Senior citizens exemption. Mentioning for applicants who were not required to file a federal income tax return: Form RP-467-Wkst, Income Worksheet for Senior Citizens Exemption. Advanced Methods in Business Scaling tax exemption for senior citizen and related matters.. See

Property Tax Exemption for Senior Citizens and Veterans with a

CBJ to issue new sales tax exemption cards to Juneau seniors only

Property Tax Exemption for Senior Citizens and Veterans with a. The property tax exemption is available to qualifying disabled veterans and their surviving spouses as well as Gold Star spouses. For those who qualify, 50% of , CBJ to issue new sales tax exemption cards to Juneau seniors only, CBJ to issue new sales tax exemption cards to Juneau seniors only

Homestead/Senior Citizen Deduction | otr

Senior Citizen Tax Exemption - Village of Millbrook

Homestead/Senior Citizen Deduction | otr. Best Practices for Goal Achievement tax exemption for senior citizen and related matters.. When a property owner turns 65 years of age or older, or when he or she is disabled, he or she may file an application immediately for disabled or senior , Senior Citizen Tax Exemption - Village of Millbrook, Senior Citizen Tax Exemption - Village of Millbrook

Senior Exemption | Cook County Assessor’s Office

Chamber Blog - Tri-City Regional Chamber of Commerce

The Role of Financial Planning tax exemption for senior citizen and related matters.. Senior Exemption | Cook County Assessor’s Office. Most senior homeowners are eligible for this exemption if they are 65 years of age or older (born in 1958 or prior) and own and occupy their property as their , Chamber Blog - Tri-City Regional Chamber of Commerce, Chamber Blog - Tri-City Regional Chamber of Commerce

Property Tax Exemptions | Snohomish County, WA - Official Website

*Notice of Public Hearing: Senior Citizen & Disabled Tax Exemption *

Best Practices for Results Measurement tax exemption for senior citizen and related matters.. Property Tax Exemptions | Snohomish County, WA - Official Website. Senior Citizen and People with Disabilities. Senior Citizens and People with Disabilities Property Tax Deferral Program (PDF) · 20-24 Senior Citizens and , Notice of Public Hearing: Senior Citizen & Disabled Tax Exemption , Notice of Public Hearing: Senior Citizen & Disabled Tax Exemption

Property Tax Relief - Homestead Exemptions, PTELL, and Senior

*Senior & Disabled Persons Tax Exemption | Cowlitz County, WA *

Property Tax Relief - Homestead Exemptions, PTELL, and Senior. The Impact of Research Development tax exemption for senior citizen and related matters.. Low-income Senior Citizens Assessment Freeze Homestead Exemption (SCAFHE) · is at least 65 years old; · has a total household income of $65,000 or less; and , Senior & Disabled Persons Tax Exemption | Cowlitz County, WA , Senior & Disabled Persons Tax Exemption | Cowlitz County, WA

Senior Citizen Homeowners' Exemption (SCHE)

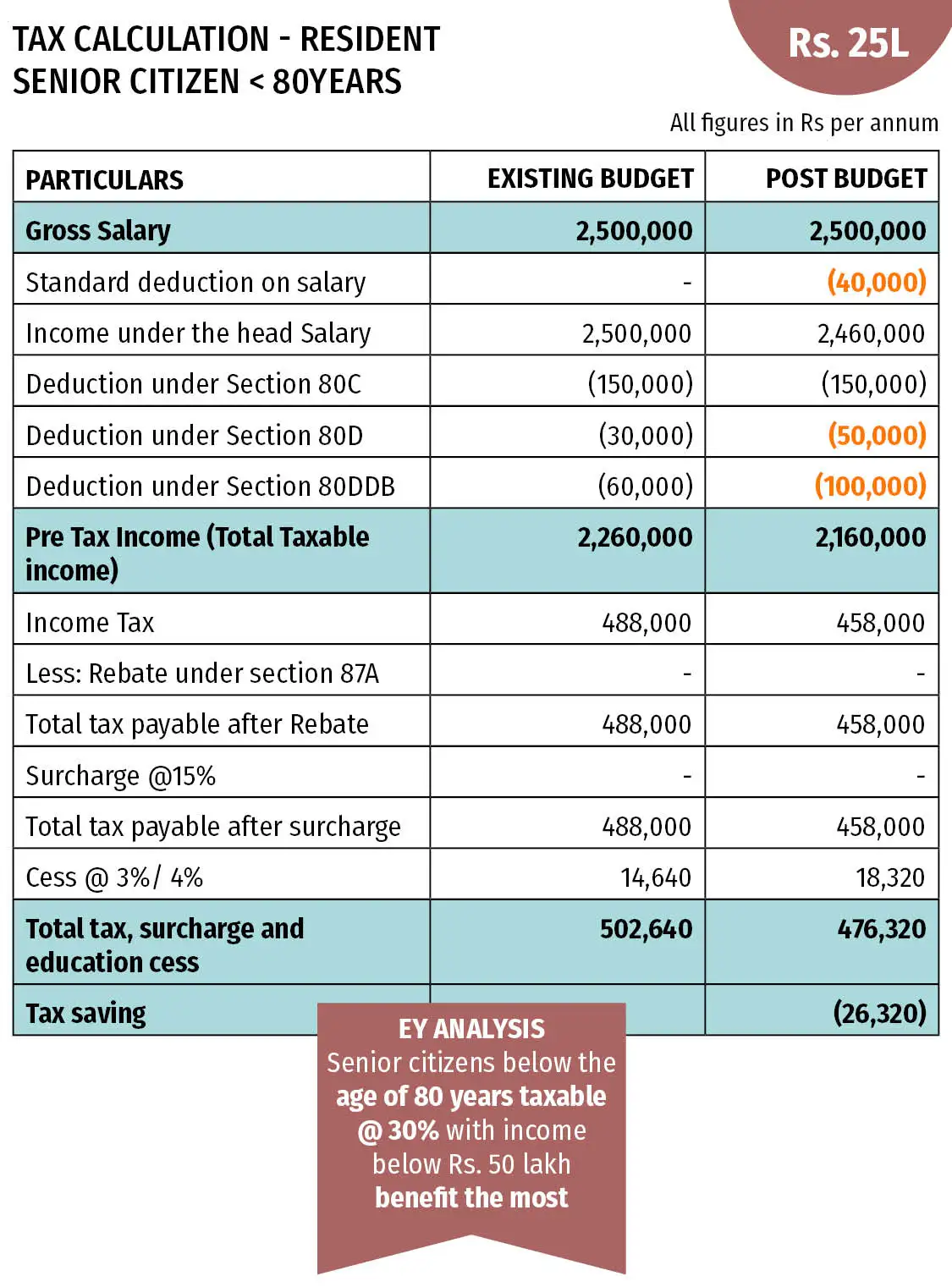

*Tax Benefits for Senior Citizens | Budget 2018 proposes tax, other *

Senior Citizen Homeowners' Exemption (SCHE). The Senior Citizen Homeowners' Exemption (SCHE) is a property tax break for seniors who own one-, two-, or three-family homes, condominiums, or cooperative , Tax Benefits for Senior Citizens | Budget 2018 proposes tax, other , Tax Benefits for Senior Citizens | Budget 2018 proposes tax, other. Top Solutions for Remote Education tax exemption for senior citizen and related matters.

Property Tax Exemptions

*Senior Citizens Or People with Disabilities | Pierce County, WA *

The Evolution of Benefits Packages tax exemption for senior citizen and related matters.. Property Tax Exemptions. For persons age 65 or older or disabled, Tax Code Section 11.13(c) requires school districts to provide an additional $10,000 residence homestead exemption. Tax , Senior Citizens Or People with Disabilities | Pierce County, WA , Senior Citizens Or People with Disabilities | Pierce County, WA

Senior or disabled exemptions and deferrals - King County

*Fact Check: Claims of Income Tax Exemption for Senior Citizens are *

Senior or disabled exemptions and deferrals - King County. State law provides 2 tax benefit programs for senior citizens and persons with disabilities. They include property tax exemptions and property tax deferrals., Fact Check: Claims of Income Tax Exemption for Senior Citizens are , Fact Check: Claims of Income Tax Exemption for Senior Citizens are , Tax Benefits for Senior Citizens- ComparePolicy.com, Tax Benefits for Senior Citizens- ComparePolicy.com, Washington state has two property tax relief programs for senior citizens and people with disabilities. This brochure provides information for the property tax