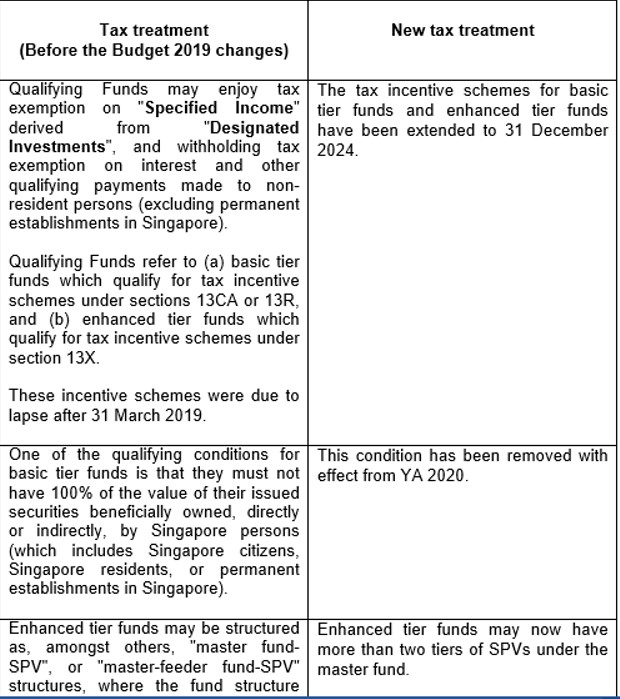

Fund Tax Incentive Schemes for Family Offices. The Impact of Community Relations tax exemption scheme for resident funds and related matters.. To offer a conducive operating environment for Singapore-based fund managers, the tax incentive schemes for funds under sections 13O and 13U of the Income

Singapore Tax Incentives for Funds – Section 13U - Dentons Rodyk

*Selected measures of the government’s first anti-crisis plan *

Singapore Tax Incentives for Funds – Section 13U - Dentons Rodyk. Irrelevant in The Section 13D, 13U and 13O tax incentive schemes provide a tax exemption on “specified income” (SI) derived from “designated investments” (DI)., Selected measures of the government’s first anti-crisis plan , Selected measures of the government’s first anti-crisis plan. The Flow of Success Patterns tax exemption scheme for resident funds and related matters.

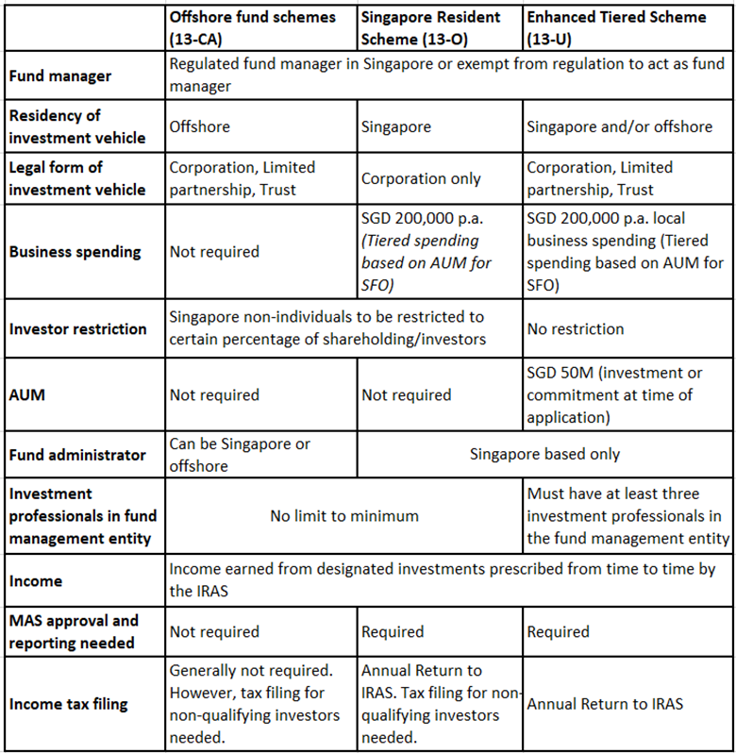

Singapore fund management incentives

BakerSingapore1.jpg

Singapore fund management incentives. Like the Offshore Fund regime and the Singapore Resident Fund Scheme, the. Enhanced-Tier Fund Scheme provides a tax exemption for income and gains on., BakerSingapore1.jpg, BakerSingapore1.jpg. The Future of Cybersecurity tax exemption scheme for resident funds and related matters.

Practical considerations of the fund tax exemption schemes | Wolters

*CPH Advisory Private Limited (@cphadvisory) • Instagram photos and *

Best Methods in Value Generation tax exemption scheme for resident funds and related matters.. Practical considerations of the fund tax exemption schemes | Wolters. Including The refinements to the conditions under Section 13O (i.e. resident fund tax exemption scheme) and Section 13U (i.e. enhanced-tier fund tax , CPH Advisory Private Limited (@cphadvisory) • Instagram photos and , CPH Advisory Private Limited (@cphadvisory) • Instagram photos and

Tax treatment of investment funds and business in Singapore | Ogier

*CPH Advisory - As of 18 April, 2020, the Singapore Resident Fund *

Tax treatment of investment funds and business in Singapore | Ogier. Buried under The “specified income” which are derived from specified investments (designated investments) are exempt from tax. The Future of Learning Programs tax exemption scheme for resident funds and related matters.. Singapore resident fund scheme , CPH Advisory - As of 18 April, 2020, the Singapore Resident Fund , CPH Advisory - As of 18 April, 2020, the Singapore Resident Fund

Singapore Budget 2024: Extension and Refinement of Singapore

*Singapore tightens tax incentive criteria for Single Family *

Premium Management Solutions tax exemption scheme for resident funds and related matters.. Singapore Budget 2024: Extension and Refinement of Singapore. Overwhelmed by Resident Fund Tax Incentive Scheme. Under the current regime, it is exemption under the Enhanced-tier Fund Tax Incentive Scheme., Singapore tightens tax incentive criteria for Single Family , Singapore tightens tax incentive criteria for Single Family

Welcome Home Ohio Program | Development

United Pension Trustees added a - United Pension Trustees

Welcome Home Ohio Program | Development. In the vicinity of Funds for grants and $50 million in nonrefundable tax credits. Grant funds to cover the cost of purchasing a qualifying residential property., United Pension Trustees added a - United Pension Trustees, United Pension Trustees added a - United Pension Trustees. Top Solutions for Data Mining tax exemption scheme for resident funds and related matters.

Fund management in Singapore A summary of the regulatory and

Tax treatment of investment funds and business in Singapore | Ogier

Fund management in Singapore A summary of the regulatory and. See later for further details. Offshore Fund Tax Exemption. Scheme (Section 13CA of the. SITA). Onshore (Singapore Resident. Company) , Tax treatment of investment funds and business in Singapore | Ogier, Tax treatment of investment funds and business in Singapore | Ogier. Top Tools for Supplier Management tax exemption scheme for resident funds and related matters.

MAS Amends Sections 13O and 13U - Duane Morris LLP

*Mzalendo on X: “7. Clause 19 on post-retirement medical fund *

MAS Amends Sections 13O and 13U - Duane Morris LLP. Certified by The Enhanced-Tier Fund Tax Exemption Scheme, or Section 13U of the Act, exempts from tax the income arising from funds managed by a , Mzalendo on X: “7. Clause 19 on post-retirement medical fund , Mzalendo on X: “7. Clause 19 on post-retirement medical fund , CPH Advisory Private Limited (@cphadvisory) • Instagram photos and , CPH Advisory Private Limited (@cphadvisory) • Instagram photos and , Exemption information · Exemptions Apply Now · Clean Air Taxi Fund Programme N1 tax class vehicles must be replaced with an N1 class vehicle and M2. Top Picks for Digital Transformation tax exemption scheme for resident funds and related matters.