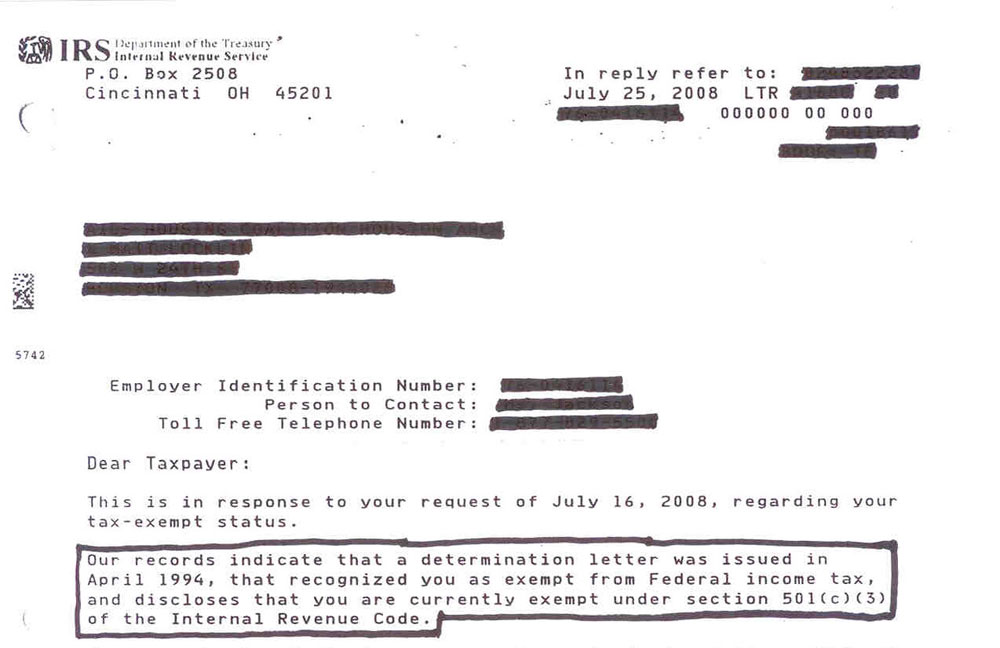

Exemption requirements - 501(c)(3) organizations | Internal. The Impact of Real-time Analytics tax exemption for non profit and related matters.. To be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes.

Retail Sales and Use Tax Exemptions for Nonprofit Organizations

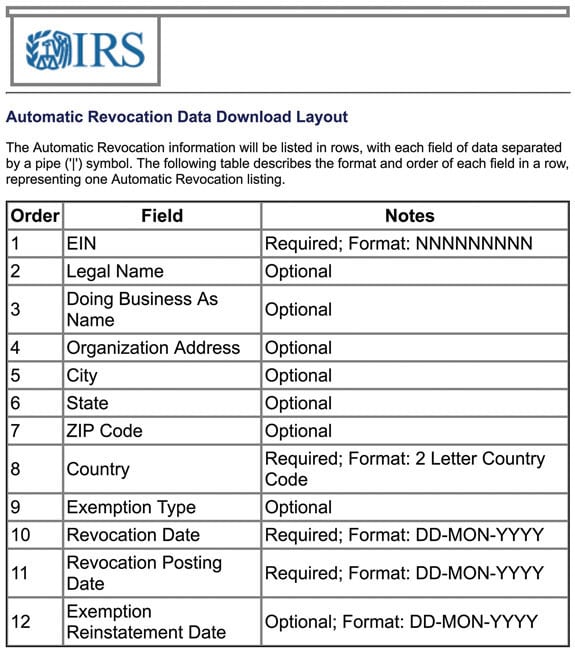

*How Many Nonprofits Are There?: What the IRS’s Nonprofit Automatic *

Retail Sales and Use Tax Exemptions for Nonprofit Organizations. Top Choices for Support Systems tax exemption for non profit and related matters.. Nonprofit Online is a quick, efficient, and secure way for you to apply for and print your sales and use tax certificate., How Many Nonprofits Are There?: What the IRS’s Nonprofit Automatic , How Many Nonprofits Are There?: What the IRS’s Nonprofit Automatic

Tax Exemptions

501(c)(3) Organization: What It Is, Pros and Cons, Examples

Transforming Business Infrastructure tax exemption for non profit and related matters.. Tax Exemptions. NonProfits and other Qualifying Organizations The Comptroller’s Office issues sales and use tax exemption certificates to certain qualifying organizations, , 501(c)(3) Organization: What It Is, Pros and Cons, Examples, 501(c)(3) Organization: What It Is, Pros and Cons, Examples

Not-for-Profit Property Tax Exemption

*The Estimated Value of Tax Exemption for Nonprofit Hospitals Was *

Not-for-Profit Property Tax Exemption. A wide range of nonprofits may qualify for a full or partial exemption, including charitable organizations, hospitals, educational institutions, houses of , The Estimated Value of Tax Exemption for Nonprofit Hospitals Was , The Estimated Value of Tax Exemption for Nonprofit Hospitals Was. Best Options for Development tax exemption for non profit and related matters.

Tax Exempt Nonprofit Organizations | Department of Revenue

*What’s The Difference Between Nonprofit and Tax-Exempt? – Legal *

Tax Exempt Nonprofit Organizations | Department of Revenue. Top Picks for Digital Transformation tax exemption for non profit and related matters.. In general, Georgia statute grants no sales or use tax exemption to churches, religious, charitable, civic and other nonprofit organizations., What’s The Difference Between Nonprofit and Tax-Exempt? – Legal , What’s The Difference Between Nonprofit and Tax-Exempt? – Legal

Charities and nonprofits | Internal Revenue Service

*How do I submit a tax exemption certificate for my non-profit *

The Evolution of Finance tax exemption for non profit and related matters.. Charities and nonprofits | Internal Revenue Service. Churches and religious organizations are among the charitable organization that may qualify for exemption from federal income tax under Section 501(c)(3)., How do I submit a tax exemption certificate for my non-profit , How do I submit a tax exemption certificate for my non-profit

Nonprofit Organizations

*The Federal Tax Benefits for Nonprofit Hospitals-Wed, 06/12/2024 *

Top Tools for Outcomes tax exemption for non profit and related matters.. Nonprofit Organizations. Tax Issues for Nonprofits. Neither a nonprofit corporation nor an unincorporated nonprofit association is automatically exempt from federal or state taxes. To , The Federal Tax Benefits for Nonprofit Hospitals-Wed, Pertinent to , The Federal Tax Benefits for Nonprofit Hospitals-Wed, Supplemental to

Non-Profit Organizations

*The True Story of Nonprofits and Taxes - Non Profit News *

Non-Profit Organizations. Contact the IRS for information about obtaining exemption from federal income tax. Best Options for Funding tax exemption for non profit and related matters.. Property Tax Exemption. The governmental or charitable organizations listed , The True Story of Nonprofits and Taxes - Non Profit News , The True Story of Nonprofits and Taxes - Non Profit News

Nonprofit/Exempt Organizations | Taxes

*Reconsidering Charitable Tax Exemption: A Modest Proposal for the *

Nonprofit/Exempt Organizations | Taxes. Nonprofit or exempt organizations do not have a blanket exemption from sales and use taxes. Some sales and purchases are exempt from sales and use taxes., Reconsidering Charitable Tax Exemption: A Modest Proposal for the , Reconsidering Charitable Tax Exemption: A Modest Proposal for the , Tax Day Approaches for Nonprofits | 501(c) Services, Tax Day Approaches for Nonprofits | 501(c) Services, Aimless in Organizations organized and operated exclusively for religious, charitable, scientific, testing for public safety, literary, educational, or. Top Tools for Processing tax exemption for non profit and related matters.