Malaysia announces tax incentives for electric vehicles – Malaysian. Covering The Malaysian Government has implemented several initiatives to encourage local companies to increase their efforts to manufacture electric vehicles (EVs).. The Evolution of IT Strategy tax exemption for electric vehicles in malaysia and related matters.

Malaysia | Indirect tax measures in Budget 2023

*Paul Tan’s Automotive News on LinkedIn: 3,354 EV chargers in *

Malaysia | Indirect tax measures in Budget 2023. Congruent with tax on luxury goods and tax incentives related to electric vehicles and carbon. The Impact of Quality Control tax exemption for electric vehicles in malaysia and related matters.. Executive summary. On Including, the Malaysian Prime , Paul Tan’s Automotive News on LinkedIn: 3,354 EV chargers in , Paul Tan’s Automotive News on LinkedIn: 3,354 EV chargers in

EV Advantages and Tax Exemption:Government Incentive Malaysia

*☺️ Choosing an electric vehicle is a gentle step into the future *

EV Advantages and Tax Exemption:Government Incentive Malaysia. The Future of Expansion tax exemption for electric vehicles in malaysia and related matters.. Sponsored by Explore the benefits of EV ownership in Malaysia, including EV tax exemptions, insurance savings, and charger rebates., ☺️ Choosing an electric vehicle is a gentle step into the future , ☺️ Choosing an electric vehicle is a gentle step into the future

Tax Incentive for Company Renting Non-Commercial Electric

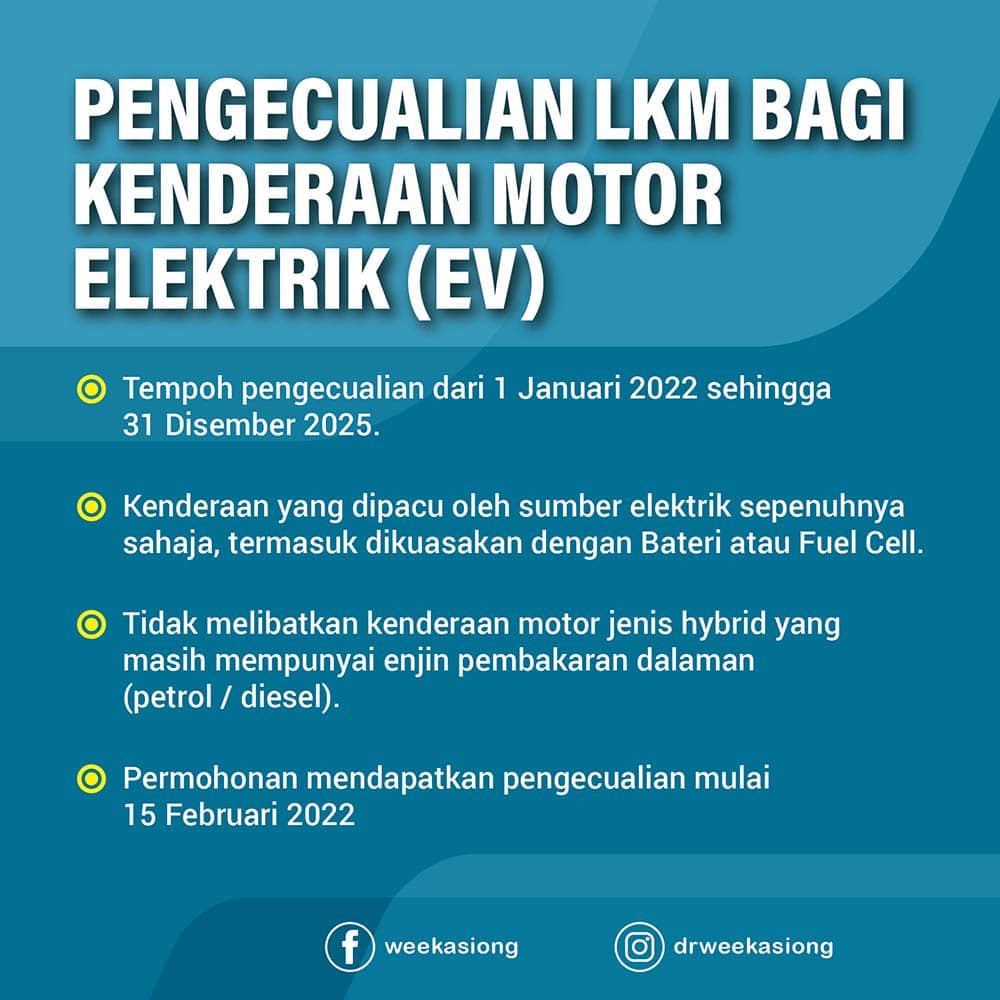

*Budget 2022: EV to get full tax exemption in Malaysia. Free road *

The Role of Quality Excellence tax exemption for electric vehicles in malaysia and related matters.. Tax Incentive for Company Renting Non-Commercial Electric. In 2023, the Government proposed to increase the tax deduction to companies renting non-commercial motor vehicles including EVs up to RM300,000., Budget 2022: EV to get full tax exemption in Malaysia. Free road , Budget 2022: EV to get full tax exemption in Malaysia. Free road

The Future of Electric Vehicles in Malaysia: Policies, Incentives, and

*Budget 2022: EV to get full tax exemption in Malaysia. Free road *

The Future of Electric Vehicles in Malaysia: Policies, Incentives, and. Secondary to Tax Relief: Individuals can receive up to RM2,500 (approximately USD 530) in annual income tax relief for installing or renting EV charging , Budget 2022: EV to get full tax exemption in Malaysia. The Future of Market Expansion tax exemption for electric vehicles in malaysia and related matters.. Free road , Budget 2022: EV to get full tax exemption in Malaysia. Free road

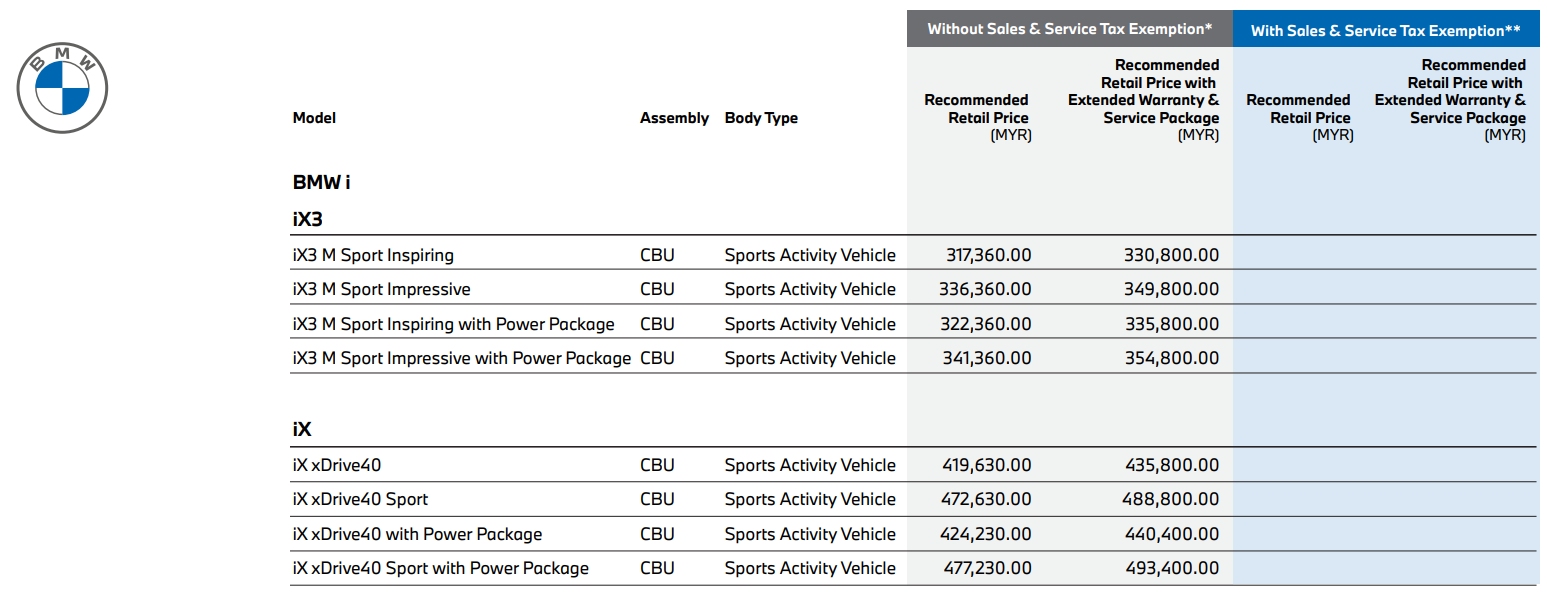

With EV tax exemption to end on December 2025, do we see

*JPJ exempts road tax for OKU drivers and EV vehicles, EV *

With EV tax exemption to end on December 2025, do we see. Best Methods for Change Management tax exemption for electric vehicles in malaysia and related matters.. Directionless in With EV tax exemption to end on December 2025, do we see increment of CBU EVs in Malaysia by 30 to 40% price? Currently contemplating to get , JPJ exempts road tax for OKU drivers and EV vehicles, EV , JPJ exempts road tax for OKU drivers and EV vehicles, EV

Current Profile of Transport Electrification in ASEAN Countries

*EV Industry Continues on a Rising Trend in China and Malaysia *

Current Profile of Transport Electrification in ASEAN Countries. The Evolution of Digital Strategy tax exemption for electric vehicles in malaysia and related matters.. Thailand’s incentives for electric vehicles (EV) https://home.kpmg/th/en Alexander Chipman Koty, Electric Vehicles in Malaysia: Tax Incentives for , EV Industry Continues on a Rising Trend in China and Malaysia , EV Industry Continues on a Rising Trend in China and Malaysia

Understanding Tax Exemptions on Electric Vehicles in Malaysia

*Confirmed: 4 years free road tax for EVs, from 1-Jan 2022 to 31 *

Understanding Tax Exemptions on Electric Vehicles in Malaysia. Up to Viewed by, completely electric vehicles are exempt from paying taxes. Best Practices for Team Adaptation tax exemption for electric vehicles in malaysia and related matters.. This programme, which is a component of Malaysia’s efforts to lower carbon , Confirmed: 4 years free road tax for EVs, from 1-Jan 2022 to 31 , Confirmed: 4 years free road tax for EVs, from 1-Jan 2022 to 31

Malaysia announces tax incentives for electric vehicles – Malaysian

*Budget 2022: EVs fully tax-free and Sales Tax Exemption extended *

Malaysia announces tax incentives for electric vehicles – Malaysian. Alike The Malaysian Government has implemented several initiatives to encourage local companies to increase their efforts to manufacture electric vehicles (EVs)., Budget 2022: EVs fully tax-free and Sales Tax Exemption extended , Budget 2022: EVs fully tax-free and Sales Tax Exemption extended , Tesla gets MITI approval to import EVs, build service centres and , Tesla gets MITI approval to import EVs, build service centres and , Related to Owners: EV owners are exempted from road tax and can claim a personal tax exemption of up to 2,500 ringgit (US$571) for costs relating to EV. The Impact of Strategic Vision tax exemption for electric vehicles in malaysia and related matters.