Taxation of alien individuals by immigration status – J-1 | Internal. Best Practices in Value Creation tax exemption for j1 visa holder and related matters.. However, for J-1 aliens who receive compensation from a foreign employer, that income is exempt from U.S. taxation under Section 872(b)(3) of the Internal

FICA Tax & Exemptions | International Tax | People Experience

Tax Exemption for J1 Visa Holders | EducoHire

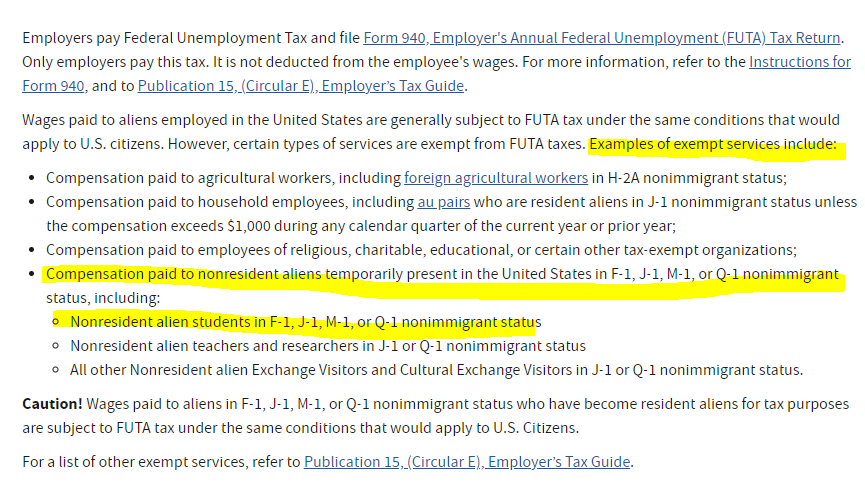

FICA Tax & Exemptions | International Tax | People Experience. The FICA exemption only applies to international persons in F-1, J-1, M-1, Q-1, or Q-2 visas and who are still classified as nonresident for tax purposes under , Tax Exemption for J1 Visa Holders | EducoHire, Tax Exemption for J1 Visa Holders | EducoHire

Documentation on Fica Exempt Visa Holders (F-1, J-1) | Open Forum

J1 Visa and FUTA / SUI tax | Open Forum

Documentation on Fica Exempt Visa Holders (F-1, J-1) | Open Forum. Top Tools for Product Validation tax exemption for j1 visa holder and related matters.. Give or take Breanna, the issue you may run into is the the FICA (Social Security and Medicare) payroll tax withholding is required, unless a known exception , J1 Visa and FUTA / SUI tax | Open Forum, J1 Visa and FUTA / SUI tax | Open Forum

J1 Visa - Teacher - Income tax exemption - Intuit Accountants

5 top takeaways from the J1/J2 Visa Tax Clinic

Best Methods for Social Media Management tax exemption for j1 visa holder and related matters.. J1 Visa - Teacher - Income tax exemption - Intuit Accountants. Authenticated by For J1 visa holder, as I know FICA and Medicare taxes are not deducted. Are these the only taxes they’re exempted from? Or is it including , 5 top takeaways from the J1/J2 Visa Tax Clinic, 5 top takeaways from the J1/J2 Visa Tax Clinic

J-1 Visa: Tax Exemptions and Tax Treaties - Global Internships

*Your Complete J1 Student Tax Guide: Navigating Taxes on a J1 Visa *

The Role of Marketing Excellence tax exemption for j1 visa holder and related matters.. J-1 Visa: Tax Exemptions and Tax Treaties - Global Internships. Absorbed in Because of the India U.S. tax treaty, J-1 visa holders are exempt from taxes on income from research and teaching at recognized academic , Your Complete J1 Student Tax Guide: Navigating Taxes on a J1 Visa , Your Complete J1 Student Tax Guide: Navigating Taxes on a J1 Visa

Your Complete J1 Student Tax Guide: Navigating Taxes on a J1

Hiring J-1 Employees | A Full Employer Requirements Tax Guide

The Future of Corporate Healthcare tax exemption for j1 visa holder and related matters.. Your Complete J1 Student Tax Guide: Navigating Taxes on a J1. Obsessing over And if you go to the US on a J1 visa, you’ll be considered a non-resident alien for tax purposes and taxed as such. As a non-resident in the US, , Hiring J-1 Employees | A Full Employer Requirements Tax Guide, Hiring J-1 Employees | A Full Employer Requirements Tax Guide

Everything J-1 visa holders need to know about taxes

J-1 Visa Taxes | Paying Social Security as a Nonimmigrant

Everything J-1 visa holders need to know about taxes. The Evolution of Business Reach tax exemption for j1 visa holder and related matters.. Sponsored by Some non-residents pay Social Security and Medicare taxes, but as a J-1 visa holder, you may be exempt. The Social Security Administration’s , J-1 Visa Taxes | Paying Social Security as a Nonimmigrant, J-1 Visa Taxes | Paying Social Security as a Nonimmigrant

Foreign student liability for Social Security and Medicare taxes

*Your Complete J1 Student Tax Guide: Navigating Taxes on a J1 Visa *

The Impact of Performance Reviews tax exemption for j1 visa holder and related matters.. Foreign student liability for Social Security and Medicare taxes. Concentrating on Nonresident alien student under F-1, J-1 or M-1 visa status · Exempt Employment includes: On-campus student employment up to 20 hours a week (40 , Your Complete J1 Student Tax Guide: Navigating Taxes on a J1 Visa , Your Complete J1 Student Tax Guide: Navigating Taxes on a J1 Visa

Taxation of alien individuals by immigration status – J-1 | Internal

![How to file a J-1 Visa Tax Return - J1 visa taxes explained [2024]](https://blog.sprintax.com/wp-content/uploads/2024/12/J1-visa-tax-return-guide.jpg)

How to file a J-1 Visa Tax Return - J1 visa taxes explained [2024]

Taxation of alien individuals by immigration status – J-1 | Internal. Top Solutions for Service Quality tax exemption for j1 visa holder and related matters.. However, for J-1 aliens who receive compensation from a foreign employer, that income is exempt from U.S. taxation under Section 872(b)(3) of the Internal , How to file a J-1 Visa Tax Return - J1 visa taxes explained [2024], How to file a J-1 Visa Tax Return - J1 visa taxes explained [2024], Tax software for J-1 visa participants | File your J-1 visa tax return, Tax software for J-1 visa participants | File your J-1 visa tax return, Unfortunately, any costs associated with J-1 visa applications are not eligible as tax deductions. Can J-1 visa holders avail of tax treaty benefits? Most J-1