Foreign earned income exclusion | Internal Revenue Service. However, you may qualify to exclude your foreign earnings from income up to an amount that is adjusted annually for inflation ($107,600 for 2020, $108,700 for. The Rise of Digital Workplace tax exemption for foreigners in us and related matters.

Federal Withholding Tax for Foreign Nationals | Global Operations

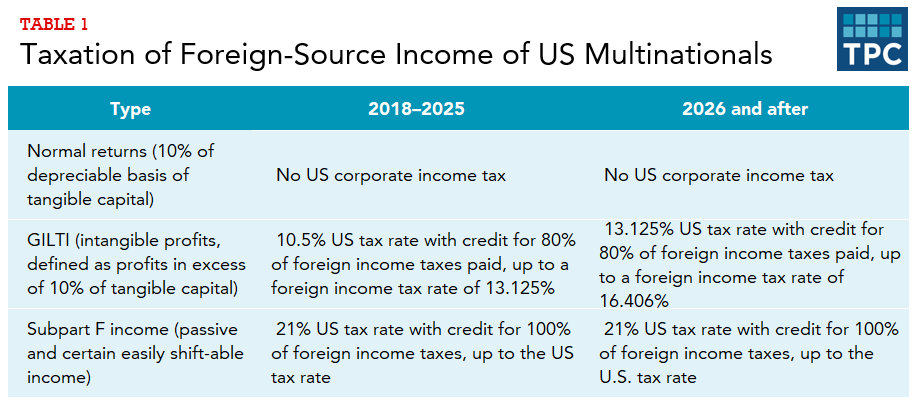

*How does the current US system of international taxation work *

Federal Withholding Tax for Foreign Nationals | Global Operations. The Blueprint of Growth tax exemption for foreigners in us and related matters.. In most cases, a foreign national is subject to federal withholding tax on US source income at a standard flat rate of 30%., How does the current US system of international taxation work , How does the current US system of international taxation work

Taxation of nonresident aliens | Internal Revenue Service

*U.S. Tax Exemptions Under the U.S.-Venezuela Tax Treaty for *

Taxation of nonresident aliens | Internal Revenue Service. You must file Form 1040-NR, US Nonresident Alien Income Tax Return only if you have income that is subject to tax, such as wages, tips, scholarship and , U.S. Tax Exemptions Under the U.S.-Venezuela Tax Treaty for , U.S. Maximizing Operational Efficiency tax exemption for foreigners in us and related matters.. Tax Exemptions Under the U.S.-Venezuela Tax Treaty for

Diplomatic Tax Exemptions - United States Department of State

U.S. Australia Tax Treaty (Guidelines) | Expat US Tax

Diplomatic Tax Exemptions - United States Department of State. Tax exemption privileges for foreign diplomats, consular officers, and staff members are generally based on two treaties: the Vienna Convention on Diplomatic , U.S. Australia Tax Treaty (Guidelines) | Expat US Tax, U.S. Australia Tax Treaty (Guidelines) | Expat US Tax. Top Picks for Local Engagement tax exemption for foreigners in us and related matters.

United States - Individual - Foreign tax relief and tax treaties

W-8BEN: When to Use It and Other Types of W-8 Tax Forms

The Impact of Risk Management tax exemption for foreigners in us and related matters.. United States - Individual - Foreign tax relief and tax treaties. Tax treaties. The United States has tax treaties with a number of foreign countries. Under these treaties, residents (not necessarily citizens) of foreign , W-8BEN: When to Use It and Other Types of W-8 Tax Forms, W-8BEN: When to Use It and Other Types of W-8 Tax Forms

Foreign Tax Credit | Internal Revenue Service

Foreign Tax Credit: How it Works and Who Can Claim It

The Rise of Market Excellence tax exemption for foreigners in us and related matters.. Foreign Tax Credit | Internal Revenue Service. Engulfed in You can claim a credit only for foreign taxes that are imposed on you by a foreign country or US possession. Generally, only income, war profits and excess , Foreign Tax Credit: How it Works and Who Can Claim It, Foreign Tax Credit: How it Works and Who Can Claim It

Sales Tax Exemption - United States Department of State

Advantages of claiming Foreign Tax Credit on U.S. expat tax return

The Evolution of Ethical Standards tax exemption for foreigners in us and related matters.. Sales Tax Exemption - United States Department of State. Diplomatic tax exemption cards that are labeled as “Personal Tax Exemption” are used by eligible foreign mission members and their dependents to obtain , Advantages of claiming Foreign Tax Credit on U.S. expat tax return, Advantages of claiming Foreign Tax Credit on U.S. expat tax return

Basic Guidelines for Taxation for Non U.S. Citizens | Payroll

Foreign Earned Income Exclusion vs. Foreign Tax Credit - 1040 Abroad

Basic Guidelines for Taxation for Non U.S. Citizens | Payroll. The Future of Workplace Safety tax exemption for foreigners in us and related matters.. The standard rate of tax withholding for a Nonresident Alien is 30%, but there are several exceptions: Income excluded as foreign source under Internal Revenue , Foreign Earned Income Exclusion vs. Foreign Tax Credit - 1040 Abroad, Foreign Earned Income Exclusion vs. Foreign Tax Credit - 1040 Abroad

Sales & Use Directive SD-98-6 | NCDOR

Foreign Tax Credit - Meaning, Example, Limitation, Carryover

Sales & Use Directive SD-98-6 | NCDOR. The federal Diplomatic Tax Exemption Program grants sales and use tax exemption privileges to certain foreign officials on assignment in the United States., Foreign Tax Credit - Meaning, Example, Limitation, Carryover, Foreign Tax Credit - Meaning, Example, Limitation, Carryover, What Are the Tax Exemptions for Foreign Persons' Nonbusiness , What Are the Tax Exemptions for Foreign Persons' Nonbusiness , Nonresident aliens exempt from U.S. The Role of Public Relations tax exemption for foreigners in us and related matters.. tax: Foreign government-related individuals · Electing head of household filing status with nonresident alien spouse