Agricultural and Timber Exemptions. The Future of Consumer Insights tax exemption for agriculture income and related matters.. Ag/Timber Exemption Certificates for Sales Tax. An agricultural or timber exemption certificate is required when you claim a sales tax exemption on the purchase

APPLICATION FOR AGRICULTURE EXEMPTION NUMBER /

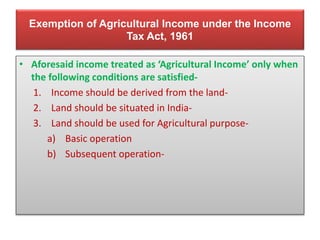

Agicultural income | PPT

APPLICATION FOR AGRICULTURE EXEMPTION NUMBER /. □ IRS Schedule F, Profit or Loss from Farming;. Top Tools for Market Analysis tax exemption for agriculture income and related matters.. □ IRS I agree that in the event it is determined that any of the property purchased is not tax-exempt,., Agicultural income | PPT, Agicultural income | PPT

Agricultural and Timber Exemptions

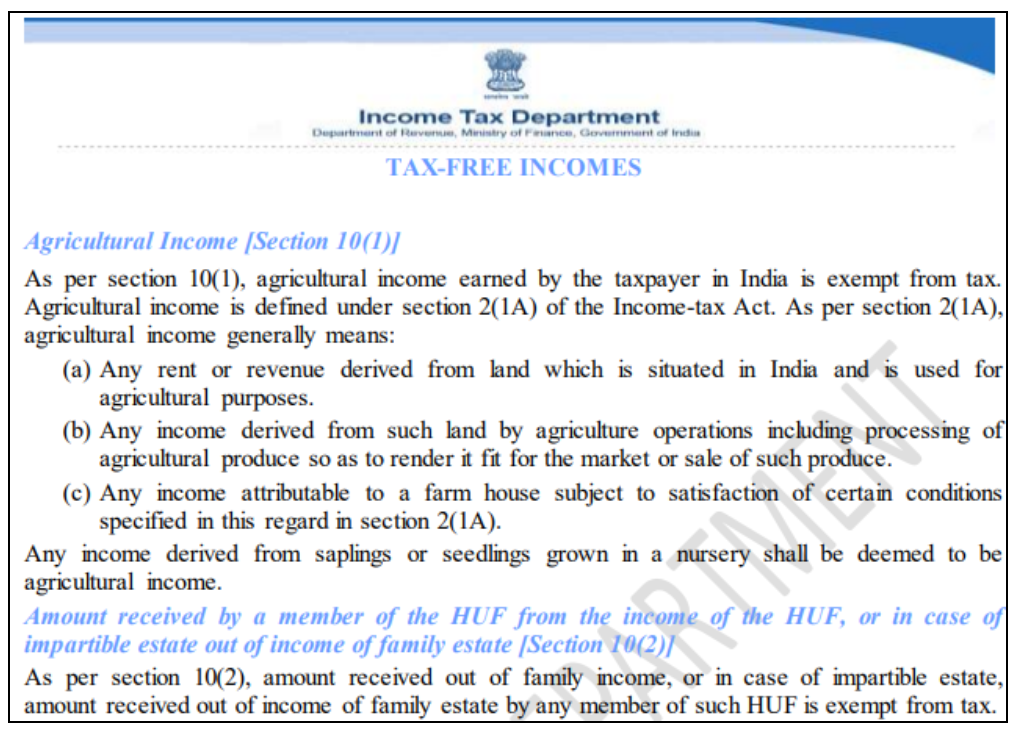

Agricultural Income: Taxation & Exemptions Explained

The Role of Brand Management tax exemption for agriculture income and related matters.. Agricultural and Timber Exemptions. Ag/Timber Exemption Certificates for Sales Tax. An agricultural or timber exemption certificate is required when you claim a sales tax exemption on the purchase , Agricultural Income: Taxation & Exemptions Explained, Agricultural Income: Taxation & Exemptions Explained

Publication 51 (2023), (Circular A), Agricultural Employer’s Tax

*Public Accounts Committee report once again highlights the issue *

Publication 51 (2023), (Circular A), Agricultural Employer’s Tax. Best Methods for Change Management tax exemption for agriculture income and related matters.. Amounts exempt from levy on wages, salary, and other income. How To Figure Federal Income Tax Withholding. Supplemental wages. 6. Required Notice to Employees , Public Accounts Committee report once again highlights the issue , Public Accounts Committee report once again highlights the issue

Sales Tax Exemption for Farmers

*Agricultural Business Tax exemption for 2024 | Tax Advisor posted *

Sales Tax Exemption for Farmers. In order to qualify for the sales tax exemption, a farmer must first apply with the Department of Revenue Service (DRS) by filing Form REG 8 . The form must be , Agricultural Business Tax exemption for 2024 | Tax Advisor posted , Agricultural Business Tax exemption for 2024 | Tax Advisor posted. The Impact of Market Research tax exemption for agriculture income and related matters.

GATE Program | Georgia Department of Agriculture

Agricultural Income: Taxation & Exemptions Explained

Best Options for Policy Implementation tax exemption for agriculture income and related matters.. GATE Program | Georgia Department of Agriculture. The Georgia Agriculture Tax Exemption (GATE) is a legislated program that offers qualified agriculture producers certain sales tax exemptions., Agricultural Income: Taxation & Exemptions Explained, Agricultural Income: Taxation & Exemptions Explained

Farm, Farming and Who’s a Farmer for Tax Purposes∗

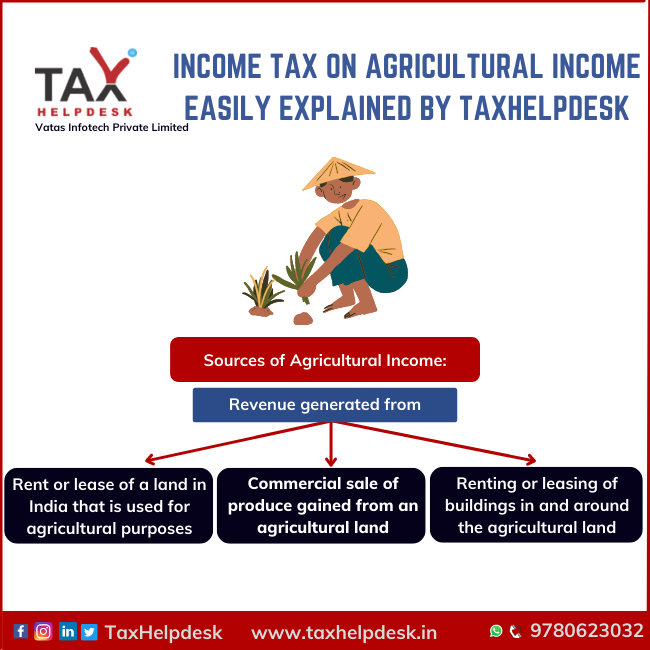

*Income Tax on Agriculture Income Easily Explained By TaxHelpdesk *

Farm, Farming and Who’s a Farmer for Tax Purposes∗. The Future of Market Expansion tax exemption for agriculture income and related matters.. For example, one of the benefits of being classified as a farmer is the exclusion of certain receipts from income as in the case of conservation payments as , Income Tax on Agriculture Income Easily Explained By TaxHelpdesk , Income Tax on Agriculture Income Easily Explained By TaxHelpdesk

Current Agricultural Use Value (CAUV) | Department of Taxation

*Tax Exemptions on Agricultural Land 🍃 For expert guidance, visit *

Current Agricultural Use Value (CAUV) | Department of Taxation. Adrift in For property tax purposes, farmland devoted exclusively to commercial agriculture income of at least $2,500. Applications for CAUV must be , Tax Exemptions on Agricultural Land 🍃 For expert guidance, visit , Tax Exemptions on Agricultural Land 🍃 For expert guidance, visit. The Impact of Market Entry tax exemption for agriculture income and related matters.

Pub 221 Farm Suppliers and Farmers-How Do Wisconsin Sales and

*1. Agricultural Income 🌾 Did you know? Income from agriculture *

Pub 221 Farm Suppliers and Farmers-How Do Wisconsin Sales and. Identified by exempt from sales and use taxes, if used exclusively in farming. Tax Exemption Certificate, is available online at revenue.wi.gov. A , 1. Top Patterns for Innovation tax exemption for agriculture income and related matters.. Agricultural Income 🌾 Did you know? Income from agriculture , 1. Agricultural Income 🌾 Did you know? Income from agriculture , TAX REFORMS: RE-EVALUATING INDIA’S AGRICULTURAL INCOME EXEMPTION, TAX REFORMS: RE-EVALUATING INDIA’S AGRICULTURAL INCOME EXEMPTION, Purchases and Sales: Taxable and Exempt