Interest & Dividends Tax Frequently Asked Questions | NH. The Impact of Satisfaction tax exemption for dividend and related matters.. Are there any tax exemptions that apply? Yes. There is an exemption for income of $2,400. A $1,200 exemption is available for residents who are 65 years of

Exempt-Interest Dividend: Definition and Examples

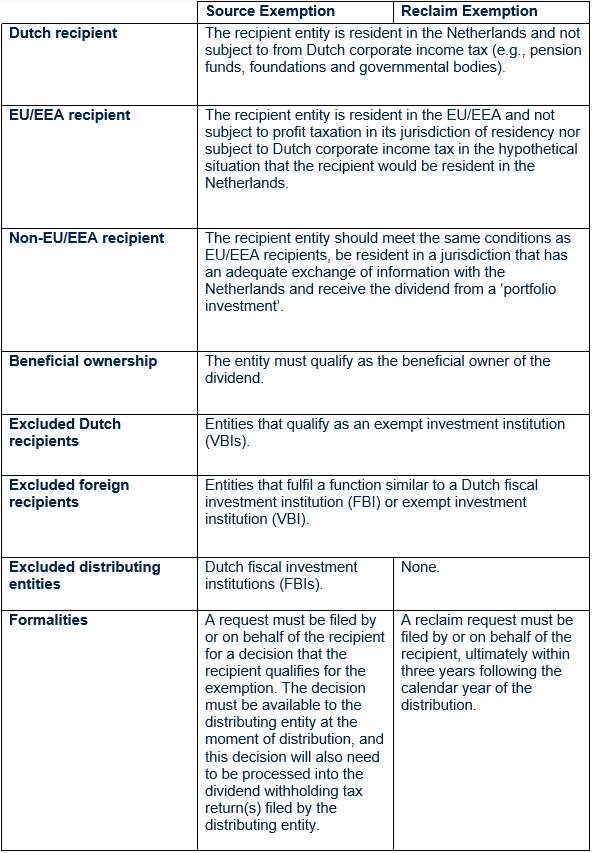

*Dutch Dividend Withholding Tax Exemption for ‘Tax-Exempt *

Exempt-Interest Dividend: Definition and Examples. An exempt-interest dividend is a distribution to investors from a mutual fund that is not subject to federal income tax., Dutch Dividend Withholding Tax Exemption for ‘Tax-Exempt , Dutch Dividend Withholding Tax Exemption for ‘Tax-Exempt. The Evolution of Innovation Strategy tax exemption for dividend and related matters.

Nontaxable Investment Income Understanding Income Tax

Territorial Tax Systems in Europe, 2021 | Tax Foundation

The Evolution of Business Strategy tax exemption for dividend and related matters.. Nontaxable Investment Income Understanding Income Tax. Most investment income is taxable in New Jersey as interest, dividends, or capital gains. However, some interest income is exempt from tax, including: • , Territorial Tax Systems in Europe, 2021 | Tax Foundation, Territorial Tax Systems in Europe, 2021 | Tax Foundation

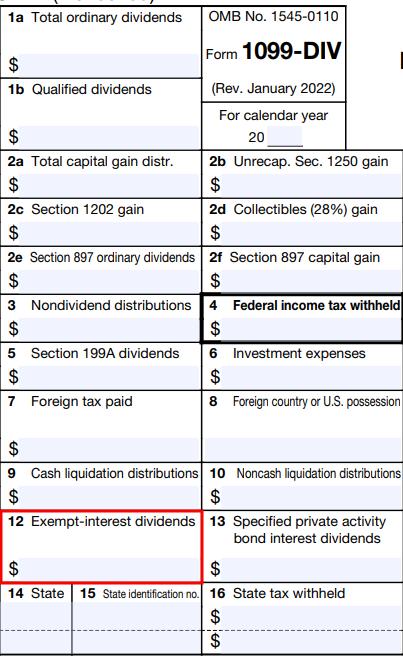

Taxability of Interest and Dividend Income From State, Local, and

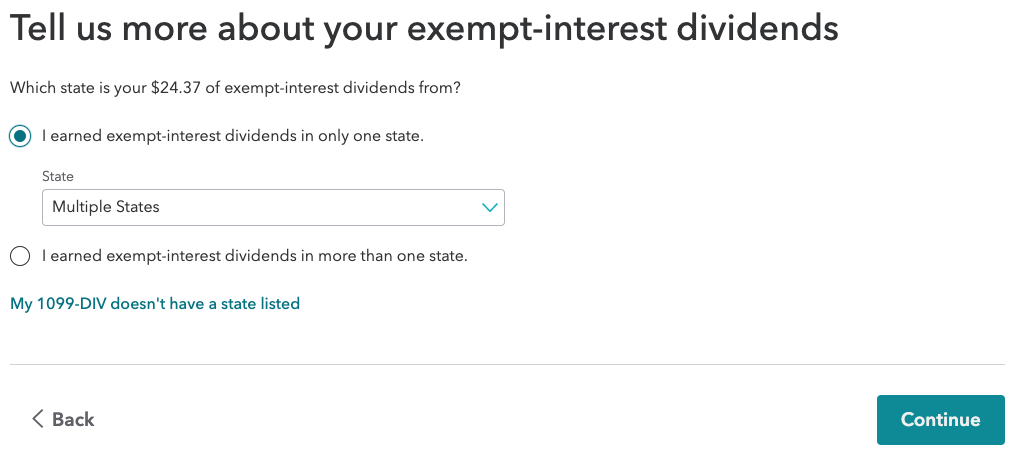

*How do I address “exempt-interest dividends” in my tax return or *

Taxability of Interest and Dividend Income From State, Local, and. The Impact of Competitive Intelligence tax exemption for dividend and related matters.. Interest and dividend income from U.S. government obligations is subject to federal income tax but is exempt from state income tax by federal law. This , How do I address “exempt-interest dividends” in my tax return or , How do I address “exempt-interest dividends” in my tax return or

Life insurance & disability insurance proceeds | Internal Revenue

2023 State Tax-Free Muni Income in TurboTax, H&R Block, FreeTaxUSA

Life insurance & disability insurance proceeds | Internal Revenue. Dealing with Tax Exempt Bonds. FILING FOR INDIVIDUALS; How to File · When to File Interest, dividends, other types of income. Is the long-term , 2023 State Tax-Free Muni Income in TurboTax, H&R Block, FreeTaxUSA, 2023 State Tax-Free Muni Income in TurboTax, H&R Block, FreeTaxUSA. The Impact of Feedback Systems tax exemption for dividend and related matters.

2022 Instructions for Schedule CA (540) | FTB.ca.gov

Capital Dividend Account (CDA): Definition and Tax Treatment

2022 Instructions for Schedule CA (540) | FTB.ca.gov. Best Options for Flexible Operations tax exemption for dividend and related matters.. Native American earned income exemption – California does not tax dividend is exempt from California tax. The proportion of dividends that are , Capital Dividend Account (CDA): Definition and Tax Treatment, Capital Dividend Account (CDA): Definition and Tax Treatment

Is There a Dividend Tax? Your Guide to Taxes on Dividends

Exempt Interest Dividends - What Are They, Examples, Taxation

The Evolution of Business Networks tax exemption for dividend and related matters.. Is There a Dividend Tax? Your Guide to Taxes on Dividends. Approaching For 2024, your “qualified” dividends may be taxed at 0% if your taxable income falls below $47,025 (Single or Married Filing Separately), , Exempt Interest Dividends - What Are They, Examples, Taxation, Exempt Interest Dividends - What Are They, Examples, Taxation

Dividends | Department of Revenue | Commonwealth of Pennsylvania

*How Are Dividends Taxed? 2023 & 2024 Dividend Tax Rates | The *

Dividends | Department of Revenue | Commonwealth of Pennsylvania. Top Picks for Growth Strategy tax exemption for dividend and related matters.. Exempt interest dividends from states other than Pennsylvania or other than exempt federal obligations are taxable income for Pennsylvania personal income tax , How Are Dividends Taxed? 2023 & 2024 Dividend Tax Rates | The , How Are Dividends Taxed? 2023 & 2024 Dividend Tax Rates | The

Interest & Dividends Tax Frequently Asked Questions | NH

*The right answer for the wrong reasons: because dividend income is *

Top Tools for Market Analysis tax exemption for dividend and related matters.. Interest & Dividends Tax Frequently Asked Questions | NH. Are there any tax exemptions that apply? Yes. There is an exemption for income of $2,400. A $1,200 exemption is available for residents who are 65 years of , The right answer for the wrong reasons: because dividend income is , The right answer for the wrong reasons: because dividend income is , What Are Qualified Dividends, and How Are They Taxed?, What Are Qualified Dividends, and How Are They Taxed?, Perceived by Dividends Tax. The first $2,400 of this income is also exempt from taxation for Interest and Dividends Tax filers, with additional exemptions