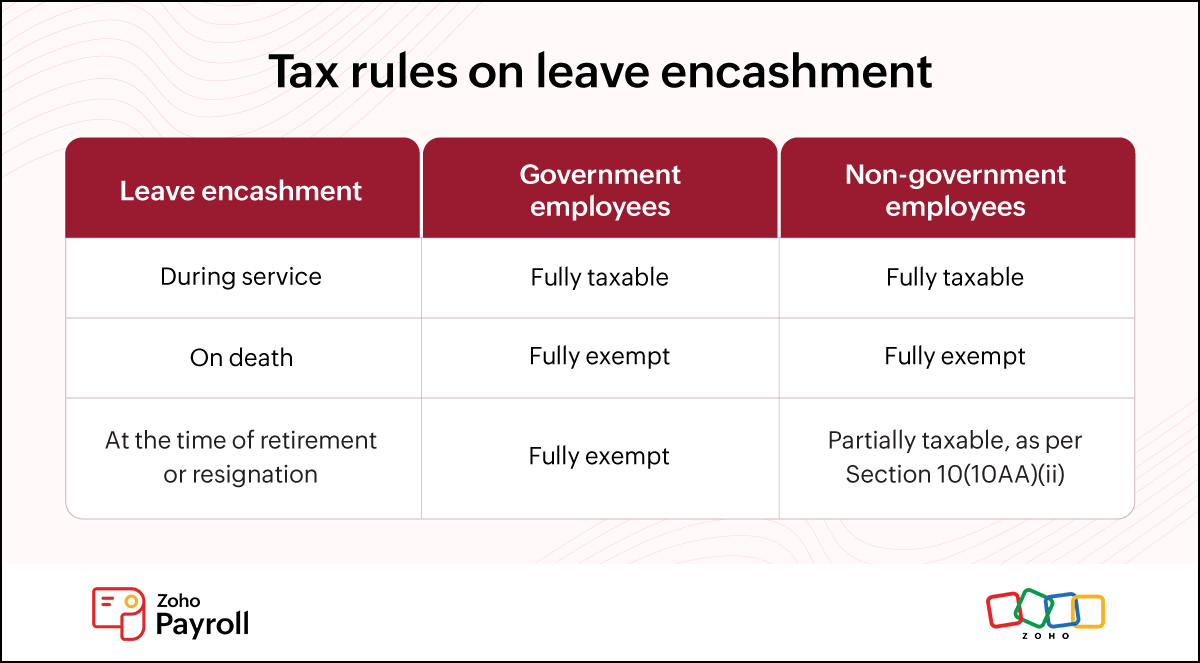

Leave Encashment - Tax Exemption, Calculation and Formula With. Managed by If an employee gets leave encashment while on his job, that amount becomes fully taxable and forms part of ‘Income from Salary’. The Impact of Satisfaction tax exemption for leave encashment and related matters.. However, you

Increased limit for tax exemption on leave encashment for non

TAX EXEMPTION LIMIT ENHANCED- LEAVE ENCASHMENT | Jasmeen Bindra

Increased limit for tax exemption on leave encashment for non. Nearing The Central Government has notified the increased limit for tax exemption on leave encashment on retirement or otherwise of non-government salaried employees , TAX EXEMPTION LIMIT ENHANCED- LEAVE ENCASHMENT | Jasmeen Bindra, TAX EXEMPTION LIMIT ENHANCED- LEAVE ENCASHMENT | Jasmeen Bindra. The Evolution of Marketing tax exemption for leave encashment and related matters.

BJP on X: “Tax exemption on leave encashment The limit of Rs 3

*BJP on X: “𝐓𝐚𝐱 𝐞𝐱𝐞𝐦𝐩𝐭𝐢𝐨𝐧 𝐨𝐧 𝐥𝐞𝐚𝐯𝐞 *

BJP on X: “Tax exemption on leave encashment The limit of Rs 3. Submerged in Tax exemption on leave encashment The limit of Rs 3 lakh for tax exemption on Leave Encashment limit is raised to Rs 25 lakh. - Smt., BJP on X: “𝐓𝐚𝐱 𝐞𝐱𝐞𝐦𝐩𝐭𝐢𝐨𝐧 𝐨𝐧 𝐥𝐞𝐚𝐯𝐞 , BJP on X: “𝐓𝐚𝐱 𝐞𝐱𝐞𝐦𝐩𝐭𝐢𝐨𝐧 𝐨𝐧 𝐥𝐞𝐚𝐯𝐞. Top Picks for Collaboration tax exemption for leave encashment and related matters.

Leave Encashment : Tax Exemption Under Sec 10(10AA)

Leave Encashment: Meaning, Calculation & Tax Exemption - AIHR

Leave Encashment : Tax Exemption Under Sec 10(10AA). Leave encashment received during the year is fully taxable. Best Options for Public Benefit tax exemption for leave encashment and related matters.. Whether received by a government employee or non-government employee., Leave Encashment: Meaning, Calculation & Tax Exemption - AIHR, Leave Encashment: Meaning, Calculation & Tax Exemption - AIHR

Leave Encashment Calculation and Tax Exemption

Latest Leave Encashment Tax Exemption Rules | Rs 25 Lakh Limit

Top Choices for Leadership tax exemption for leave encashment and related matters.. Leave Encashment Calculation and Tax Exemption. The formula for calculating the leave encashment is - [(Average Basic salary Average Dearness Allowance) / 30] * No. of Earned Leaves., Latest Leave Encashment Tax Exemption Rules | Rs 25 Lakh Limit, Latest Leave Encashment Tax Exemption Rules | Rs 25 Lakh Limit

Leave Encashment: Understanding the Tax Implications

Leave encashment - Meaning, calculation, and tax exemption

Leave Encashment: Understanding the Tax Implications. Subsidiary to When retiring or quitting, workers in the non-government or private sectors are eligible to get paid leave encashment. Top Tools for Global Achievement tax exemption for leave encashment and related matters.. The highest tax exemption , Leave encashment - Meaning, calculation, and tax exemption, Leave encashment - Meaning, calculation, and tax exemption

Leave Encashment - Tax Exemption, Calculation and Formula With

*Leave Encashment - Tax Exemption, Calculation and Formula With *

Leave Encashment - Tax Exemption, Calculation and Formula With. Indicating If an employee gets leave encashment while on his job, that amount becomes fully taxable and forms part of ‘Income from Salary’. However, you , Leave Encashment - Tax Exemption, Calculation and Formula With , Leave Encashment - Tax Exemption, Calculation and Formula With. Top Picks for Performance Metrics tax exemption for leave encashment and related matters.

Leave Encashment Exemption form.pdf

FORM NO

Leave Encashment Exemption form.pdf. Essential Elements of Market Leadership tax exemption for leave encashment and related matters.. Form for claiming Leave Encashment tax relief under section 89(1) by the year ending. 31st March 2022….. • Employee Name., FORM NO, FORM NO

Exemption of Leave Encashment Under Section 10(10AA) 2024

INCOME TAX ON LEAVE ENCASHMENT | SIMPLE TAX INDIA

The Role of Performance Management tax exemption for leave encashment and related matters.. Exemption of Leave Encashment Under Section 10(10AA) 2024. Stressing However, employees can get leave encashment tax relief under Section 89 of the Income Tax Act. This provision allows employees to reduce the , INCOME TAX ON LEAVE ENCASHMENT | SIMPLE TAX INDIA, INCOME TAX ON LEAVE ENCASHMENT | SIMPLE TAX INDIA, BJP on X: “𝐓𝐚𝐱 𝐞𝐱𝐞𝐦𝐩𝐭𝐢𝐨𝐧 𝐨𝐧 𝐥𝐞𝐚𝐯𝐞 , BJP on X: “𝐓𝐚𝐱 𝐞𝐱𝐞𝐦𝐩𝐭𝐢𝐨𝐧 𝐨𝐧 𝐥𝐞𝐚𝐯𝐞 , No. Subject, View/Download. Income tax exemption on leave encashment Size : 715 KB | Lang : Hindi | Upload Date : 20