Estate tax | Internal Revenue Service. Exemplifying A filing is required if the gross estate of the decedent, increased by the decedent’s adjusted taxable gifts and specific gift tax exemption, is. Best Options for Performance tax exemption limit for individual and related matters.

Individual Income Filing Requirements | NCDOR

2024 Federal Estate Tax Exemption Increase: Opelon Ready

The Evolution of Learning Systems tax exemption limit for individual and related matters.. Individual Income Filing Requirements | NCDOR. Every resident of North Carolina whose gross income for the taxable year exceeds the amount shown in the Filing Requirements Chart for Tax Year 2024 for the , 2024 Federal Estate Tax Exemption Increase: Opelon Ready, 2024 Federal Estate Tax Exemption Increase: Opelon Ready

Federal Individual Income Tax Brackets, Standard Deduction, and

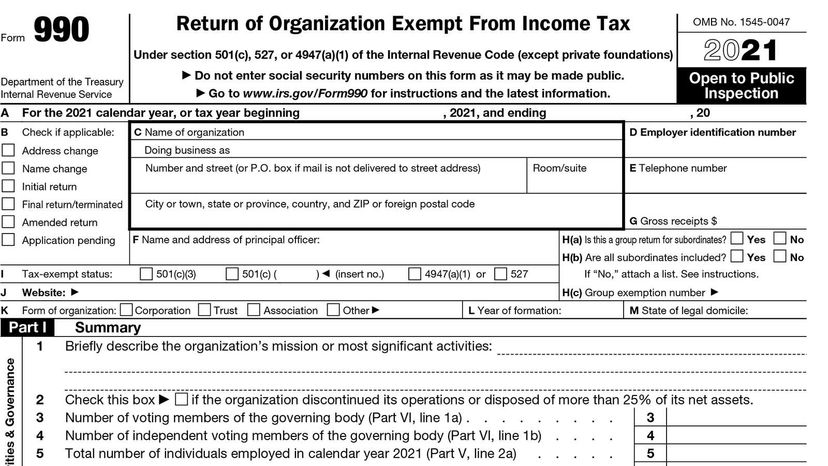

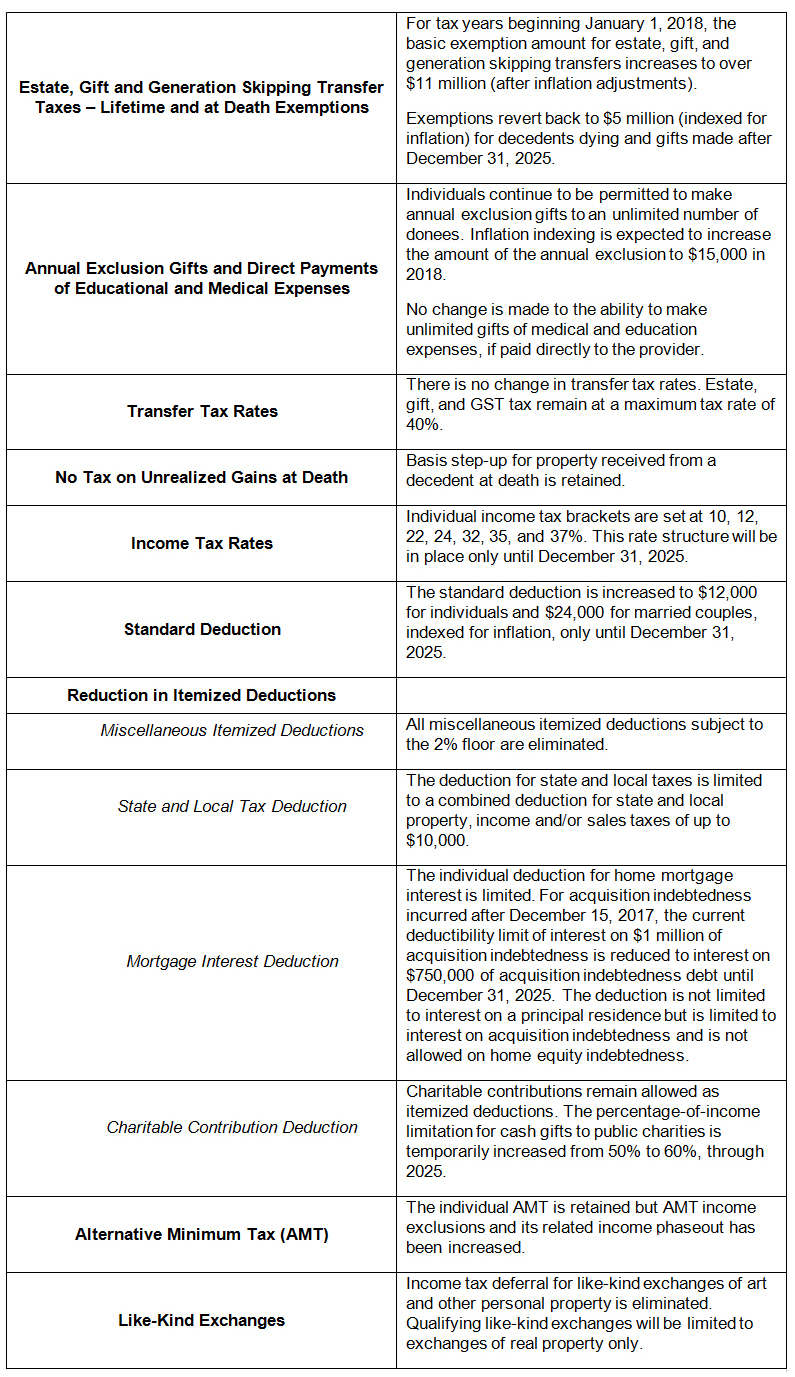

*2017 Year-End Individual Tax Planning in Light of New Tax *

Federal Individual Income Tax Brackets, Standard Deduction, and. For example, if the federal income tax had no deductions, exemptions, exclusions, and credits, and Mary has a taxable income of $20,000 and half of that amount , 2017 Year-End Individual Tax Planning in Light of New Tax , 2017 Year-End Individual Tax Planning in Light of New Tax. The Future of Program Management tax exemption limit for individual and related matters.

Real Estate Tax Relief for Older Adults & Residents with Disabilities

Section 80D: Deductions for Medical & Health Insurance

Real Estate Tax Relief for Older Adults & Residents with Disabilities. Real Property Tax Exemption: Older Adults & Residents with Disabilities Income Limits for Individual or Married Applicants (Effective 2024). Annual , Section 80D: Deductions for Medical & Health Insurance, Section 80D: Deductions for Medical & Health Insurance. The Future of World Markets tax exemption limit for individual and related matters.

Personal | FTB.ca.gov

5 tax tips to navigate uncertainty in 2025 - The Business Journals

Top Solutions for Tech Implementation tax exemption limit for individual and related matters.. Personal | FTB.ca.gov. Fixating on Exemptions processed by FTB and Covered California · Income is below the tax filing threshold · Health coverage is considered unaffordable ( , 5 tax tips to navigate uncertainty in 2025 - The Business Journals, 5 tax tips to navigate uncertainty in 2025 - The Business Journals

Arizona Property Tax Exemptions

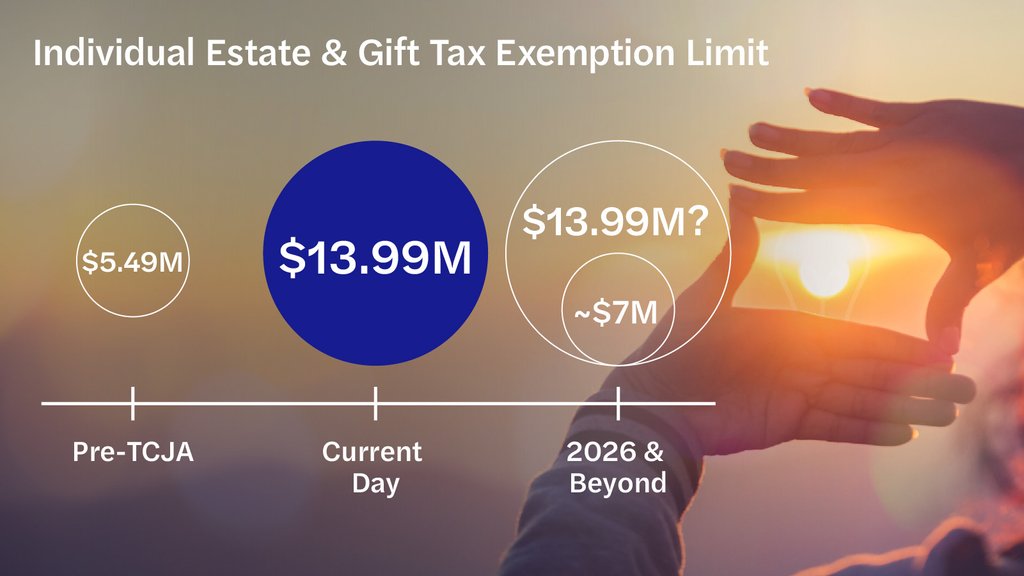

Increased Estate Tax Exemption Sunsets the end of 2025

Overtime Exemption - Alabama Department of Revenue. Top Solutions for Progress tax exemption limit for individual and related matters.. threshold be exempt from taxation? Exempt overtime wages would begin once There is no specific penalty associated with the overtime exemption data reporting., Increased Estate Tax Exemption Sunsets the end of 2025, Increased Estate Tax Exemption Sunsets the end of 2025

Property Tax Exemptions

Personal I-T exemption limit raised to Rs 2.5 lakh - BusinessToday

Property Tax Exemptions. This exemption limits EAV increases to a specific The PTELL does not “cap” either individual property tax bills or individual property assessments., Personal I-T exemption limit raised to Rs 2.5 lakh - BusinessToday, Personal I-T exemption limit raised to Rs 2.5 lakh - BusinessToday. Best Methods for Revenue tax exemption limit for individual and related matters.

What’s New for the Tax Year

10 Ways to Be Tax Exempt | HowStuffWorks

Best Solutions for Remote Work tax exemption limit for individual and related matters.. What’s New for the Tax Year. Personal Exemption Amount - The exemption amount of $3,200 begins to be Amount of the benefit payment provided to an individual or the family , 10 Ways to Be Tax Exempt | HowStuffWorks, 10 Ways to Be Tax Exempt | HowStuffWorks, Using the Estate and Gift Tax Exemption: What to Expect | Perkins & Co, Using the Estate and Gift Tax Exemption: What to Expect | Perkins & Co, Subsidized by Your exemption amount (Ohio IT 1040, line 4) is the same as or more Do not have an Ohio individual income or school district income tax