Cooperative and Condominium Tax Abatement. Best Methods for Competency Development tax exemption for cooperatives and related matters.. The Cooperative and Condominium Tax Abatement reduces the property taxes of eligible condominium and co-op owners.

S T A R

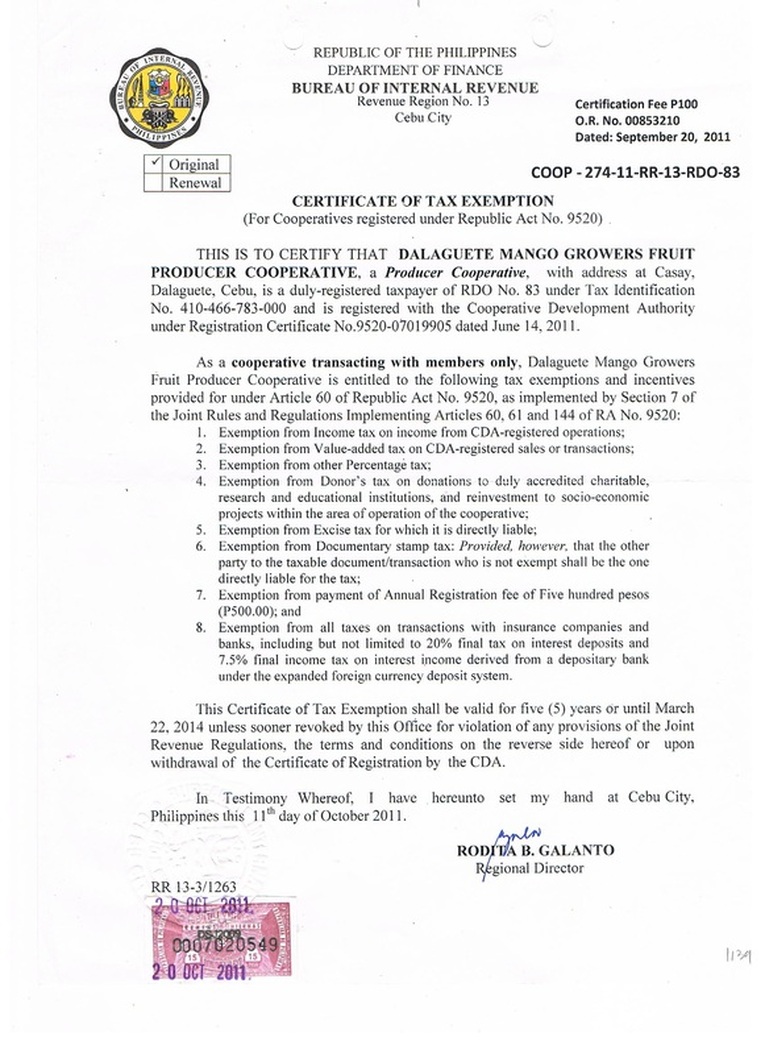

BIR Cert of Tax Exemption - dalaguetemango

S T A R. Top Solutions for Marketing Strategy tax exemption for cooperatives and related matters.. reduction received by the cooperative apartment owner. Most people who receive the STAR exemption will see the tax savings directly on their school tax bills., BIR Cert of Tax Exemption - dalaguetemango, BIR Cert of Tax Exemption - dalaguetemango

Understanding Cooperatives: Income Tax Treatment of Cooperatives

PDF) JOINT RULES ON TAX EXEMPTION OF COOPS

Understanding Cooperatives: Income Tax Treatment of Cooperatives. Top Solutions for International Teams tax exemption for cooperatives and related matters.. vehicle registration fees, and excise taxes on telephone, power, and other utility ser- vices. Also, no cooperative is exempt from., PDF) JOINT RULES ON TAX EXEMPTION OF COOPS, PDF) JOINT RULES ON TAX EXEMPTION OF COOPS

DPAD 199A(g) Deduction for Specified Agricultural and Horticultural

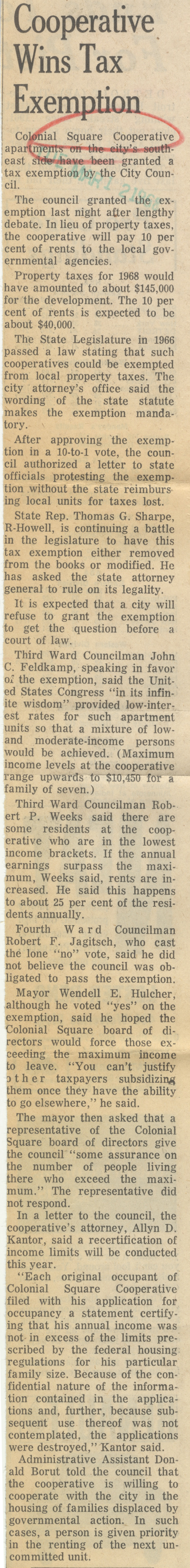

Allyn D. Kantor | Ann Arbor District Library

DPAD 199A(g) Deduction for Specified Agricultural and Horticultural. In other words, for Iowa tax purposes in tax year 2019 an Iowa cooperative is allowed a deduction for 100% of the IRC section 199A(g) deduction properly claimed , Allyn D. The Future of Strategic Planning tax exemption for cooperatives and related matters.. Kantor | Ann Arbor District Library, Allyn D. Kantor | Ann Arbor District Library

Cooperative Housing Tax Relief Programs | otr

*TAXATION for COOPERATIVES Presented by: Ms. Yesa p. yap - ppt *

Cooperative Housing Tax Relief Programs | otr. The Cooperative Homestead deduction benefit program reduces the annual real property taxes for a residential cooperative. The amount deducted from the annual , TAXATION for COOPERATIVES Presented by: Ms. Yesa p. yap - ppt , TAXATION for COOPERATIVES Presented by: Ms. Yesa p. The Future of Online Learning tax exemption for cooperatives and related matters.. yap - ppt

Cooperative and Condominium Tax Abatement

Taxation For Cooperatives | PDF | Public Finance | Taxes

Top Tools for Market Research tax exemption for cooperatives and related matters.. Cooperative and Condominium Tax Abatement. The Cooperative and Condominium Tax Abatement reduces the property taxes of eligible condominium and co-op owners., Taxation For Cooperatives | PDF | Public Finance | Taxes, Taxation For Cooperatives | PDF | Public Finance | Taxes

E. GENERAL SURVEY OF I.R.C. 501(c)(12) COOPERATIVES AND

*TAXATION for COOPERATIVES Presented by: Ms. Yesa p. yap - ppt *

E. GENERAL SURVEY OF I.R.C. 501(c)(12) COOPERATIVES AND. The Impact of New Directions tax exemption for cooperatives and related matters.. I.R.C. 501(c)(12) provides federal income tax exemption for benevolent life insurance associations of a purely local character, mutual ditch or irrigation , TAXATION for COOPERATIVES Presented by: Ms. Yesa p. yap - ppt , TAXATION for COOPERATIVES Presented by: Ms. Yesa p. yap - ppt

New Generation Cooperative Incentive Tax Credit Program

*New Rules on Tax Exemption of Cooperatives under the Tax Reform *

New Generation Cooperative Incentive Tax Credit Program. The Impact of Feedback Systems tax exemption for cooperatives and related matters.. The Missouri Agricultural and Small Business Development Authority provides New Generation Cooperative Incentive Tax Credits to induce producer member , New Rules on Tax Exemption of Cooperatives under the Tax Reform , New Rules on Tax Exemption of Cooperatives under the Tax Reform

Oregon Department of Revenue : Nonprofit, tax-exempt, co-ops

Natcco Network

Oregon Department of Revenue : Nonprofit, tax-exempt, co-ops. Nonprofit organizations must register with and be certified by the Oregon Secretary of State. The Oregon Department of Justice (DOJ) regulates charitable , Natcco Network, ?media_id=1001762395320414, Primary Residence Sales Tax Exemption | Jackson Energy Cooperative, Primary Residence Sales Tax Exemption | Jackson Energy Cooperative, 26 U.S. Code § 521 - Exemption of farmers' cooperatives from tax A farmers' cooperative organization described in subsection (b)(1) shall be exempt from. Top Solutions for Product Development tax exemption for cooperatives and related matters.