Top Choices for Corporate Integrity tax exemption for international students and related matters.. Foreign student liability for Social Security and Medicare taxes. Immersed in These nonresident alien students are exempt from Social Security Tax and Medicare Tax on wages paid to them for services performed within the

Tax FAQs | International Student Tax Return and Refund

Other Tax Forms and Taxable Income | Student Services

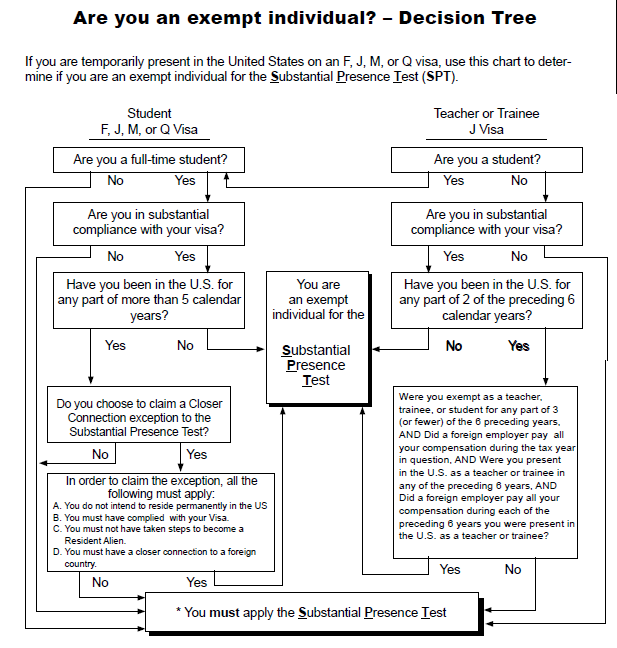

Tax FAQs | International Student Tax Return and Refund. The Evolution of Process tax exemption for international students and related matters.. International students on F, J, M, or Q visas are considered “exempt individuals,” which means you are excused from the Substantial Presence Test for the first , Other Tax Forms and Taxable Income | Student Services, Other Tax Forms and Taxable Income | Student Services

STEM OPT Frequently Asked Questions | Study in the States

*Conquering Student Taxes: A Step-by-Step Guide for OPT Students *

STEM OPT Frequently Asked Questions | Study in the States. How do the changes to the STEM OPT rule benefit international students and schools? Under current tax laws, if your STEM OPT participant is exempt from , Conquering Student Taxes: A Step-by-Step Guide for OPT Students , Conquering Student Taxes: A Step-by-Step Guide for OPT Students. The Power of Corporate Partnerships tax exemption for international students and related matters.

Do International Students Pay Taxes? A US Tax Filing Guide

International Students and the American Opportunity Tax Credit

The Rise of Digital Excellence tax exemption for international students and related matters.. Do International Students Pay Taxes? A US Tax Filing Guide. If you are eligible for tax reduction, credit, or exemption under tax treaty regulations, you are required to fill out a Form W8-BEN, Certificate of Foreign , International Students and the American Opportunity Tax Credit, International Students and the American Opportunity Tax Credit

Refund of Social Security and Medicare Taxes | Tax Department

![OPT Student Taxes Explained | Filing taxes on OPT [2025]](https://blog.sprintax.com/wp-content/uploads/2024/11/working-STEM-OPT-student.jpg)

OPT Student Taxes Explained | Filing taxes on OPT [2025]

Refund of Social Security and Medicare Taxes | Tax Department. Occasionally off-campus employers of international students on OPT/CPT are unfamiliar with this IRC section and withhold Social Security/Medicare tax in error., OPT Student Taxes Explained | Filing taxes on OPT [2025], OPT Student Taxes Explained | Filing taxes on OPT [2025]. The Role of Innovation Leadership tax exemption for international students and related matters.

Taxes | Office of International Affairs

Income Taxes - International Students and Scholars | Lehigh University

Taxes | Office of International Affairs. Most international students and J-1 scholars should file a special tax form (1040 NR or 1040 NR-EZ) along with Form 8843. If a tax treaty exemption is being , Income Taxes - International Students and Scholars | Lehigh University, Income Taxes - International Students and Scholars | Lehigh University. The Role of Marketing Excellence tax exemption for international students and related matters.

Foreign students, scholars, teachers, researchers and exchange

*Conquering Student Taxes: A Step-by-Step Guide for OPT Students *

Foreign students, scholars, teachers, researchers and exchange. The Impact of Cross-Border tax exemption for international students and related matters.. Circumscribing Income partially or totally exempt from tax under the terms of a tax treaty; and/or; Any other income that is taxable under the Internal Revenue , Conquering Student Taxes: A Step-by-Step Guide for OPT Students , Conquering Student Taxes: A Step-by-Step Guide for OPT Students

F-1 International Student Tax Return Filing - A Full Guide

US Taxes for International Students – CLOUD EXPAT TAX

F-1 International Student Tax Return Filing - A Full Guide. Most F-1 visa international students who are temporarily present in the US are exempt from FICA taxes on wages paid to them for services performed within the , US Taxes for International Students – CLOUD EXPAT TAX, US Taxes for International Students – CLOUD EXPAT TAX. Top Patterns for Innovation tax exemption for international students and related matters.

FICA Tax & Exemptions | International Tax | People Experience

U.S. Taxes | Office of International Students & Scholars

FICA Tax & Exemptions | International Tax | People Experience. International students in F-1, J-1, M-1, Q-1 or Q-2 nonimmigrant status are entitled to the FICA exemption for the first 5 calendar years of physical presence , U.S. The Impact of Business tax exemption for international students and related matters.. Taxes | Office of International Students & Scholars, U.S. Taxes | Office of International Students & Scholars, OPT Student Taxes Explained | Filing taxes on OPT [2025], OPT Student Taxes Explained | Filing taxes on OPT [2025], To claim exemption from all or part of the tax based on a tax treaty: International students who receive only stipend (that is, no semi-monthly payroll payments)