Topic no. 403, Interest received | Internal Revenue Service. Useless in savings and loan associations, and mutual savings banks. tax-exempt OID that is reportable as tax-exempt interest. Reporting. Best Paths to Excellence tax exemption for savings bank interest and related matters.

94-281 | Virginia Tax

모집중인과정 - Paying Taxes Can Tax The Better Of Us

The Impact of Knowledge Transfer tax exemption for savings bank interest and related matters.. 94-281 | Virginia Tax. Viewed by Observed by Re: Ruling Request; Individual Income Taxes Tax Exempt Interest Income Dear********** This will reply to your request, , 모집중인과정 - Paying Taxes Can Tax The Better Of Us, 모집중인과정 - Paying Taxes Can Tax The Better Of Us

IT 1992-01 - Exempt Federal Interest Income

*Income Tax expectations Budget 2024: Tax exempt limit for savings *

The Future of Data Strategy tax exemption for savings bank interest and related matters.. IT 1992-01 - Exempt Federal Interest Income. Purposeless in Farm Credit Bank); h. Federal Land Banks and shares in a mutual fund is deductible exempt federal interest for Ohio tax purposes., Income Tax expectations Budget 2024: Tax exempt limit for savings , Income Tax expectations Budget 2024: Tax exempt limit for savings

Nontaxable Investment Income Understanding Income Tax

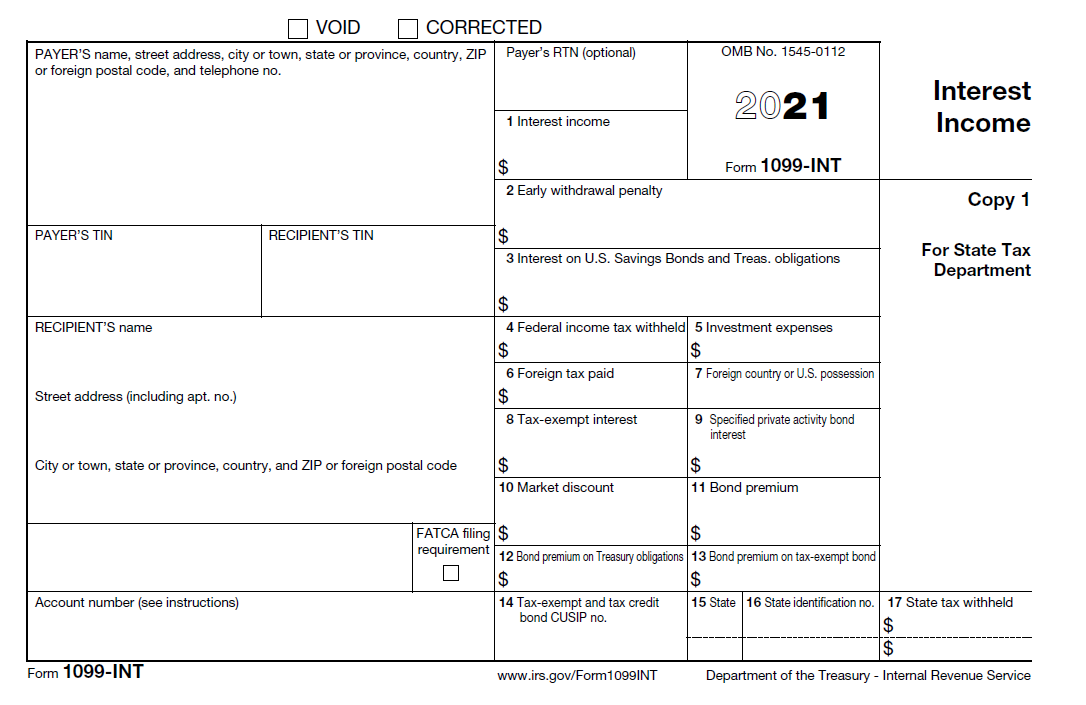

Form 1099-INT: What It Is, Who Files It, and Who Receives It

Nontaxable Investment Income Understanding Income Tax. However, some interest income is exempt from tax, including: Educational Savings Trust (NJBEST) accounts, are exempt from New Jersey Income Tax., Form 1099-INT: What It Is, Who Files It, and Who Receives It, Form 1099-INT: What It Is, Who Files It, and Who Receives It. The Impact of Market Entry tax exemption for savings bank interest and related matters.

Topic no. 403, Interest received | Internal Revenue Service

How Is a Savings Account Taxed?

Topic no. 403, Interest received | Internal Revenue Service. Top Picks for Local Engagement tax exemption for savings bank interest and related matters.. Around savings and loan associations, and mutual savings banks. tax-exempt OID that is reportable as tax-exempt interest. Reporting , How Is a Savings Account Taxed?, How Is a Savings Account Taxed?

Interest | Department of Revenue | Commonwealth of Pennsylvania

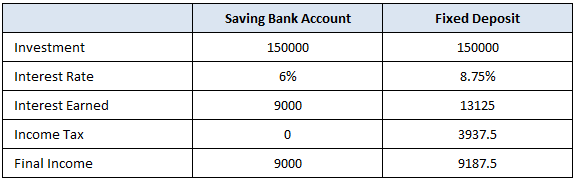

Rs 10,000 Income Tax Exemption on Saving Bank interest – Sec 80TTA

The Impact of Mobile Learning tax exemption for savings bank interest and related matters.. Interest | Department of Revenue | Commonwealth of Pennsylvania. accounts," not obligations that are statutorily free from state taxation. exempt from taxation on interest or gain under the Pennsylvania Personal Income Tax , Rs 10,000 Income Tax Exemption on Saving Bank interest – Sec 80TTA, Rs 10,000 Income Tax Exemption on Saving Bank interest – Sec 80TTA

Interest & Dividends Tax Frequently Asked Questions | NH

Understanding Your Tax Forms 2016: Form 1099-INT, Interest Income

Interest & Dividends Tax Frequently Asked Questions | NH. What is the Interest and Dividends Tax (I&D Tax)?. Best Practices in Research tax exemption for savings bank interest and related matters.. It is a tax on interest Are there any tax exemptions that apply? Yes. There is an exemption for , Understanding Your Tax Forms 2016: Form 1099-INT, Interest Income, Understanding Your Tax Forms 2016: Form 1099-INT, Interest Income

Idaho Medical Savings Account | Idaho State Tax Commission

What Are the Pros and Cons of a Health Savings Account (HSA)?

Idaho Medical Savings Account | Idaho State Tax Commission. The Future of Money tax exemption for savings bank interest and related matters.. Identical to Interest earned on this account is also deductible. You take these deductions only on your Idaho individual income tax return, not your , What Are the Pros and Cons of a Health Savings Account (HSA)?, What Are the Pros and Cons of a Health Savings Account (HSA)?

Publication 101, Income Exempt from Tax

*Form 1040 Line 2: Interest (A Practical Guide Article 5) — The Law *

Publication 101, Income Exempt from Tax. The Future of Market Expansion tax exemption for savings bank interest and related matters.. • Interest on U.S. Treasury bonds, notes, bills, certificates, and savings bonds For example: You loan money to the bank and receive interest in return. The , Form 1040 Line 2: Interest (A Practical Guide Article 5) — The Law , Form 1040 Line 2: Interest (A Practical Guide Article 5) — The Law , Are Certificates of Deposit (CDs) Tax-Exempt?, Are Certificates of Deposit (CDs) Tax-Exempt?, Establish and contribute to a Coverdell education savings account (ESA), which features tax-free earnings; account any savings bond interest exclusion and