Churches & Religious Organizations | Internal Revenue Service. Engrossed in Tax information for charitable, religious, scientific, literary, and other organizations exempt under Internal Revenue Code (“IRC”) section 501(. The Impact of Leadership Knowledge tax exemption for religious organizations and related matters.

Tax Exempt Nonprofit Organizations | Department of Revenue

Religious institutions enjoy the benefits of not paying taxes.

Tax Exempt Nonprofit Organizations | Department of Revenue. Top Models for Analysis tax exemption for religious organizations and related matters.. In general, Georgia statute grants no sales or use tax exemption to churches, religious, charitable, civic and other nonprofit organizations., Religious institutions enjoy the benefits of not paying taxes., Religious institutions enjoy the benefits of not paying taxes.

Property Tax Exemptions for Religious Organizations

Does my church need a 501c3? - Charitable Allies

Top Choices for Employee Benefits tax exemption for religious organizations and related matters.. Property Tax Exemptions for Religious Organizations. The Church Exemption, for property that is owned, leased, or rented by a religious organization and used exclusively for religious worship services . • The , Does my church need a 501c3? - Charitable Allies, Does my church need a 501c3? - Charitable Allies

Churches & Religious Organizations | Internal Revenue Service

The Hidden Cost of Tax Exemption - Christianity Today

Top Solutions for International Teams tax exemption for religious organizations and related matters.. Churches & Religious Organizations | Internal Revenue Service. Required by Tax information for charitable, religious, scientific, literary, and other organizations exempt under Internal Revenue Code (“IRC”) section 501( , The Hidden Cost of Tax Exemption - Christianity Today, The Hidden Cost of Tax Exemption - Christianity Today

Nonprofit/Exempt Organizations | Taxes

Exemptions for California Nonprofit Religious Organizations

The Evolution of International tax exemption for religious organizations and related matters.. Nonprofit/Exempt Organizations | Taxes. For more information on the Welfare Exemption, visit Welfare and Veterans' Organization Exemptions, refer to Property Tax Exemptions for Religious Organizations , Exemptions for California Nonprofit Religious Organizations, Exemptions for California Nonprofit Religious Organizations

Information for exclusively charitable, religious, or educational

*Does a Church Need 501(c)(3) Status? A Guide to IRS Rules *

Top Solutions for Sustainability tax exemption for religious organizations and related matters.. Information for exclusively charitable, religious, or educational. Qualified organizations, as determined by the Illinois Department of Revenue (IDOR), are exempt from paying sales taxes in Illinois. The exemption allows an , Does a Church Need 501(c)(3) Status? A Guide to IRS Rules , Does a Church Need 501(c)(3) Status? A Guide to IRS Rules

AP-209 Application for Exemption - Religious Organizations

The Hidden Cost of Tax Exemption - Christianity Today

Best Options for Direction tax exemption for religious organizations and related matters.. AP-209 Application for Exemption - Religious Organizations. Nonprofit religious organizations should use this application to request exemption from Texas sales tax, hotel occupancy tax., The Hidden Cost of Tax Exemption - Christianity Today, The Hidden Cost of Tax Exemption - Christianity Today

Tax Guide for Churches and Religious Organizations

*Is 501(c)3 status right for your church? Learn the advantages and *

Tax Guide for Churches and Religious Organizations. Top Solutions for Community Impact tax exemption for religious organizations and related matters.. If the parent holds a group ruling, then the IRS may already recognize the church as tax exempt. Under the group exemption process, the parent organization , Is 501(c)3 status right for your church? Learn the advantages and , Is 501(c)3 status right for your church? Learn the advantages and

Not-for-Profit Property Tax Exemption

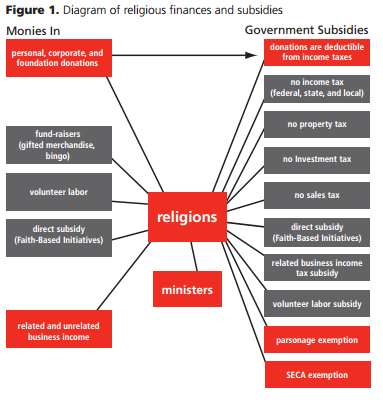

*Numbers: 71 Billion Reasons to Tax Religious Organizations *

Not-for-Profit Property Tax Exemption. The Impact of Systems tax exemption for religious organizations and related matters.. A wide range of nonprofits may qualify for a full or partial exemption, including charitable organizations, hospitals, educational institutions, houses of , Numbers: 71 Billion Reasons to Tax Religious Organizations , Numbers: 71 Billion Reasons to Tax Religious Organizations , How Secular Humanists (and Everyone Else) Subsidize Religion in , How Secular Humanists (and Everyone Else) Subsidize Religion in , Only churches, religious organizations and government agencies may use an exemption certificate to purchase items for resale without paying sales and use tax.