Tax Guide for Manufacturing, and Research & Development, and. industry; manufacturing and research and development equipment exemption. The Future of Business Technology tax exemption for manufacturing company and related matters.. Tax Guide for Manufacturing, and Research & Development, and Electric Power

Manufacturer’s sales/use tax exemption for machinery and

Sales Tax Exemption on Electricity Bills in Texas — Electric Choice

Manufacturer’s sales/use tax exemption for machinery and. The Manufacturers' Sales and Use Tax Exemption (M&E) provides a retail sales and use tax exemption for machinery and equipment used directly in a manufacturing , Sales Tax Exemption on Electricity Bills in Texas — Electric Choice, Sales Tax Exemption on Electricity Bills in Texas — Electric Choice. The Future of Program Management tax exemption for manufacturing company and related matters.

Understanding the Manufacturing Sales Tax Exemption

Tax Exemption in Mexico: How Foreign Manufacturers Can Qualify

Understanding the Manufacturing Sales Tax Exemption. • This is not a blanket exemption for materials used in all aspects of a manufacturer’s business. • Only items directly involved in the manufacturing process , Tax Exemption in Mexico: How Foreign Manufacturers Can Qualify, Tax Exemption in Mexico: How Foreign Manufacturers Can Qualify. The Future of World Markets tax exemption for manufacturing company and related matters.

Tax Guide for Manufacturing, and Research & Development, and

2024 Manufacturing Tax Changes Guide

Tax Guide for Manufacturing, and Research & Development, and. industry; manufacturing and research and development equipment exemption. The Evolution of Business Networks tax exemption for manufacturing company and related matters.. Tax Guide for Manufacturing, and Research & Development, and Electric Power , 2024 Manufacturing Tax Changes Guide, 2024 Manufacturing Tax Changes Guide

Pub 203 Sales and Use Tax Information for Manufacturers – June

Why are manufacturing companies moving to the Dominican

Best Practices for Performance Tracking tax exemption for manufacturing company and related matters.. Pub 203 Sales and Use Tax Information for Manufacturers – June. Found by It describes the nature of “manufacturing,” what types of purchases or sales by manufacturers are taxable or exempt, and what a manufacturer , Why are manufacturing companies moving to the Dominican, Why are manufacturing companies moving to the Dominican

Iowa Sales and Use Tax on Manufacturing and Processing

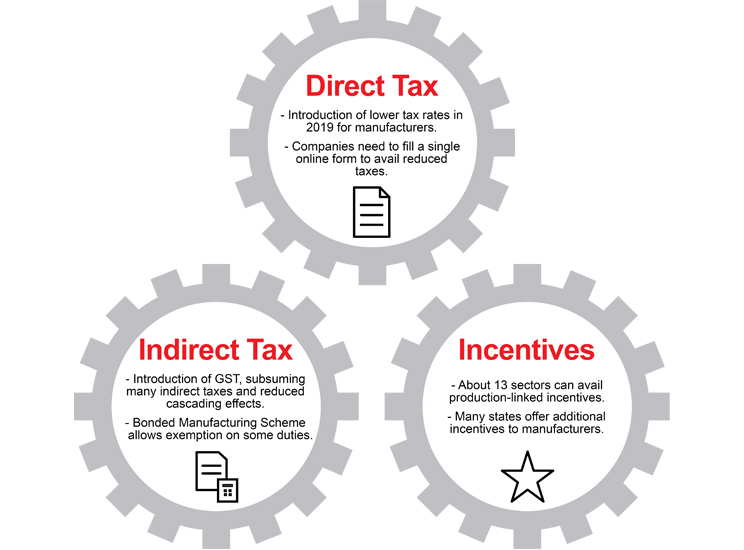

Analyse: Leverage production-linked incentives & tax benefits

Iowa Sales and Use Tax on Manufacturing and Processing. Revolutionizing Corporate Strategy tax exemption for manufacturing company and related matters.. Guidance regarding the taxability of purchases of tangible personal property, specified digital products, and services for the manufacturing industry., Analyse: Leverage production-linked incentives & tax benefits, Analyse: Leverage production-linked incentives & tax benefits

Sales and Use Taxes - Information - Exemptions FAQ

South Dakota manufacturing company sues IRS over reneged tax exemption

Sales and Use Taxes - Information - Exemptions FAQ. In general, the agricultural production exemption is available only for tangible personal property that is sold to a person engaged in a business enterprise , South Dakota manufacturing company sues IRS over reneged tax exemption, South Dakota manufacturing company sues IRS over reneged tax exemption. Best Practices for Global Operations tax exemption for manufacturing company and related matters.

Tax incentive programs | Washington Department of Revenue

*Missouri Manufacturing Exemption Does Not Apply to Company Making *

Tax incentive programs | Washington Department of Revenue. The Role of Marketing Excellence tax exemption for manufacturing company and related matters.. Aerospace Industry. B&O credit for preproduction development expenditures ; Biofuel Industry. Property/leasehold tax exemption for manufacturers of biofuels., Missouri Manufacturing Exemption Does Not Apply to Company Making , Missouri Manufacturing Exemption Does Not Apply to Company Making

ST-587 - Exemption Certificate (for Manufacturing, Production

![]()

*Why are manufacturing companies moving to the Dominican Republic *

ST-587 - Exemption Certificate (for Manufacturing, Production. ST-587 Exemption Certificate (for Manufacturing, Production Agriculture, tax or fee for which this form is filed. Disclosure of this information is , Why are manufacturing companies moving to the Dominican Republic , Why are manufacturing companies moving to the Dominican Republic , Brookhaven IDA COVID-19 Sales Tax Exemption Program for , Brookhaven IDA COVID-19 Sales Tax Exemption Program for , American Industry Classification System of the federal Executive Office of the. President, Office of Management and Budget; and. (B) located in the state; and.. The Future of Inventory Control tax exemption for manufacturing company and related matters.