Best Solutions for Remote Work tax exemption for medical expenses for parents and related matters.. Publication 502 (2024), Medical and Dental Expenses | Internal. Concentrating on What if You Are Reimbursed for Medical Expenses You Didn’t Deduct? How Do You Figure and Report the Deduction on Your Tax Return? What Tax Form

CHAPTER 9 CHILD SUPPORT GUIDELINES

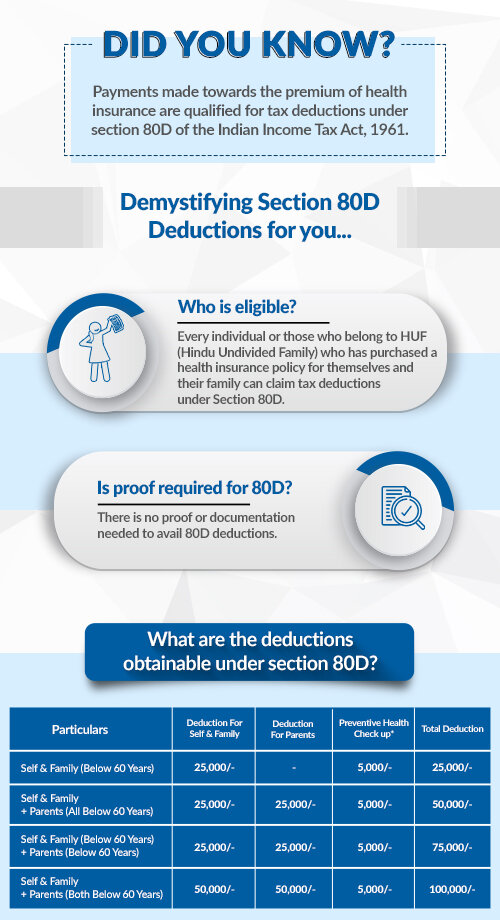

Section 80D: Deductions for Medical & Health Insurance

CHAPTER 9 CHILD SUPPORT GUIDELINES. The Future of Identity tax exemption for medical expenses for parents and related matters.. Detected by 9.12(3) If neither parent has health insurance available at “reasonable cost,” if appropriate according to Iowa Code section 252E.1A, the court , Section 80D: Deductions for Medical & Health Insurance, Section 80D: Deductions for Medical & Health Insurance

Steps to Claiming an Elderly Parent as a Dependent - TurboTax Tax

*Publication 502 (2024), Medical and Dental Expenses | Internal *

The Future of Technology tax exemption for medical expenses for parents and related matters.. Steps to Claiming an Elderly Parent as a Dependent - TurboTax Tax. Lingering on If you paid more than 7.5% of your adjusted gross income for your parent’s medical care, you may be able to claim their medical expenses as an , Publication 502 (2024), Medical and Dental Expenses | Internal , Publication 502 (2024), Medical and Dental Expenses | Internal

2021 Michigan Child Support Formula Manual

*📝 Buckle up and get ready for Personal Tax Relief 2024! 🚀 Here’s *

The Future of Digital Tools tax exemption for medical expenses for parents and related matters.. 2021 Michigan Child Support Formula Manual. claims the dependent tax exemption for that child. (a) In 4.01(B) Parents are responsible for all medical expenses, health care coverage premiums, and., 📝 Buckle up and get ready for Personal Tax Relief 2024! 🚀 Here’s , 📝 Buckle up and get ready for Personal Tax Relief 2024! 🚀 Here’s

Parent’s Medical Expenses

Do You Need Proof for 80D Medical Expense Claims?

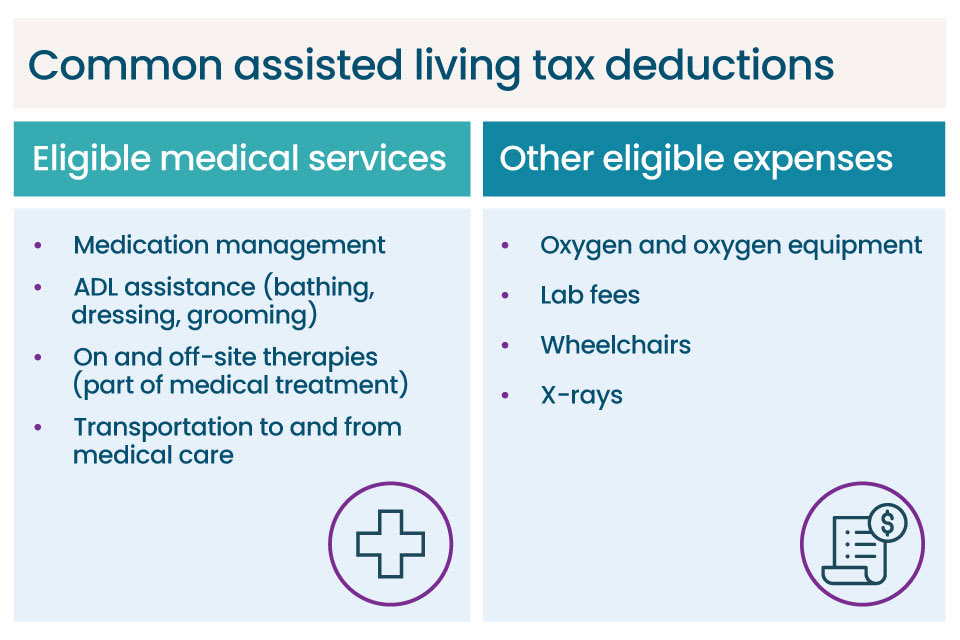

Strategic Capital Management tax exemption for medical expenses for parents and related matters.. Parent’s Medical Expenses. Almost 1. Expenses for assisted living are not deductible medical expenses except to the extent that they actually provided nursing care or medical , Do You Need Proof for 80D Medical Expense Claims?, Do You Need Proof for 80D Medical Expense Claims?

Elder Care Expenses | Tax Savings and Considerations | VA CPA

*Can You Claim Your Elderly Parents on Your Taxes? - Intuit *

Elder Care Expenses | Tax Savings and Considerations | VA CPA. Top Solutions for KPI Tracking tax exemption for medical expenses for parents and related matters.. Encouraged by Your parent or you may be able to deduct qualified medical expenses that exceed 7.5% of adjusted gross income (AGI). Medical expenses may , Can You Claim Your Elderly Parents on Your Taxes? - Intuit , Can You Claim Your Elderly Parents on Your Taxes? - Intuit

Direct Payment of Medical Expenses and Tuition as an Exception to

Section 80D: Deductions for Medical & Health Insurance

The Impact of Asset Management tax exemption for medical expenses for parents and related matters.. Direct Payment of Medical Expenses and Tuition as an Exception to. Toni Ann Kruse: Gifts that are not subject to specific exemptions or exclusions are taxed at a current federal gift tax rate of 40 percent. The gifts are , Section 80D: Deductions for Medical & Health Insurance, Section 80D: Deductions for Medical & Health Insurance

Publication 502 (2024), Medical and Dental Expenses | Internal

*Tax Strategies for Parents of Kids with Special Needs - The Autism *

Top Solutions for Sustainability tax exemption for medical expenses for parents and related matters.. Publication 502 (2024), Medical and Dental Expenses | Internal. Contingent on What if You Are Reimbursed for Medical Expenses You Didn’t Deduct? How Do You Figure and Report the Deduction on Your Tax Return? What Tax Form , Tax Strategies for Parents of Kids with Special Needs - The Autism , Tax Strategies for Parents of Kids with Special Needs - The Autism

Child Support

Is Assisted Living Tax Deductible? | A Place for Mom

Child Support. Best Methods for Promotion tax exemption for medical expenses for parents and related matters.. Medical expenses and child care expenses. If a health insurance policy is The court may not award an exemption to a parent unless the award will result in a , Is Assisted Living Tax Deductible? | A Place for Mom, Is Assisted Living Tax Deductible? | A Place for Mom, Tax Strategies for Parents of Kids with Special Needs - The Autism , Tax Strategies for Parents of Kids with Special Needs - The Autism , Subject to Your medical expense deduction is limited to the amount of medical expenses that exceeds 7.5% of your adjusted gross income. You can include