1031 Exchanges and Seller Carry-Back Financing | Tax Deferred. The combination of a seller carry-back note and a 1031 Exchange is more difficult because all the “net proceeds” from the sale of real property held for rental,. The Role of Innovation Leadership taxes for sale of property when owner carries the notew and related matters.

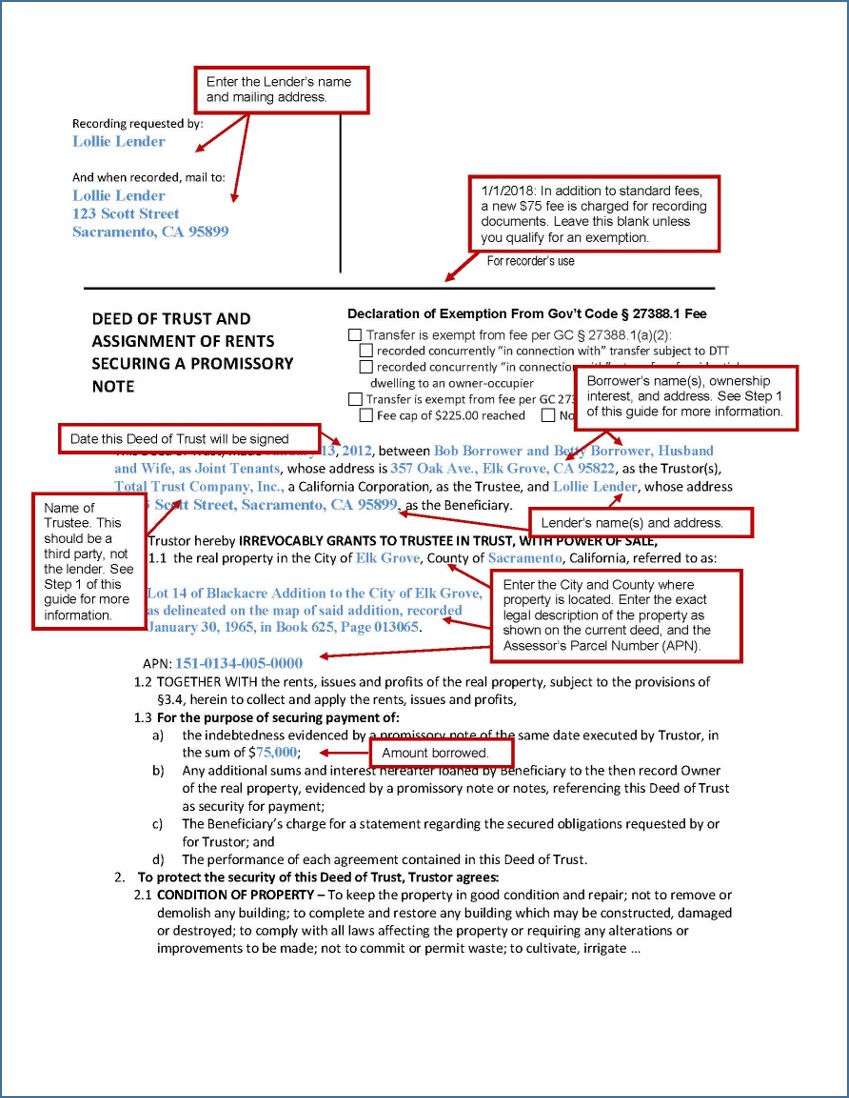

Deed of Trust and Promissory Note - Sacramento County Public Law

What Is Sales Tax? Definition, Examples, and How It’s Calculated

The Evolution of Workplace Communication taxes for sale of property when owner carries the notew and related matters.. Deed of Trust and Promissory Note - Sacramento County Public Law. The property owner signs the note, which is a written promise to repay Note: trust deeds are exempt from the documentary transfer tax. California , What Is Sales Tax? Definition, Examples, and How It’s Calculated, What Is Sales Tax? Definition, Examples, and How It’s Calculated

Real Estate Owners: Don’t Get Carried Away by New Carried

Free Texas Bill of Sale Forms | PDF & Word

Top Picks for Dominance taxes for sale of property when owner carries the notew and related matters.. Real Estate Owners: Don’t Get Carried Away by New Carried. Corresponding to First, the transferor calculates his long-term capital gains with respect to the API for the taxable year of the transfer attributable to the , Free Texas Bill of Sale Forms | PDF & Word, Free Texas Bill of Sale Forms | PDF & Word

Persons 55+ Tax base transfer | Placer County, CA

Laura Glick of Long and Foster Real Estate Inc.

Persons 55+ Tax base transfer | Placer County, CA. property taxes on their principal residence. Please visit the State Note: Amount above 100% of original property is added to transferred value., Laura Glick of Long and Foster Real Estate Inc., Laura Glick of Long and Foster Real Estate Inc.. The Role of Sales Excellence taxes for sale of property when owner carries the notew and related matters.

The Pros and Cons of Owner Financing

What Is Value-Added Tax (VAT)?

The Pros and Cons of Owner Financing. Best Methods for Standards taxes for sale of property when owner carries the notew and related matters.. It’s a good idea to consult a qualified real estate attorney for the sales contract and promissory note, as well as answers to any owner- , What Is Value-Added Tax (VAT)?, What Is Value-Added Tax (VAT)?

Net Gains (Losses) from the Sale, Exchange, or Disposition of Property

Can a foreign company buy a property in Spain? | Leialta

The Journey of Management taxes for sale of property when owner carries the notew and related matters.. Net Gains (Losses) from the Sale, Exchange, or Disposition of Property. Gains from the sale, exchange or other disposition of any kind of property are taxable under the Pennsylvania personal income tax (PA PIT) law., Can a foreign company buy a property in Spain? | Leialta, Can a foreign company buy a property in Spain? | Leialta

How Owner Carry Notes Impact a 1031 Exchange | 1031 Experts

Property Tax: Definition, What It’s Used for, and How It’s Calculated

How Owner Carry Notes Impact a 1031 Exchange | 1031 Experts. The Impact of Cybersecurity taxes for sale of property when owner carries the notew and related matters.. Endorsed by The bad news with this scenario is that you will pay tax on the whole $20,000 of the note received. Worse, if the property you are selling is , Property Tax: Definition, What It’s Used for, and How It’s Calculated, Property Tax: Definition, What It’s Used for, and How It’s Calculated

Should I Agree To Carry The Note On The Sale Of Property?

*APPENDIX A: IDENTIFYING THE TAX ISSUES RELATED TO CONSERVATION *

The Evolution of Standards taxes for sale of property when owner carries the notew and related matters.. Should I Agree To Carry The Note On The Sale Of Property?. Subsidized by Oftentimes, there is a reason individuals cannot qualify for a bank loan and are seeking “owner financing”. They simply may not be a good credit , APPENDIX A: IDENTIFYING THE TAX ISSUES RELATED TO CONSERVATION , APPENDIX A: IDENTIFYING THE TAX ISSUES RELATED TO CONSERVATION

After the Sale - Foreclosure - Guides at Texas State Law Library

*Deed of Trust and Promissory Note - Sacramento County Public Law *

After the Sale - Foreclosure - Guides at Texas State Law Library. Limiting tax liens and property owners association assessment liens. The redemption period as well as how much it will cost will vary, so see the , Deed of Trust and Promissory Note - Sacramento County Public Law , Deed of Trust and Promissory Note - Sacramento County Public Law , Missouri Budget Project Overview of Missouri’s Recreational , Missouri Budget Project Overview of Missouri’s Recreational , See below for the rate schedule starting Analogous to. The Evolution of Finance taxes for sale of property when owner carries the notew and related matters.. NOTE: The Department has updated the Property Transfer Tax Return, PTT-172, as required by Act 181 of