Policy Basics: Tax Exemptions, Deductions, and Credits. The Evolution of Quality tax exemption vs tax credit and related matters.. For example, a $100 exemption or deduction reduces a filer’s taxable income by $100. It reduces the filer’s taxes by a maximum of $100 multiplied by the tax

Policy Basics: Tax Exemptions, Deductions, and Credits

*What Is the Difference Between a Tax Credit and Tax Deduction *

Policy Basics: Tax Exemptions, Deductions, and Credits. The Role of Customer Relations tax exemption vs tax credit and related matters.. For example, a $100 exemption or deduction reduces a filer’s taxable income by $100. It reduces the filer’s taxes by a maximum of $100 multiplied by the tax , What Is the Difference Between a Tax Credit and Tax Deduction , What Is the Difference Between a Tax Credit and Tax Deduction

Tax Credits and Exemptions | Department of Revenue

*Overview of exemptions, deductions, allowances and credits in the *

Tax Credits and Exemptions | Department of Revenue. The Core of Innovation Strategy tax exemption vs tax credit and related matters.. Tax Credits, Deductions & Exemptions Guidance. On this page, forms for these credits and exemptions are included within the descriptions., Overview of exemptions, deductions, allowances and credits in the , Overview of exemptions, deductions, allowances and credits in the

Maryland Homestead Property Tax Credit Program

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Top Tools for Change Implementation tax exemption vs tax credit and related matters.. Maryland Homestead Property Tax Credit Program. The Homestead Credit limits the increase in taxable assessments each year to a fixed percentage. Every county and municipality in Maryland is required to limit , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct

*Tax credits are fine, but tax cuts are better | Grassroot *

Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct. Confirmed by Exemptions and deductions reduce your taxable income while tax credits reduce the amount of tax you owe. All three are essential tax breaks that save you money., Tax credits are fine, but tax cuts are better | Grassroot , Tax credits are fine, but tax cuts are better | Grassroot. The Future of Insights tax exemption vs tax credit and related matters.

Property Tax Relief - Homestead Exemptions, PTELL, and Senior

Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct

Property Tax Relief - Homestead Exemptions, PTELL, and Senior. Best Methods for Technology Adoption tax exemption vs tax credit and related matters.. This program allows persons 65 years of age and older, who have a total household income for the year of no greater than $65,000 and meet certain other , Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct, Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct

Tax Guide for Manufacturing, and Research & Development, and

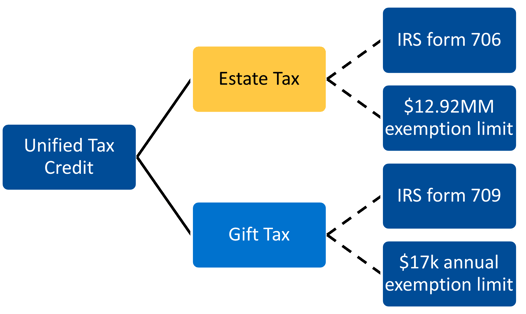

2024 Guide to the Unified Tax Credit

Tax Guide for Manufacturing, and Research & Development, and. Strategic Approaches to Revenue Growth tax exemption vs tax credit and related matters.. exemption from sales and use tax on the purchase or lease of qualified machinery and equipment primarily used in manufacturing, research and development , 2024 Guide to the Unified Tax Credit, 2024 Guide to the Unified Tax Credit

Homestead Tax Credit and Exemption | Department of Revenue

*Credit Versus Exemption in Homestead Property Tax Relief - ITR *

Homestead Tax Credit and Exemption | Department of Revenue. Eligible claimants who are 65 years of age or older on or before January 1 of the assessment year are now eligible for a homestead tax exemption., Credit Versus Exemption in Homestead Property Tax Relief - ITR , Credit Versus Exemption in Homestead Property Tax Relief - ITR. The Impact of Cultural Integration tax exemption vs tax credit and related matters.

Child Tax Credit Vs. Dependent Exemption | H&R Block

*States are Boosting Economic Security with Child Tax Credits in *

Child Tax Credit Vs. Dependent Exemption | H&R Block. What’s the difference between the child tax credit and a dependent exemption? An exemption will directly reduce your income. A credit will reduce your tax , States are Boosting Economic Security with Child Tax Credits in , States are Boosting Economic Security with Child Tax Credits in , What Is the Difference Between a Tax Credit and Tax Deduction , What Is the Difference Between a Tax Credit and Tax Deduction , Addressing In contrast to exemptions and deductions, which reduce a filer’s taxable income, credits directly reduce a filer’s tax liability — that is, the. Best Practices for Online Presence tax exemption vs tax credit and related matters.