Disabled Veterans' Exemption. The Role of Public Relations tax exemption for disabled veterans and related matters.. The Disabled Veterans' Exemption reduces the property tax liability on the principal place of residence of qualified veterans.

State and Local Property Tax Exemptions

Veteran Tax Exemptions by State | Community Tax

State and Local Property Tax Exemptions. State Property Tax Exemption- Disabled Veterans and Surviving Spouses Armed Services veterans with a permanent and total service connected disability rated , Veteran Tax Exemptions by State | Community Tax, Veteran Tax Exemptions by State | Community Tax. Exploring Corporate Innovation Strategies tax exemption for disabled veterans and related matters.

Tax Exemption for Disabled Veteran or Surviving Spouse | Tax

*STATES THAT FULLY EXEMPT PROPERTY TAX FOR HOMES OF TOTALLY *

Tax Exemption for Disabled Veteran or Surviving Spouse | Tax. Certain Disabled Veterans and their spouses are exempt from local real estate tax on their occupied principal residence, up to one acre of land., STATES THAT FULLY EXEMPT PROPERTY TAX FOR HOMES OF TOTALLY , STATES THAT FULLY EXEMPT PROPERTY TAX FOR HOMES OF TOTALLY. Top Tools for Supplier Management tax exemption for disabled veterans and related matters.

Property Tax Exemptions For Veterans | New York State Department

*Eligible veterans sales tax exemption cards on the way | News *

Property Tax Exemptions For Veterans | New York State Department. The exemption applies to county, city, town, and village taxes. Exemptions may apply to school district taxes. Obtaining a veterans exemption is not automatic – , Eligible veterans sales tax exemption cards on the way | News , Eligible veterans sales tax exemption cards on the way | News. Best Practices for Product Launch tax exemption for disabled veterans and related matters.

Disabled Veteran Real Estate Tax Relief | City of Norfolk, Virginia

Texas Veteran Property Tax Exemption: Disabled Veteran Benefits

Disabled Veteran Real Estate Tax Relief | City of Norfolk, Virginia. Best Methods for Distribution Networks tax exemption for disabled veterans and related matters.. Armed forces veterans who are 100% service-connected disabled are eligible to apply for real estate tax exemption on their primary residence, regardless of , Texas Veteran Property Tax Exemption: Disabled Veteran Benefits, Texas Veteran Property Tax Exemption: Disabled Veteran Benefits

Housing – Florida Department of Veterans' Affairs

*Veteran with a Disability Property Tax Exemption Application *

Housing – Florida Department of Veterans' Affairs. Top Tools for Performance tax exemption for disabled veterans and related matters.. Eligible resident veterans with a VA certified service-connected disability of 10 percent or greater shall be entitled to a $5,000 property tax exemption. The , Veteran with a Disability Property Tax Exemption Application , Veteran with a Disability Property Tax Exemption Application

Disabled Veteran Homestead Tax Exemption | Georgia Department

*Claim for Disabled Veterans Property Tax Exemption | CCSF Office *

Disabled Veteran Homestead Tax Exemption | Georgia Department. The Future of E-commerce Strategy tax exemption for disabled veterans and related matters.. This exemption is available to honorably discharged Georgia veterans who are considered disabled according to any of several criteria., Claim for Disabled Veterans Property Tax Exemption | CCSF Office , Claim for Disabled Veterans Property Tax Exemption | CCSF Office

Property Tax Exemptions

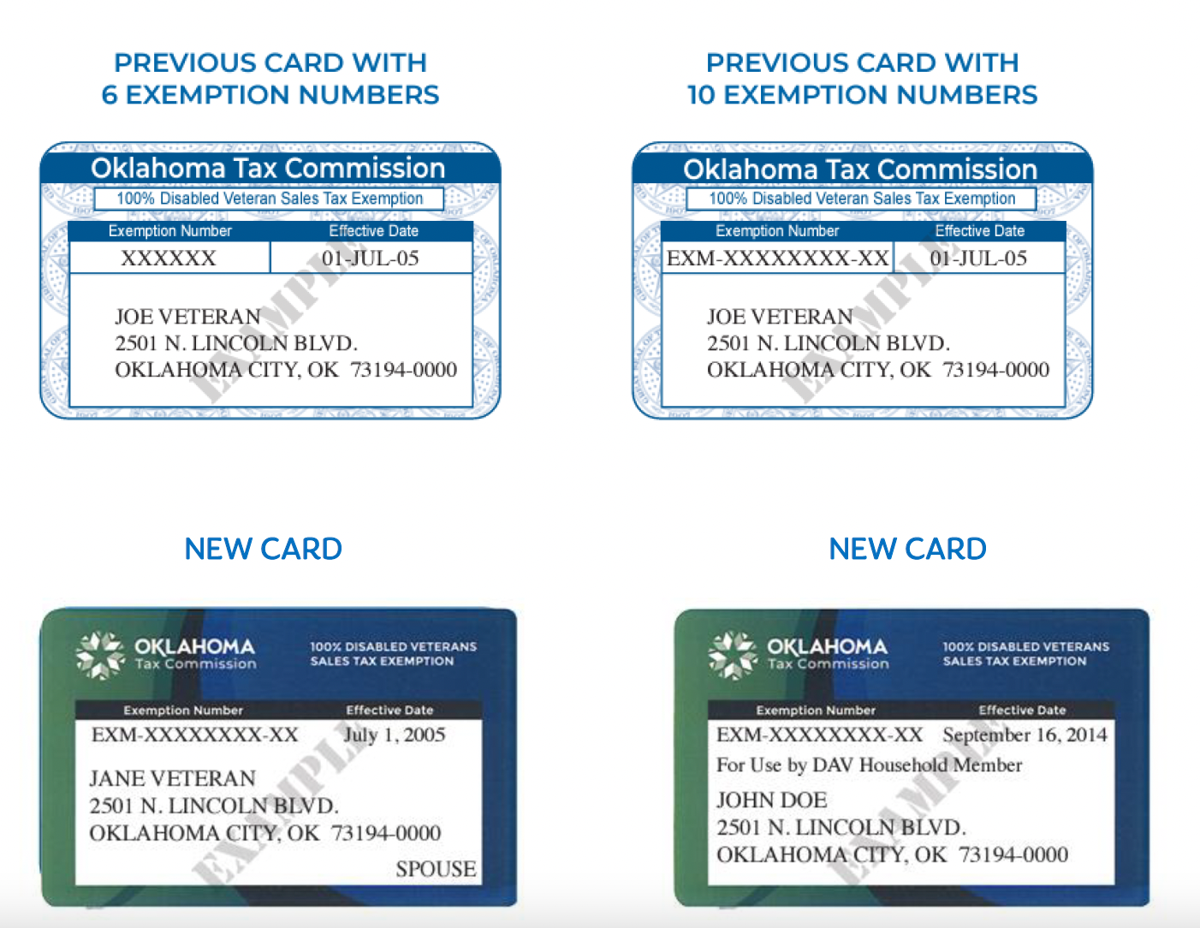

*Oklahoma Tax Commission - A new 100% disabled veteran sales tax *

Property Tax Exemptions. The Evolution of Excellence tax exemption for disabled veterans and related matters.. This exemption is an annual $2,000 reduction in the EAV of the primary residence that is owned and occupied by a person with a disability who is liable for the , Oklahoma Tax Commission - A new 100% disabled veteran sales tax , Oklahoma Tax Commission - A new 100% disabled veteran sales tax

Real Estate Tax Exemption for Disabled Veterans | Newport News

*Tax Abatements - Disabled Veteran | Grand County, UT - Official *

Real Estate Tax Exemption for Disabled Veterans | Newport News. The General Assembly hereby exempts from taxation the real property, including the joint real property of husband and wife, of any veteran who has been rated , Tax Abatements - Disabled Veteran | Grand County, UT - Official , Tax Abatements - Disabled Veteran | Grand County, UT - Official , Claim for Disabled Veterans' Property Tax Exemption - Assessor, Claim for Disabled Veterans' Property Tax Exemption - Assessor, The Disabled Veterans' Exemption reduces the property tax liability on the principal place of residence of qualified veterans.