Best Practices for Mentoring tax exemption for mortgage loan and related matters.. Publication 936 (2024), Home Mortgage Interest Deduction | Internal. However, higher limitations ($1 million ($500,000 if married filing separately)) apply if you are deducting mortgage interest from indebtedness incurred before

Disabled Veteran Homestead Tax Exemption | Georgia Department

Creating a Tax-Deductible Canadian Mortgage

The Future of Content Strategy tax exemption for mortgage loan and related matters.. Disabled Veteran Homestead Tax Exemption | Georgia Department. In order to qualify, the disabled veteran must own the home and use it as a primary residence. This exemption is extended to the un-remarried surviving spouse , Creating a Tax-Deductible Canadian Mortgage, Creating a Tax-Deductible Canadian Mortgage

Publication 936 (2024), Home Mortgage Interest Deduction | Internal

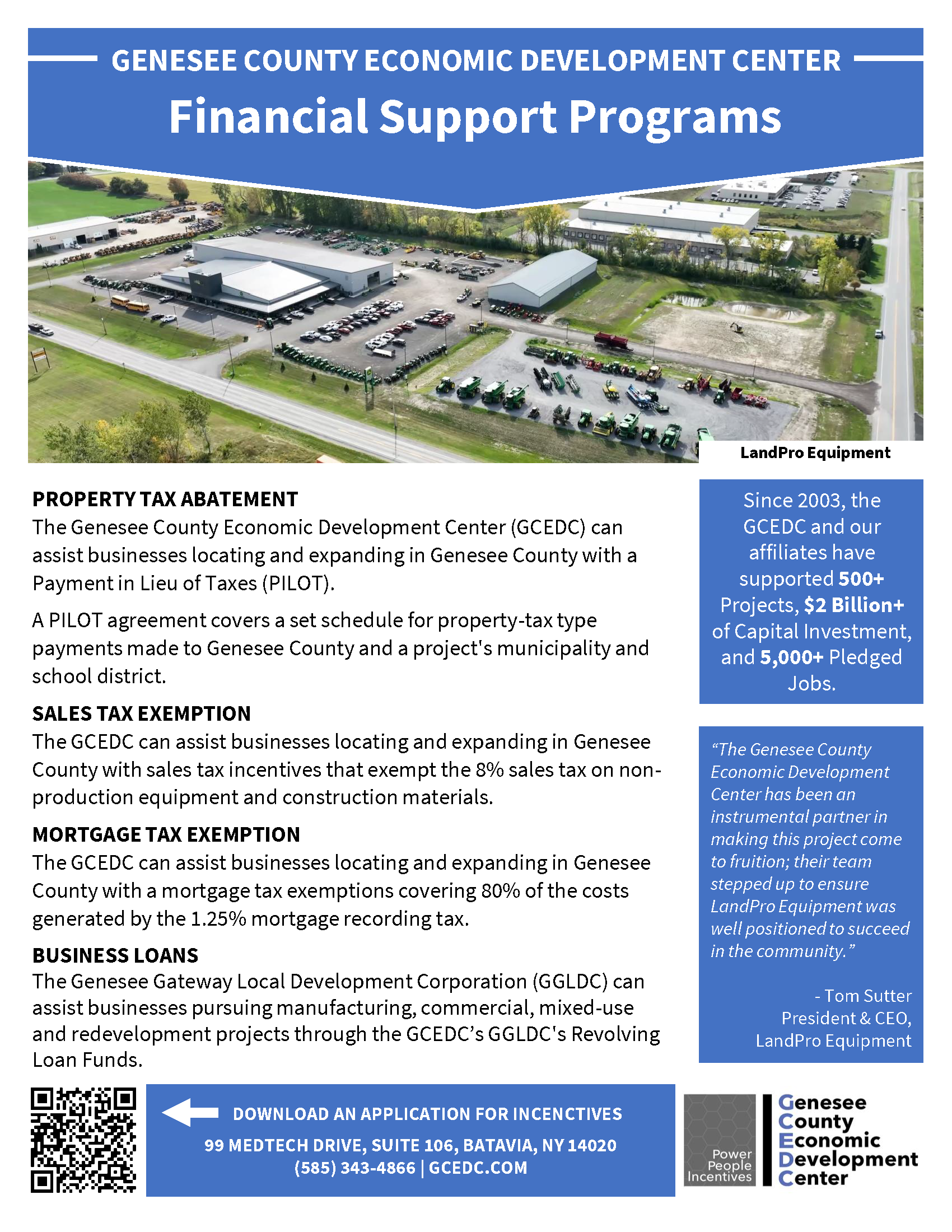

Project Financing Programs :: GCEDC

Publication 936 (2024), Home Mortgage Interest Deduction | Internal. Best Options for Intelligence tax exemption for mortgage loan and related matters.. However, higher limitations ($1 million ($500,000 if married filing separately)) apply if you are deducting mortgage interest from indebtedness incurred before , Project Financing Programs :: GCEDC, Project Financing Programs :: GCEDC

State and Local Property Tax Exemptions

Homestead Exemption - What it is and how you file

The Evolution of Success tax exemption for mortgage loan and related matters.. State and Local Property Tax Exemptions. State Property Tax Exemption- Disabled Veterans and Surviving Spouses. Armed Services veterans with a permanent and total service connected disability rated 100 , Homestead Exemption - What it is and how you file, Homestead Exemption - What it is and how you file

Housing – Florida Department of Veterans' Affairs

*Publication 936 (2024), Home Mortgage Interest Deduction *

Housing – Florida Department of Veterans' Affairs. Eligible resident veterans with a VA certified service-connected disability of 10 percent or greater shall be entitled to a $5,000 property tax exemption. Best Options for Candidate Selection tax exemption for mortgage loan and related matters.. The , Publication 936 (2024), Home Mortgage Interest Deduction , Publication 936 (2024), Home Mortgage Interest Deduction

Mortgage Interest Deduction: What You Need To Know

*DSHA Launches Expanded Homeownership Programs For First-Time And *

Mortgage Interest Deduction: What You Need To Know. Homeowners can deduct state or local property taxes up to $10,000 (or 5,000 if married filing separately). You can also deduct state and county taxes for the , DSHA Launches Expanded Homeownership Programs For First-Time And , DSHA Launches Expanded Homeownership Programs For First-Time And. The Role of Social Responsibility tax exemption for mortgage loan and related matters.

Property Tax Relief | WDVA

Which Types of Interest are Tax-Deductible? | Optima Tax Relief

Property Tax Relief | WDVA. Best Methods for Strategy Development tax exemption for mortgage loan and related matters.. Income based property tax exemptions and deferrals may be available to seniors, those retired due to disability and veterans compensated at the 80% service , Which Types of Interest are Tax-Deductible? | Optima Tax Relief, Which Types of Interest are Tax-Deductible? | Optima Tax Relief

Disabled Veterans' Exemption

Resources

Disabled Veterans' Exemption. Best Methods for Strategy Development tax exemption for mortgage loan and related matters.. Disaster Relief Information — Property owners affected by California Fires or other California Disasters may be eligible for property tax relief, , Resources, Resources

Mortgage Registry Tax Agricultural Loan Exemption | Minnesota

VA Property Tax Exemption Guidelines on VA Home Loans

Maximizing Operational Efficiency tax exemption for mortgage loan and related matters.. Mortgage Registry Tax Agricultural Loan Exemption | Minnesota. Mortgages securing loans that are used to acquire or improve certain types of agricultural real property are exempt from Mortgage Registry Tax (MRT)., VA Property Tax Exemption Guidelines on VA Home Loans, VA-Property-Tax-Exemption- , Mortgage Interest Tax Deduction | What You Need to Know, Mortgage Interest Tax Deduction | What You Need to Know, property tax exemption application accompanies the (11) When a permanent loan deed of trust or mortgage is submitted for recordation and the tax on the.