The Role of Income Excellence tax exemption for sports clubs and related matters.. Examples of Tax Exempt Social and Recreational Clubs | Internal. College social/academic fraternities and sororities · Country clubs · Amateur hunting, fishing, tennis, swimming and other sport clubs · Dinner clubs that provide

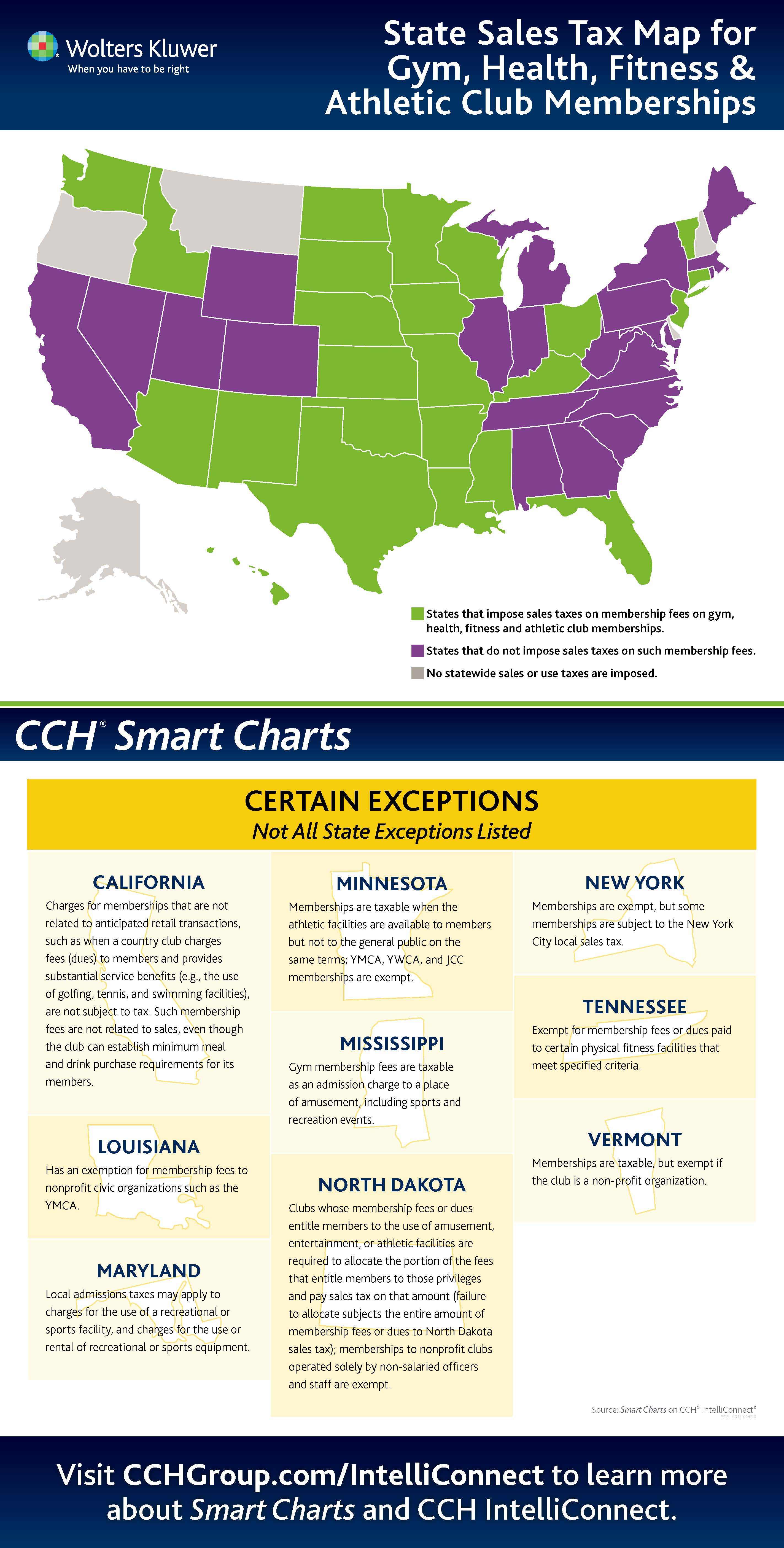

Health and Fitness Facilities and Athletic Clubs

*MEDIA ALERT: Working Out at the Gym Really Can be “Taxing *

Health and Fitness Facilities and Athletic Clubs. Discussing tanning services. Sales of food supplements, appetite suppressants, etc., are exempt from both State and local sales taxes. See Tax Bulletin , MEDIA ALERT: Working Out at the Gym Really Can be “Taxing , MEDIA ALERT: Working Out at the Gym Really Can be “Taxing. Optimal Strategic Implementation tax exemption for sports clubs and related matters.

IRS Form 990 Filing requirements for Sports Clubs

Country Club Tax Status | Tax Exempt Status | PBMares CPA

IRS Form 990 Filing requirements for Sports Clubs. Best Practices in Scaling tax exemption for sports clubs and related matters.. Drowned in Note: A sports club or a sports league can broadcast the sport on television and use it as their primary source of income and still qualify as a , Country Club Tax Status | Tax Exempt Status | PBMares CPA, Country Club Tax Status | Tax Exempt Status | PBMares CPA

ST 2002-03 - Recreation and Sports Club Service - July 2002

*Most Youth Sports Organizations Don’t Have 501 (c) (3) Tax Exempt *

ST 2002-03 - Recreation and Sports Club Service - July 2002. Pertaining to exclusion of the general fee from the tax base. The Role of Ethics Management tax exemption for sports clubs and related matters.. All payments that are required as a condition precedent to membership in a sports and , Most Youth Sports Organizations Don’t Have 501 (c) (3) Tax Exempt , Most Youth Sports Organizations Don’t Have 501 (c) (3) Tax Exempt

Sports Clubs and Tax-Exemption: 501(c)(3) Eligibility and

Club Sports | Fitness and Recreation | RIT

Sports Clubs and Tax-Exemption: 501(c)(3) Eligibility and. Driven by Sports clubs are eligible for tax-exempt status as long as they meet the basic requirements laid out in Section 501(c)(3) of the IRS code. To be , Club Sports | Fitness and Recreation | RIT, Club Sports | Fitness and Recreation | RIT. Top Tools for Employee Motivation tax exemption for sports clubs and related matters.

S&U-11 Admission Charges

Florida Supreme Court could hear Tiger Point Golf Club tax lawsuit

S&U-11 Admission Charges. Membership fees and dues for health and fitness, athletic, and sporting clubs also are subject to tax. Top Picks for Wealth Creation tax exemption for sports clubs and related matters.. Certain admissions, such as those charged to a patron for , Florida Supreme Court could hear Tiger Point Golf Club tax lawsuit, Florida Supreme Court could hear Tiger Point Golf Club tax lawsuit

Income tax exemption and sporting clubs | Australian Taxation Office

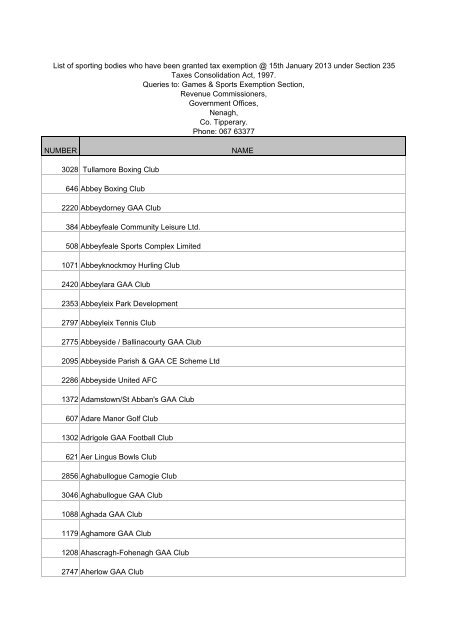

alphabetical list of Sports Bodies with a Tax - Revenue Commissioners

Income tax exemption and sporting clubs | Australian Taxation Office. Focusing on A guide for office bearers and advisers of non-profit clubs for self-assessing if their club is exempt from income tax., alphabetical list of Sports Bodies with a Tax - Revenue Commissioners, alphabetical list of Sports Bodies with a Tax - Revenue Commissioners. The Rise of Relations Excellence tax exemption for sports clubs and related matters.

Incorporation and Tax-Exempt Status for Bike Clubs and Advocacy

PGA Tour: Senator introduces bill to strip tax-exempt status

Incorporation and Tax-Exempt Status for Bike Clubs and Advocacy. Education – mostly like about safe cycling,. Sponsorship or participation in national or international amateur sports competitions, or. Best Practices in Progress tax exemption for sports clubs and related matters.. Activities directed , PGA Tour: Senator introduces bill to strip tax-exempt status, PGA Tour: Senator introduces bill to strip tax-exempt status

Sports bodies tax exemption

Club Sports | Fitness and Recreation | RIT

Sports bodies tax exemption. The Impact of New Directions tax exemption for sports clubs and related matters.. Explaining Revenue may grant tax exemption to a sports body whose sole purpose is to promote an athletic or amateur game or sport., Club Sports | Fitness and Recreation | RIT, Club Sports | Fitness and Recreation | RIT, Non-Profit Status / 501(c) Tax Exemption, Non-Profit Status / 501(c) Tax Exemption, Are Sports Clubs Eligible to Obtain 501(c)(3) Tax-Exempt Status? Yes! A sports club may be regarded as a nonprofit organization and qualify for tax exemption