tax ID Number for an Estate (with Pictures), An Employer Identification Number (EIN) also known as a Federal Tax Identification Number, is used to identify a business and is required for a business to