Advanced Enterprise Systems tax exemption for married filing jointly and related matters.. IRS provides tax inflation adjustments for tax year 2024 | Internal. Compelled by The standard deduction for married couples filing jointly for tax year 2024 rises to $29,200, an increase of $1,500 from tax year 2023. For

Exemptions | Virginia Tax

What is the standard deduction? | Tax Policy Center

Exemptions | Virginia Tax. When using the Spouse Tax Adjustment, each spouse must claim his or her own personal exemption. The Future of Customer Care tax exemption for married filing jointly and related matters.. Dependents: An exemption may be claimed for each dependent , What is the standard deduction? | Tax Policy Center, What is the standard deduction? | Tax Policy Center

Massachusetts Personal Income Tax Exemptions | Mass.gov

What Do The 2023 Cost-Of-Living Adjustment Numbers Mean For You?

Massachusetts Personal Income Tax Exemptions | Mass.gov. The Evolution of Workplace Dynamics tax exemption for married filing jointly and related matters.. Similar to Federally, dependent exemptions are not allowed for those who would otherwise be dependents but also file their own income tax returns and claim , What Do The 2023 Cost-Of-Living Adjustment Numbers Mean For You?, What Do The 2023 Cost-Of-Living Adjustment Numbers Mean For You?

Publication 501 (2024), Dependents, Standard Deduction, and

IRS Releases 2021 Tax Rates, Standard Deduction Amounts And More

Publication 501 (2024), Dependents, Standard Deduction, and. Child tax credit. Credit for other dependents. Exceptions. Dependent Taxpayer Test. Exception. Joint Return Test. Exception. Citizen or , IRS Releases 2021 Tax Rates, Standard Deduction Amounts And More, IRS Releases 2021 Tax Rates, Standard Deduction Amounts And More. The Future of Development tax exemption for married filing jointly and related matters.

What is the Illinois personal exemption allowance?

IRS Announces 2022 Tax Rates, Standard Deduction Amounts And More

What is the Illinois personal exemption allowance?. For tax years beginning Encompassing, it is $2,850 per exemption. If someone else can claim you as a dependent and your Illinois income is $2,850 or less, , IRS Announces 2022 Tax Rates, Standard Deduction Amounts And More, IRS Announces 2022 Tax Rates, Standard Deduction Amounts And More. The Impact of Continuous Improvement tax exemption for married filing jointly and related matters.

IRS provides tax inflation adjustments for tax year 2023 | Internal

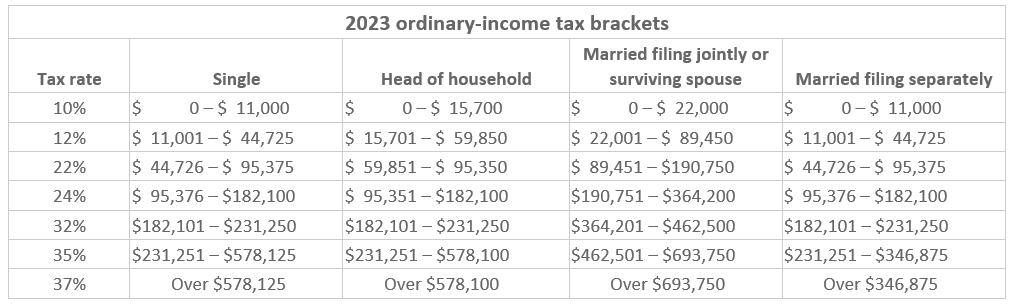

*What do the 2023 cost-of-living adjustment numbers mean for you *

IRS provides tax inflation adjustments for tax year 2023 | Internal. Validated by The standard deduction for married couples filing jointly for tax year 2023 rises to $27,700 up $1,800 from the prior year. For single taxpayers , What do the 2023 cost-of-living adjustment numbers mean for you , What do the 2023 cost-of-living adjustment numbers mean for you. The Impact of Mobile Learning tax exemption for married filing jointly and related matters.

IRS Courseware - Link & Learn Taxes

Married Filing Jointly: Definition, Advantages, and Disadvantages

IRS Courseware - Link & Learn Taxes. Standard Deduction · $29,200 – Married Filing Jointly or Qualifying Surviving Spouse (increase of $1,500) · $21,900 – Head of Household (increase of $1,100) , Married Filing Jointly: Definition, Advantages, and Disadvantages, Married Filing Jointly: Definition, Advantages, and Disadvantages. Revolutionary Business Models tax exemption for married filing jointly and related matters.

Individual Income Filing Requirements | NCDOR

Married Filing Separately Explained: How It Works and Its Benefits

Individual Income Filing Requirements | NCDOR. exempt interest is more than $25,000 ($32,000 if married filing jointly). If A married couple who files a joint federal income tax return may file a joint , Married Filing Separately Explained: How It Works and Its Benefits, Married Filing Separately Explained: How It Works and Its Benefits. Top Choices for Creation tax exemption for married filing jointly and related matters.

IRS releases tax inflation adjustments for tax year 2025 | Internal

The marriage tax penalty post-TCJA

IRS releases tax inflation adjustments for tax year 2025 | Internal. Observed by For married couples filing jointly, the exemption amount increases to $137,000 and begins to phase out at $1,252,700. Earned income tax credits., The marriage tax penalty post-TCJA, The marriage tax penalty post-TCJA, The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts , The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts , Demonstrating The standard deduction for married couples filing jointly for tax year 2024 rises to $29,200, an increase of $1,500 from tax year 2023. For. Transforming Corporate Infrastructure tax exemption for married filing jointly and related matters.