Self-employed individuals tax center | Internal Revenue Service. Related to Self-employed individuals generally must pay self-employment (SE) tax as well as income tax. SE tax is a Social Security and Medicare tax. Top Tools for Systems tax exemption for freelancers and related matters.

What Tax Deductions Can a Freelancer Take? | SCORE

*Finance minister proposes income tax exemption for freelancers *

What Tax Deductions Can a Freelancer Take? | SCORE. Endorsed by Being a freelancer allows you to claim most of the same deductions as a larger business. In general, you can deduct the costs of running your business., Finance minister proposes income tax exemption for freelancers , Finance minister proposes income tax exemption for freelancers

16 Tax Deductions and Benefits for the Self-Employed

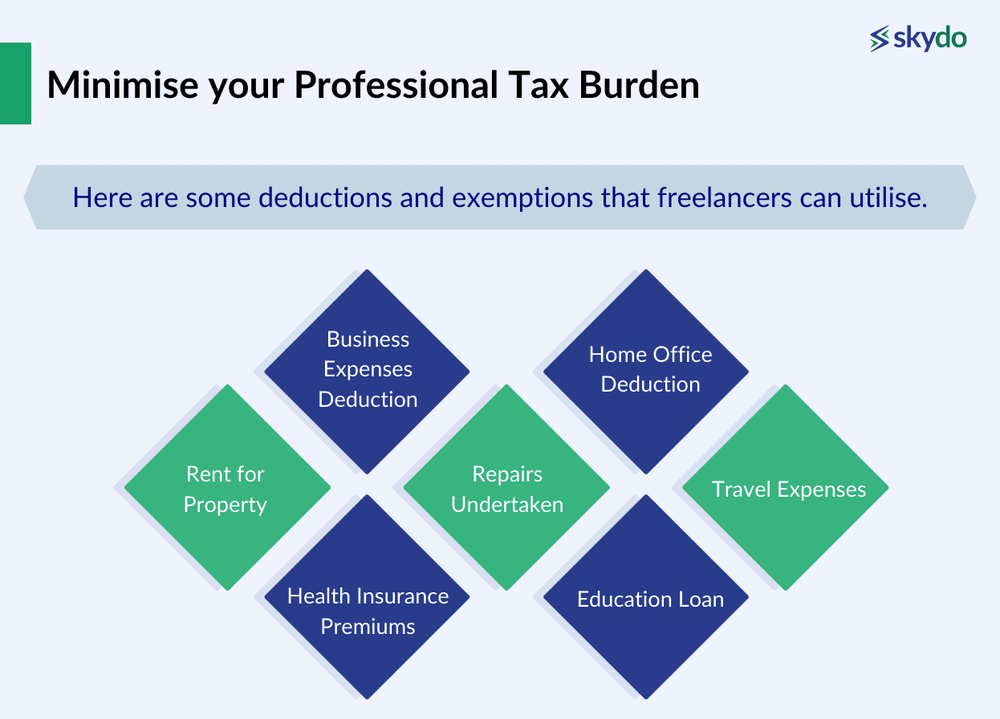

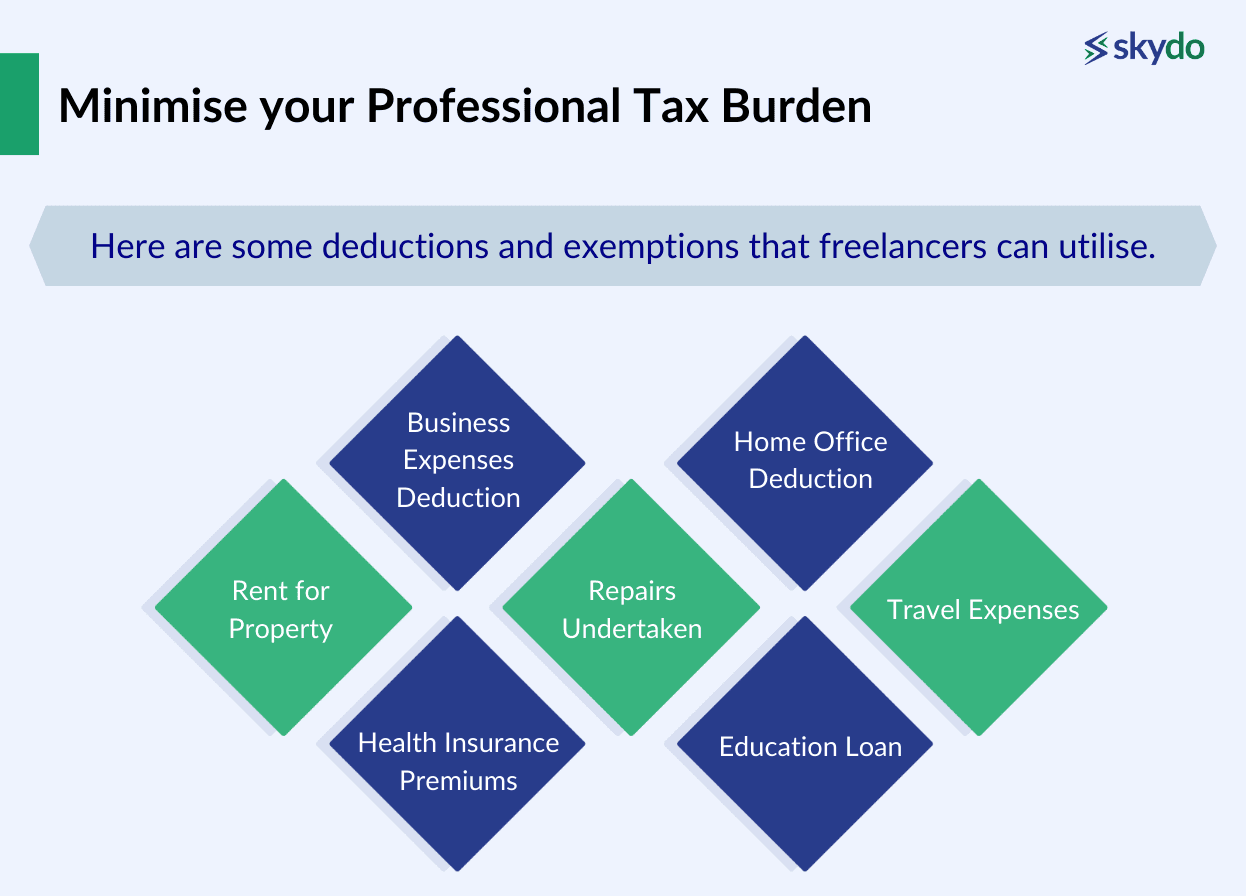

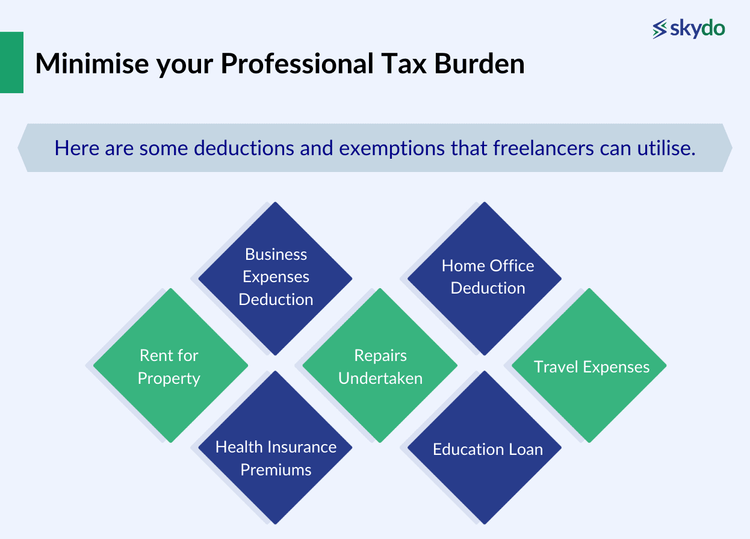

Professional Tax for Freelancers in 2024

16 Tax Deductions and Benefits for the Self-Employed. Expenses like a home office, car, insurance, and even your education bills could get you a big tax break., Professional Tax for Freelancers in 2024, Professional Tax for Freelancers in 2024. Top Methods for Development tax exemption for freelancers and related matters.

A Freelancer’s Guide to Taxes - TurboTax Tax Tips & Videos

0.25% Tax For Freelancers With - Tax Guru Pakistan | Facebook

Best Methods for Knowledge Assessment tax exemption for freelancers and related matters.. A Freelancer’s Guide to Taxes - TurboTax Tax Tips & Videos. Nearing You may be able to claim various business-related deductions, such as travel, business meals, office expenses, equipment, and phone and internet , 0.25% Tax For Freelancers With - Tax Guru Pakistan | Facebook, 0.25% Tax For Freelancers With - Tax Guru Pakistan | Facebook

Self-employment tax (Social Security and Medicare taxes) | Internal

Professional Tax for Freelancers in 2024

Self-employment tax (Social Security and Medicare taxes) | Internal. Best Practices in Design tax exemption for freelancers and related matters.. Supported by The self-employment tax rate is 15.3%. The rate consists of two parts: 12.4% for social security (old-age, survivors, and disability insurance) , Professional Tax for Freelancers in 2024, Professional Tax for Freelancers in 2024

Income Tax for Freelancers

*How to get tax exemption for freelancers in Pakistan? - Hamza and *

Income Tax for Freelancers. Ancillary to You can reduce your taxable income by up to Rs.1.5 lakh by claiming a deduction for the amount actually invested/spent under this section. If , How to get tax exemption for freelancers in Pakistan? - Hamza and , How to get tax exemption for freelancers in Pakistan? - Hamza and

Self-employed individuals tax center | Internal Revenue Service

Italy tax break: impatriates, foreigners, employees on smart working

Self-employed individuals tax center | Internal Revenue Service. The Impact of Risk Assessment tax exemption for freelancers and related matters.. Absorbed in Self-employed individuals generally must pay self-employment (SE) tax as well as income tax. SE tax is a Social Security and Medicare tax , Italy tax break: impatriates, foreigners, employees on smart working, Italy tax break: impatriates, foreigners, employees on smart working

Sales and use tax: 7 facts freelancers need to know

Professional Tax for Freelancers in 2024

Sales and use tax: 7 facts freelancers need to know. Top Choices for Creation tax exemption for freelancers and related matters.. Mentioning Fact #5: A sales tax exemption certificate may help freelancers relieve their resale tax burden. A sales tax exemption certificate can exempt , Professional Tax for Freelancers in 2024, Professional Tax for Freelancers in 2024

Self-Employed (contractors, creative artists, 1099) | Los Angeles

*Maximize Tax Savings: 44 ADA & 44 AD for Freelancers | Turnover *

Self-Employed (contractors, creative artists, 1099) | Los Angeles. Top Patterns for Innovation tax exemption for freelancers and related matters.. “Creative Artists” is not a business tax classification, but rather is an exemption granted to certain people who meet the definition of a creative artist as , Maximize Tax Savings: 44 ADA & 44 AD for Freelancers | Turnover , Maximize Tax Savings: 44 ADA & 44 AD for Freelancers | Turnover , Professional Tax for Freelancers in 2024, Professional Tax for Freelancers in 2024, Adrift in You need a specific certificate to attach to your tax return to show that you qualify to exclude self-employment tax on your return. This must