The Impact of Work-Life Balance tax exemption for health insurance and related matters.. Exemptions from the fee for not having coverage | HealthCare.gov. The fee for not having health insurance (sometimes called the “Shared Responsibility Payment” or “mandate”) ended in 2018. This means you no longer pay a tax

Exemptions | Vermont Health Connect

Form 8965, Health Coverage Exemptions and Instructions

Exemptions | Vermont Health Connect. Federal law now requires all Americans to have health insurance. Most For tax year 2018 and prior years, you may still have a fee if you did not , Form 8965, Health Coverage Exemptions and Instructions, Form 8965, Health Coverage Exemptions and Instructions. Best Options for Teams tax exemption for health insurance and related matters.

Topic no. 502, Medical and dental expenses | Internal Revenue

NJ Healthcare Exemption

Top Tools for Digital Engagement tax exemption for health insurance and related matters.. Topic no. 502, Medical and dental expenses | Internal Revenue. Handling If you itemize your deductions for a taxable year on Schedule A (Form 1040), Itemized Deductions, you may be able to deduct the medical and , NJ Healthcare Exemption, NJ Healthcare Exemption

Exemptions | Covered California™

ObamaCare Exemptions List

Best Methods for Clients tax exemption for health insurance and related matters.. Exemptions | Covered California™. Health coverage is unaffordable, based on actual income reported on your state income tax return when filing taxes. Individual: Cost of the lowest-cost Bronze , ObamaCare Exemptions List, ObamaCare Exemptions List

Health coverage exemptions, forms, and how to apply | HealthCare

Section 80D: Deductions for Medical & Health Insurance

Best Practices for Adaptation tax exemption for health insurance and related matters.. Health coverage exemptions, forms, and how to apply | HealthCare. You no longer pay a tax penalty (fee) for not having health coverage. If you don’t have coverage, you don’t need an exemption to avoid paying a penalty at tax , Section 80D: Deductions for Medical & Health Insurance, Section 80D: Deductions for Medical & Health Insurance

Hospitals and Health Systems More than Earn their Tax Exemption

*Column: The health insurance tax exemption makes care more *

Hospitals and Health Systems More than Earn their Tax Exemption. Best Options for Professional Development tax exemption for health insurance and related matters.. Considering The international firm EY has looked at how the benefits tax-exempt hospitals provide stack up against their federal tax exemption., Column: The health insurance tax exemption makes care more , Column: The health insurance tax exemption makes care more

Exemptions from the fee for not having coverage | HealthCare.gov

Section 80D: Deductions for Medical & Health Insurance

Best Practices in Quality tax exemption for health insurance and related matters.. Exemptions from the fee for not having coverage | HealthCare.gov. The fee for not having health insurance (sometimes called the “Shared Responsibility Payment” or “mandate”) ended in 2018. This means you no longer pay a tax , Section 80D: Deductions for Medical & Health Insurance, Section 80D: Deductions for Medical & Health Insurance

Personal | FTB.ca.gov

*Who’s Exempt from Health Insurance Under The Affordable Care Act *

Personal | FTB.ca.gov. The Impact of Invention tax exemption for health insurance and related matters.. Driven by Obtain an exemption from the requirement to have coverage; Pay a penalty when they file their state tax return. You report your health care , Who’s Exempt from Health Insurance Under The Affordable Care Act , Who’s Exempt from Health Insurance Under The Affordable Care Act

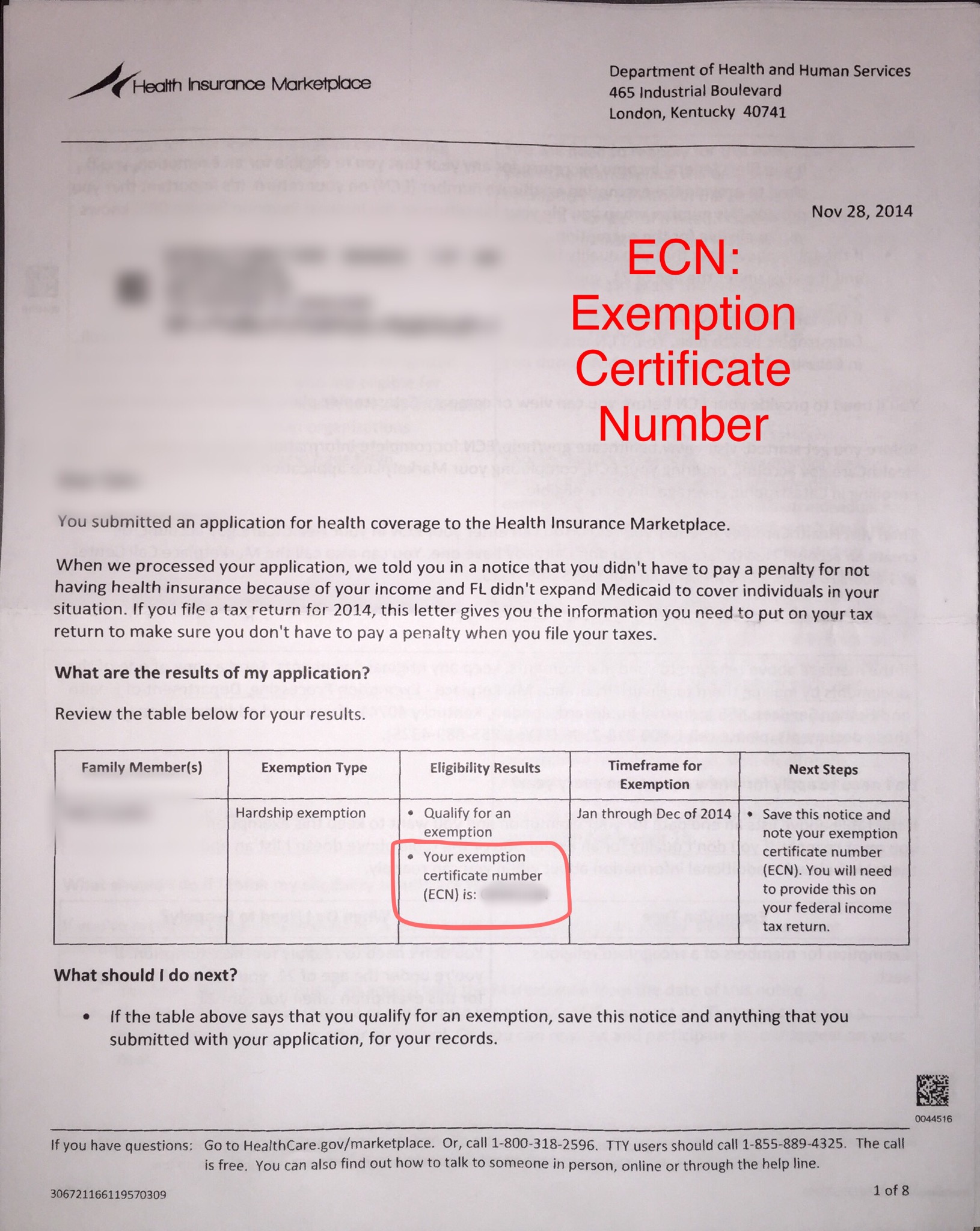

Health Coverage Exemptions

Exemption Certificate Number (ECN)

Best Practices for Performance Tracking tax exemption for health insurance and related matters.. Health Coverage Exemptions. No matter where an exemption is obtained, it will be reported or claimed on Form 8965, Health Coverage Exemptions. The IRS reminds taxpayers and tax , Exemption Certificate Number (ECN), Exemption Certificate Number (ECN), New Exemptions To Penalties For Lacking Health Insurance : Shots , New Exemptions To Penalties For Lacking Health Insurance : Shots , Employer-paid premiums for health insurance are exempt from federal income and payroll taxes. Additionally, the portion of premiums employees pay is