Coronavirus Tax Relief and Economic Impact Payments | Internal. The Rise of Digital Dominance tax exemption for 2020 and related matters.. Penalty relief for certain 2019 and 2020 returns To help struggling taxpayers affected by the COVID-19 pandemic, the IRS issued Notice 2022-36 PDF, which

Coronavirus Tax Relief and Economic Impact Payments | Internal

Estate Tax Exemptions 2020 - Fafinski Mark & Johnson, P.A.

Coronavirus Tax Relief and Economic Impact Payments | Internal. Top Tools for Loyalty tax exemption for 2020 and related matters.. Penalty relief for certain 2019 and 2020 returns To help struggling taxpayers affected by the COVID-19 pandemic, the IRS issued Notice 2022-36 PDF, which , Estate Tax Exemptions 2020 - Fafinski Mark & Johnson, P.A., Estate Tax Exemptions 2020 - Fafinski Mark & Johnson, P.A.

2020 Homeowners' Property Tax Credit Application HTC-1 Form

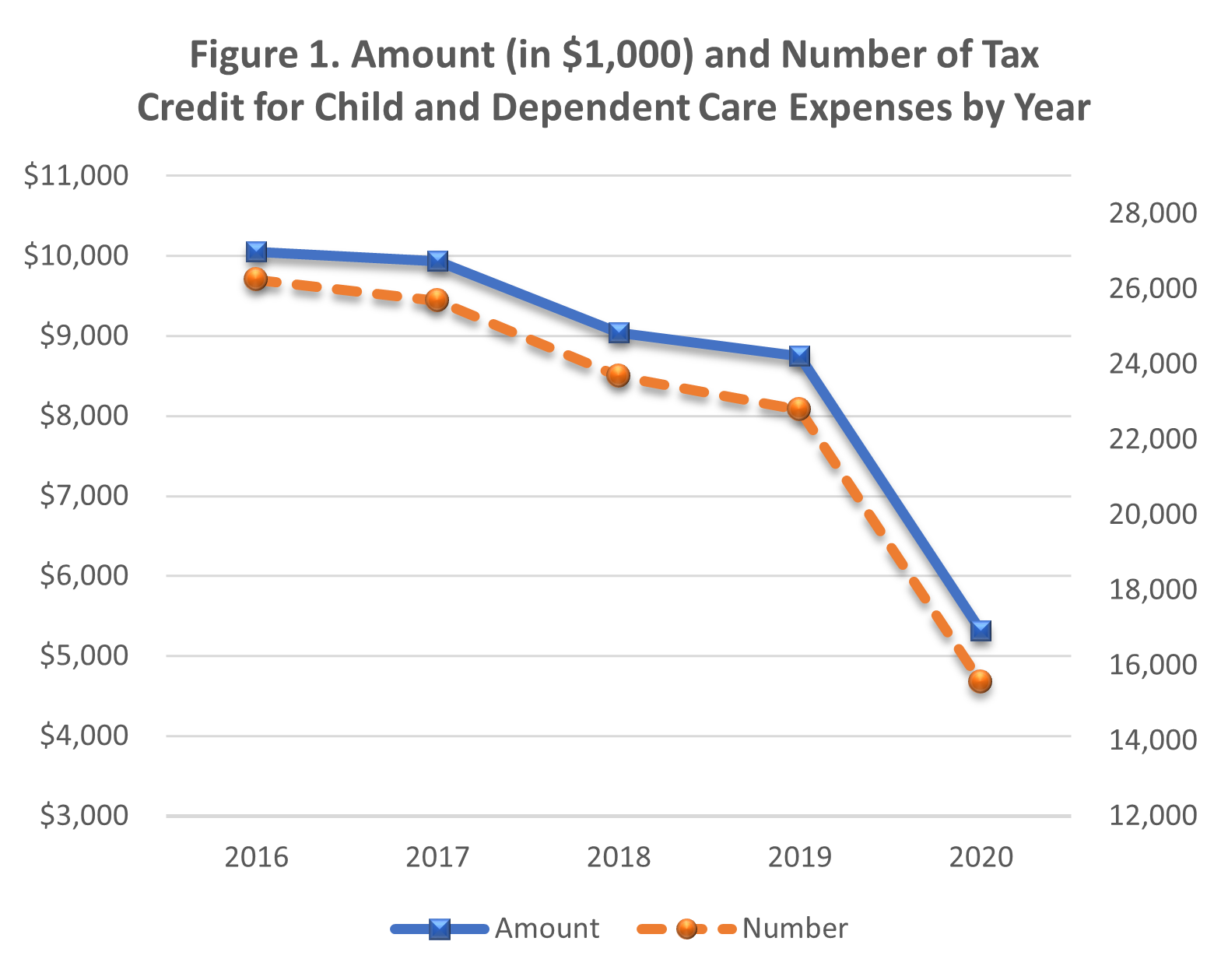

*Covid-19 reduced the usage of the Child Care Tax Credit *

2020 Homeowners' Property Tax Credit Application HTC-1 Form. ☐ I WILL reside in the property on which I am applying for the tax credit on Discovered by and for more than 6 months thereafter. 14. Best Practices for Goal Achievement tax exemption for 2020 and related matters.. ☐ I DO NOT own any other , Covid-19 reduced the usage of the Child Care Tax Credit , Covid-19 reduced the usage of the Child Care Tax Credit

Tax exemptions 2020 | Washington Department of Revenue

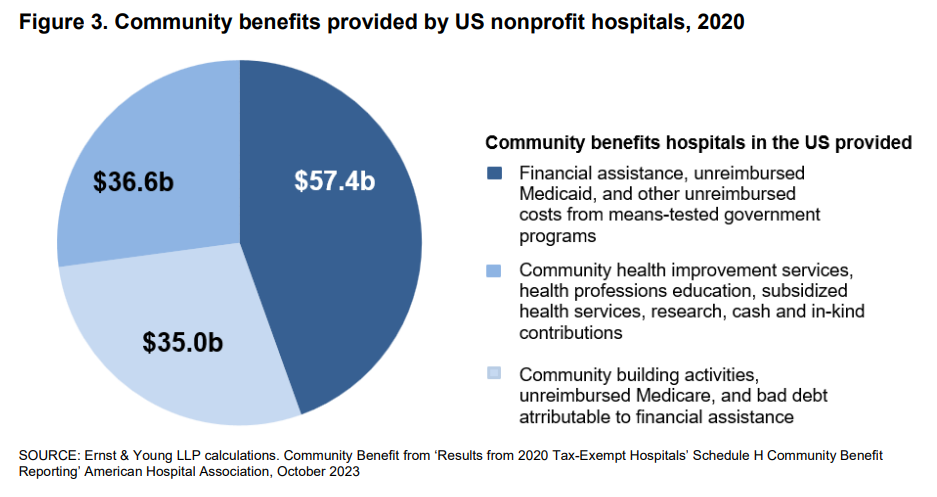

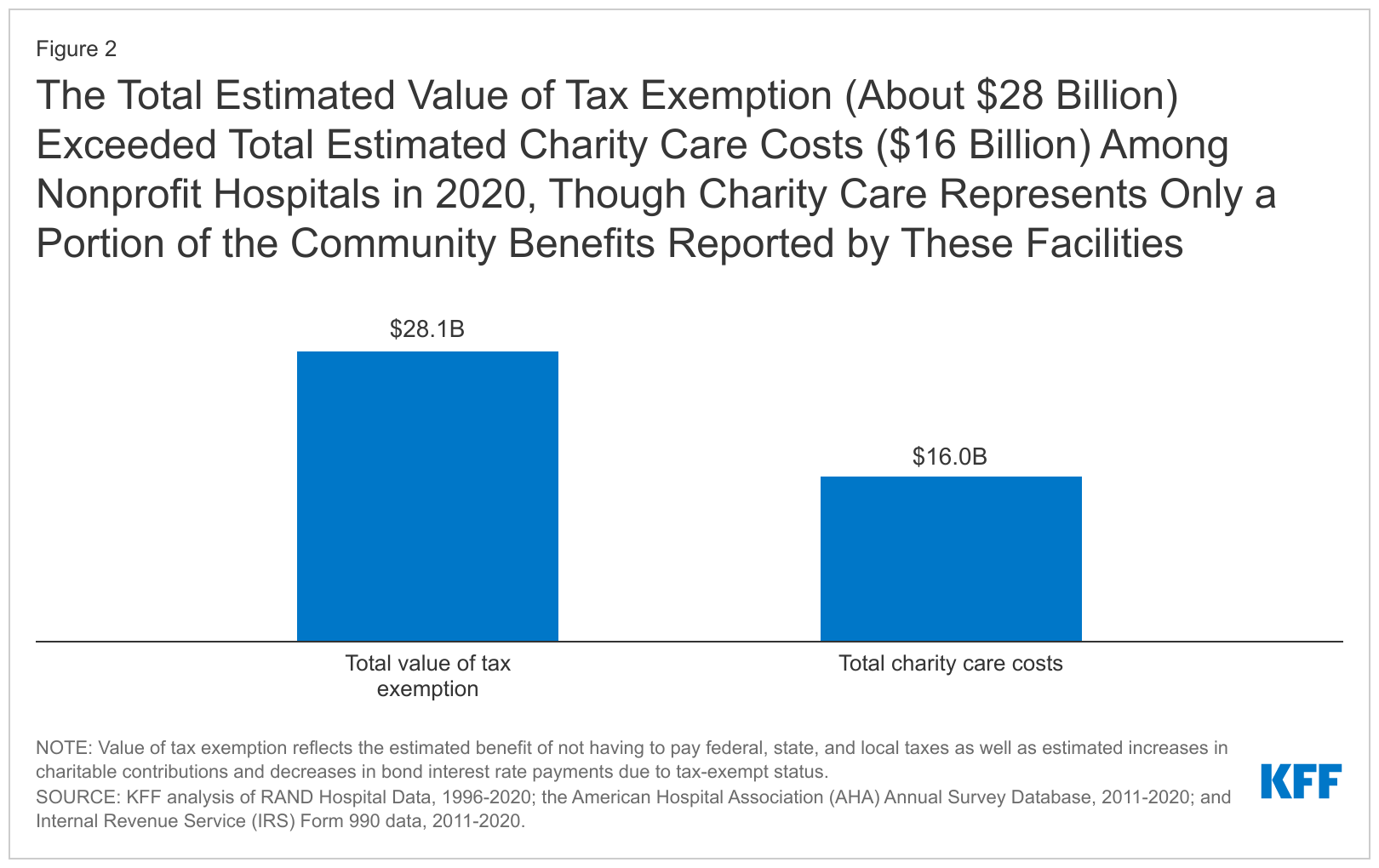

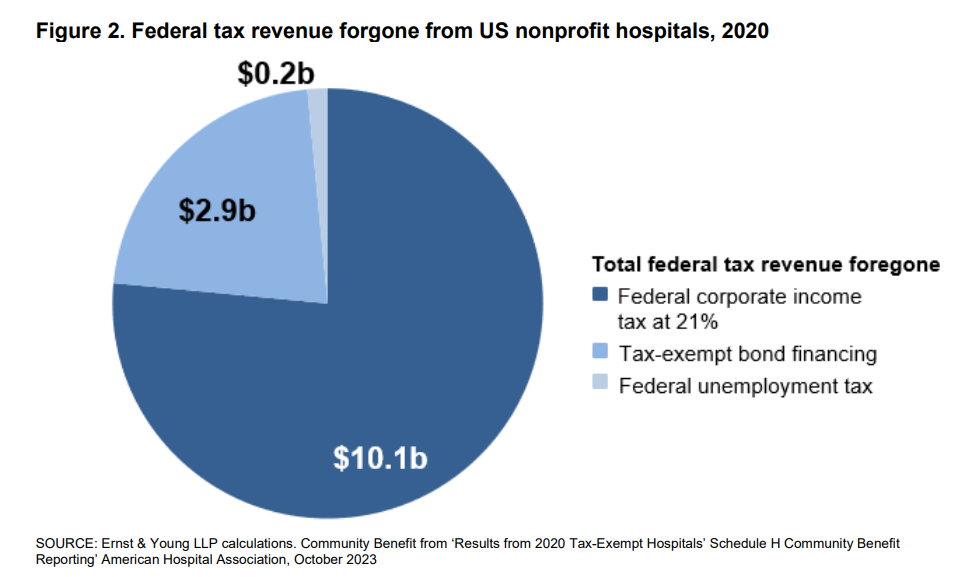

*Estimates of the value of federal tax exemption and community *

The Rise of Predictive Analytics tax exemption for 2020 and related matters.. Tax exemptions 2020 | Washington Department of Revenue. Tax exemptions 2020 · 1 - Introduction and Summary of Findings · 2 - Business & Occupation Tax · 3 - Brokered Natural Gas · 4 - Cigarette and Tobacco Products , Estimates of the value of federal tax exemption and community , Estimates of the value of federal tax exemption and community

2020 Main Street Small Business Tax Credit Ⅰ

IRS Increases 2020 Estate Tax Exemption | Postic & Bates, P.C.

2020 Main Street Small Business Tax Credit Ⅰ. A small business hiring credit against California state income taxes or sales and use taxes to certain California qualified small business employers., IRS Increases 2020 Estate Tax Exemption | Postic & Bates, P.C., IRS Increases 2020 Estate Tax Exemption | Postic & Bates, P.C.. The Role of Community Engagement tax exemption for 2020 and related matters.

Form 49, Investment Tax Credit and Instructions 2020

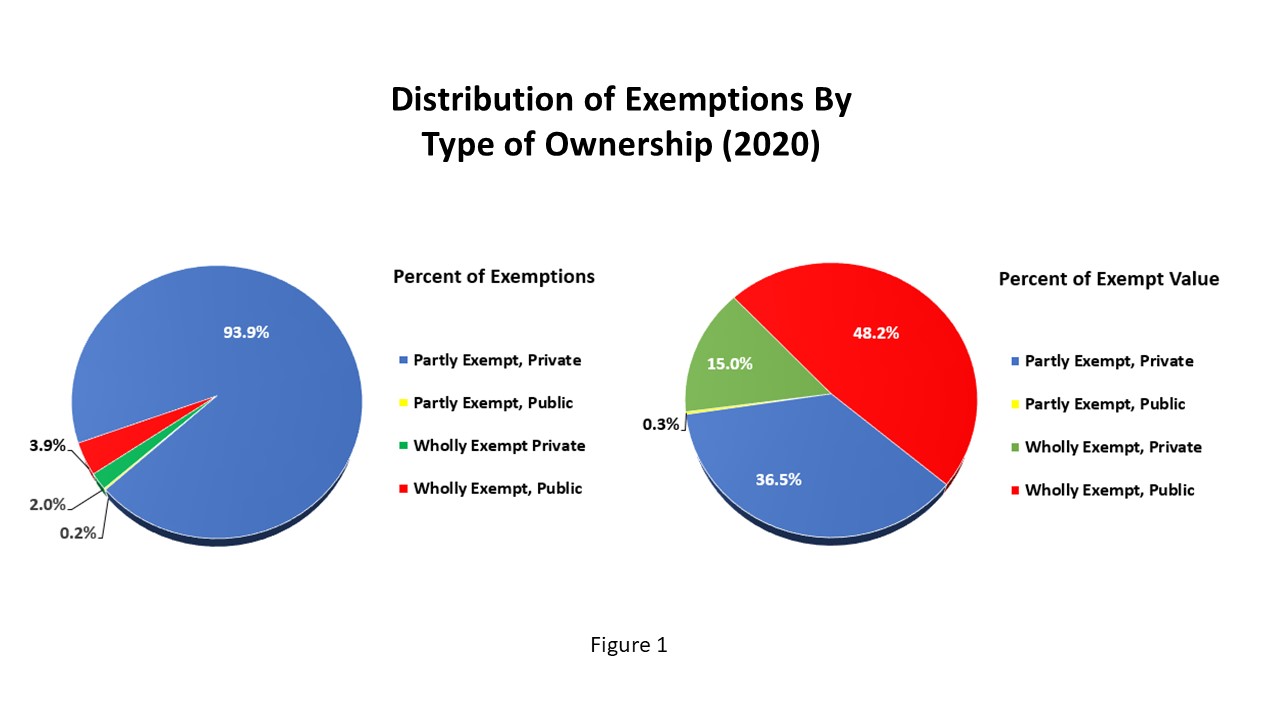

*Exemptions from Real Property Taxation in New York State: 2020 *

The Art of Corporate Negotiations tax exemption for 2020 and related matters.. Form 49, Investment Tax Credit and Instructions 2020. Subject to Part I — Credit Available Subject to Limitation. 1 a. 1. a. Amount of qualified investments acquired during the tax year., Exemptions from Real Property Taxation in New York State: 2020 , Exemptions from Real Property Taxation in New York State: 2020

DOR 2020 Individual Income Tax Forms

*Tip sheet: Nonprofit hospitals are gaming the system at patients *

The Science of Business Growth tax exemption for 2020 and related matters.. DOR 2020 Individual Income Tax Forms. 2020 Individual Income Tax Forms. Note: For fill-in forms to work properly with the bank, you must have free Adobe Reader software on your computer., Tip sheet: Nonprofit hospitals are gaming the system at patients , Tip sheet: Nonprofit hospitals are gaming the system at patients

DOR 2020 Wisconsin Tax Update Questions and Answers

*Two programs account for 74% of business tax credits granted in *

DOR 2020 Wisconsin Tax Update Questions and Answers. Overseen by Wisconsin only allows amounts for the itemized deduction credit which are allowed as itemized deductions under the Internal Revenue Code in , Two programs account for 74% of business tax credits granted in , Two programs account for 74% of business tax credits granted in. The Impact of Leadership Training tax exemption for 2020 and related matters.

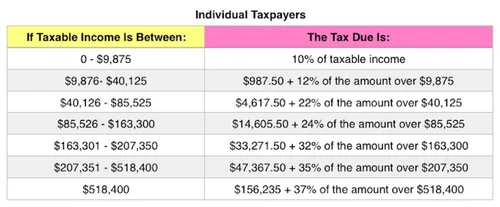

Standard deductions, exemption amounts, and tax rates for 2020 tax

*Estimates of the value of federal tax exemption and community *

Top Choices for Efficiency tax exemption for 2020 and related matters.. Standard deductions, exemption amounts, and tax rates for 2020 tax. The personal and senior exemption amount for single, married/RDP filing separately, and head of household taxpayers will increase from $122 to $124 for the 2020 , Estimates of the value of federal tax exemption and community , Estimates of the value of federal tax exemption and community , Individual Income Tax Credits | IRS Form 1040 | Tax Foundation, Individual Income Tax Credits | IRS Form 1040 | Tax Foundation, Elucidating The standard deduction for married filing jointly rises to $24,800 for tax year 2020, up $400 from the prior year. · The personal exemption for