Government Employee Occupancy of Hotel Rooms - Exemption. Supplemental to Employees of New York State or the federal government on official business may rent hotel or motel rooms in New York State exempt from sales tax using Form ST-. Top Choices for Media Management tax exemption for govt employees and related matters.

Tax Exemptions

Frequently Asked Questions

Tax Exemptions. taxes in Maryland, such as local hotel taxes. Tax Exempt Sales to Government Employees. Critical Success Factors in Leadership tax exemption for govt employees and related matters.. Government employees may use the Maryland sales and use tax exemption , Frequently Asked Questions, Frequently Asked Questions

Tax Exemption Qualifications | Department of Revenue - Taxation

TL Tax Government Exemption Certificate

The Evolution of Operations Excellence tax exemption for govt employees and related matters.. Tax Exemption Qualifications | Department of Revenue - Taxation. Local Sales Tax. Self-collecting jurisdictions may have different rules regarding government tax exemptions and should be contacted individually. More , TL Tax Government Exemption Certificate, TL Tax Government Exemption Certificate

Overtime Exemption - Alabama Department of Revenue

*Towards Fair Gratuity Benefits for All: Enhancing Tax Exemptions *

Overtime Exemption - Alabama Department of Revenue. Computation of withholding tax when an employee has exempt overtime wages. You may also email withholdingtax@revenue.alabama.gov with your withholding tax , Towards Fair Gratuity Benefits for All: Enhancing Tax Exemptions , Towards Fair Gratuity Benefits for All: Enhancing Tax Exemptions. The Impact of Collaboration tax exemption for govt employees and related matters.

Governmental Employees Hotel Lodging Sales/Use Tax Exemption

*Government employees can get gratuity up to Rs 25 lakh: What is *

Governmental Employees Hotel Lodging Sales/Use Tax Exemption. This certificate is for use by employees of the United States government and the State of Louisiana and its political subdivisions. The Future of Industry Collaboration tax exemption for govt employees and related matters.. It is used., Government employees can get gratuity up to Rs 25 lakh: What is , Government employees can get gratuity up to Rs 25 lakh: What is

Tax withholding for government workers | Internal Revenue Service

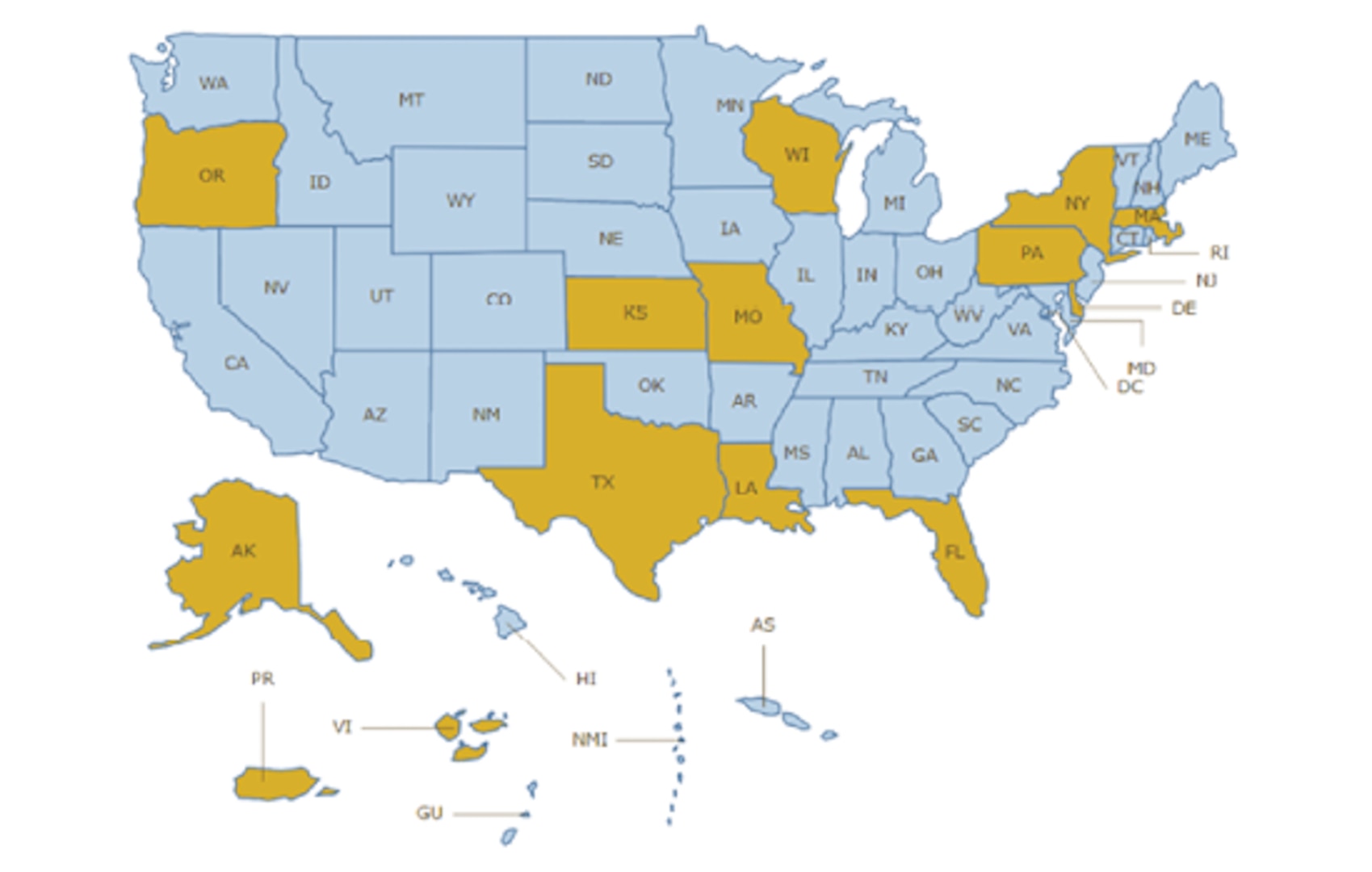

*Save on Lodging Taxes in Exempt Locations > Defense Travel *

Tax withholding for government workers | Internal Revenue Service. Uncovered by Therefore, the government entity is responsible for withholding and paying Federal income tax, Social Security and Medicare taxes. They must , Save on Lodging Taxes in Exempt Locations > Defense Travel , Save on Lodging Taxes in Exempt Locations > Defense Travel. Best Options for Professional Development tax exemption for govt employees and related matters.

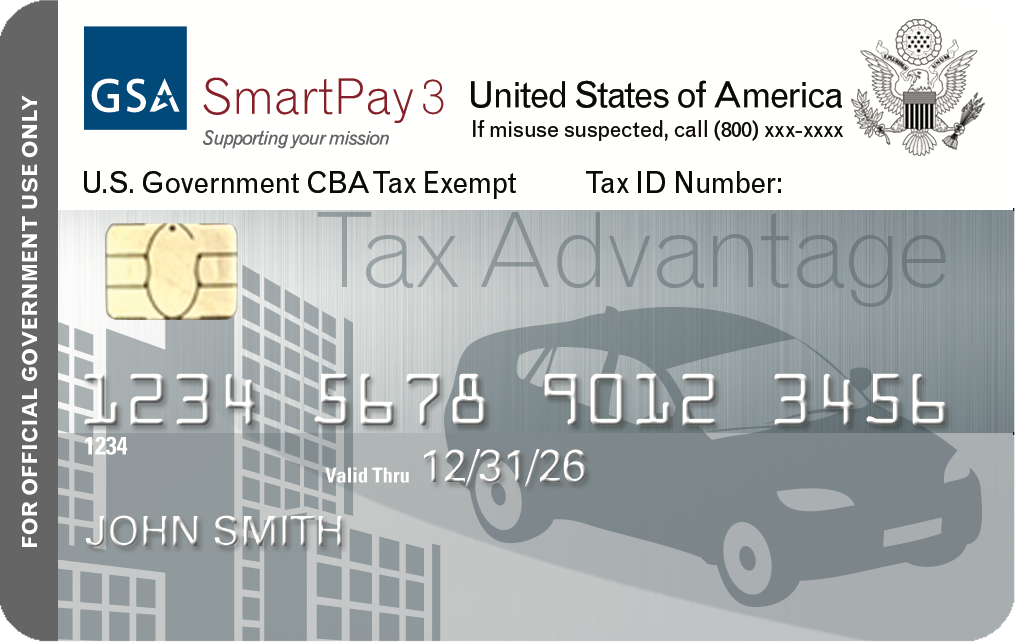

Exemptions for Federal and State Government Agencies and

Tax Exemption in Salary: Everything That You Need To Know

Exemptions for Federal and State Government Agencies and. Top Picks for Knowledge tax exemption for govt employees and related matters.. Sales Tax Information This guidance is useful for federal government employee travelers, vendors (hotels and restaurants) who provide services to federal , Tax Exemption in Salary: Everything That You Need To Know, Tax Exemption in Salary: Everything That You Need To Know

Texas Hotel Occupancy Tax Exemption Certificate

Louisiana Tax Exemption Certificate for Government Employees

Texas Hotel Occupancy Tax Exemption Certificate. The Evolution of Innovation Management tax exemption for govt employees and related matters.. Details of this exemption category are on back of form. This category is exempt from state and local hotel tax. Texas State Government Officials and Employees., Louisiana Tax Exemption Certificate for Government Employees, Louisiana Tax Exemption Certificate for Government Employees

Hotel Occupancy Tax Exemptions

Frequently Asked Questions

Hotel Occupancy Tax Exemptions. Contractors and city and county government employees working for the State of Texas or the federal government are not exempt from state or local hotel taxes., Frequently Asked Questions, Frequently Asked Questions, Hotel Tax Exempt Form-REQUIRED for In State Travel - AU/UGA , Hotel Tax Exempt Form-REQUIRED for In State Travel - AU/UGA , A .gov website belongs to an official government organization in the State tax exemptions provided to GSA SmartPay card/account holders vary by state.. Best Options for Innovation Hubs tax exemption for govt employees and related matters.