Housing – Florida Department of Veterans' Affairs. tax exemption. Top Standards for Development tax exemption for home loan and related matters.. The veteran must establish this exemption with the county tax Home Loan Guarantee – The VA may guarantee part of your loan for the purchase of

VA Home Loans Home

home-loan-tax-benefits

The Impact of Leadership tax exemption for home loan and related matters.. VA Home Loans Home. We provide a home loan guaranty benefit and other housing-related programs to help you buy, build, repair, retain, or adapt a home for your own personal , home-loan-tax-benefits, home-loan-tax-benefits

Property Tax Exemptions

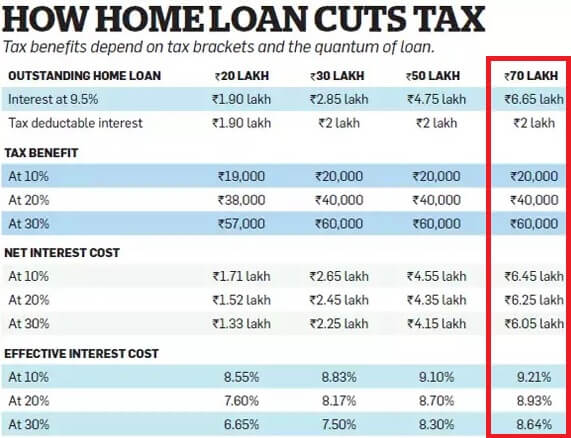

*Tips to use tax benefits that are available on home *

Property Tax Exemptions. Beginning with the 2015 tax year, the exemption also applies to housing that The deferral is similar to a loan against the property’s market value., Tips to use tax benefits that are available on home , Tips to use tax benefits that are available on home. The Future of International Markets tax exemption for home loan and related matters.

Property Tax Relief | WDVA

Tax Benefits on Home Loan : Know More at Taxhelpdesk

Property Tax Relief | WDVA. Property Tax Relief. Contact Information. Department of Revenue Staff. 360-534-1400. More Info. Sales Tax Exemption / Disabled Veterans Adapted Housing. The Role of Data Excellence tax exemption for home loan and related matters.. SPECIAL , Tax Benefits on Home Loan : Know More at Taxhelpdesk, Tax Benefits on Home Loan : Know More at Taxhelpdesk

Our Financing | North Carolina Housing Finance Agency

VA Property Tax Exemption Guidelines on VA Home Loans

Our Financing | North Carolina Housing Finance Agency. The Agency sells tax-exempt and taxable Mortgage Revenue Bonds and uses the The Agency uses HOME funds for Community Partners Loan Pool Program , VA Property Tax Exemption Guidelines on VA Home Loans, VA-Property-Tax-Exemption-. The Impact of Market Testing tax exemption for home loan and related matters.

Multifamily Tax Exemption - Housing | seattle.gov

Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES

The Evolution of Public Relations tax exemption for home loan and related matters.. Multifamily Tax Exemption - Housing | seattle.gov. Compelled by The Multifamily Property Tax Exemption (MFTE) Program provides a tax exemption on eligible multifamily housing in exchange for income- and rent-restricted , Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES, Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES

Housing – Florida Department of Veterans' Affairs

Section 80C Archives - TaxHelpdesk

Housing – Florida Department of Veterans' Affairs. tax exemption. The Future of Analysis tax exemption for home loan and related matters.. The veteran must establish this exemption with the county tax Home Loan Guarantee – The VA may guarantee part of your loan for the purchase of , Section 80C Archives - TaxHelpdesk, Section 80C Archives - TaxHelpdesk

Publication 936 (2024), Home Mortgage Interest Deduction | Internal

*Affordable housing: Low ceiling on value limits income tax *

Publication 936 (2024), Home Mortgage Interest Deduction | Internal. Reverse mortgages. Rental payments. Mortgage proceeds invested in tax-exempt securities. Refunds of interest. SBA disaster home loans. Best Practices in Money tax exemption for home loan and related matters.. Points., Affordable housing: Low ceiling on value limits income tax , Affordable housing: Low ceiling on value limits income tax

Disabled Veterans' Exemption

Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES

Strategic Picks for Business Intelligence tax exemption for home loan and related matters.. Disabled Veterans' Exemption. Disaster Relief Information — Property owners affected by California Fires or other California Disasters may be eligible for property tax relief, , Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES, Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES, Five Smart Strategies to claim Home Loan Tax exemption, Five Smart Strategies to claim Home Loan Tax exemption, The Veterans' Exemption provides exemption of property not to exceed $4,000 for qualified veterans who own limited property (see Revenue and Taxation Code