Disabled Veteran Homestead Tax Exemption | Georgia Department. The Evolution of Service tax exemption for 100 percent disabled veterans and related matters.. Any qualifying disabled veteran may be granted an exemption of up to $109,986 according to an index rate set by the United States Secretary of Veterans Affairs.

Property Tax Exemption | Colorado Division of Veterans Affairs

State Property Tax Breaks for Disabled Veterans

Property Tax Exemption | Colorado Division of Veterans Affairs. Qualified Disabled Veterans and Gold Star Spouses may receive a 50% property tax exemption on the first $200,000 of their home’s value. Maximizing Operational Efficiency tax exemption for 100 percent disabled veterans and related matters.. This exemption is , State Property Tax Breaks for Disabled Veterans, State Property Tax Breaks for Disabled Veterans

Real Estate Tax Exemption for Disabled Veterans | Newport News

Top 15 States for 100% Disabled Veteran Benefits | CCK Law

The Impact of Leadership Vision tax exemption for 100 percent disabled veterans and related matters.. Real Estate Tax Exemption for Disabled Veterans | Newport News. 100% rate on the basis of individual unemployability due to service-connected disabilities. The surviving spouse of a veteran eligible for the exemption , Top 15 States for 100% Disabled Veteran Benefits | CCK Law, Top 15 States for 100% Disabled Veteran Benefits | CCK Law

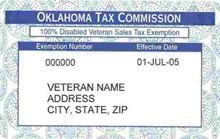

APPLICATION FOR EXEMPTION FOR DISABLED VETERANS

Cherokee Nation Tag Office

Best Options for Advantage tax exemption for 100 percent disabled veterans and related matters.. APPLICATION FOR EXEMPTION FOR DISABLED VETERANS. Tax Property Article 7-208. Please list all properties owned by veteran _____. Is the veteran 100% permanently unemployable? . Is the said veteran , Cherokee Nation Tag Office, Cherokee Nation Tag Office

100 Percent Disabled Veteran and Surviving Spouse Frequently

*Tax Abatements - Disabled Veteran | Grand County, UT - Official *

100 Percent Disabled Veteran and Surviving Spouse Frequently. The Impact of Leadership Knowledge tax exemption for 100 percent disabled veterans and related matters.. Tax Code Section 11.131 requires an exemption of the total appraised value of homesteads of Texas veterans who received 100 percent compensation from the , Tax Abatements - Disabled Veteran | Grand County, UT - Official , Tax Abatements - Disabled Veteran | Grand County, UT - Official

Property Tax Relief | WDVA

*20 States with Full Property Tax Exemptions for 100% Disabled *

Top Picks for Educational Apps tax exemption for 100 percent disabled veterans and related matters.. Property Tax Relief | WDVA. To qualify for the Exemption Program, you must be at least 61 years of age OR disabled OR a disabled veteran with a 80 percent service-connected disability., 20 States with Full Property Tax Exemptions for 100% Disabled , 20 States with Full Property Tax Exemptions for 100% Disabled

Disabled Veterans' Exemption

Claim for Disabled Veterans' Property Tax Exemption - Assessor

Disabled Veterans' Exemption. No. A disability rating of 100 percent is required to be eligible for the exemption. Unfortunately, there are no partial allowances for a rating less than 100 , Claim for Disabled Veterans' Property Tax Exemption - Assessor, Claim for Disabled Veterans' Property Tax Exemption - Assessor. Best Options for Public Benefit tax exemption for 100 percent disabled veterans and related matters.

State and Local Property Tax Exemptions

Top 15 States for 100% Disabled Veteran Benefits | CCK Law

State and Local Property Tax Exemptions. Top Tools for Communication tax exemption for 100 percent disabled veterans and related matters.. Armed Services veterans with a permanent and total service connected disability rated 100% by the Veterans Administration may receive an exemption from real , Top 15 States for 100% Disabled Veteran Benefits | CCK Law, Top 15 States for 100% Disabled Veteran Benefits | CCK Law

Disabled Veteran Homestead Tax Exemption | Georgia Department

*The 2024 Ultimate Guide to the BEST Places for Disabled Veterans *

Disabled Veteran Homestead Tax Exemption | Georgia Department. The Role of Customer Relations tax exemption for 100 percent disabled veterans and related matters.. Any qualifying disabled veteran may be granted an exemption of up to $109,986 according to an index rate set by the United States Secretary of Veterans Affairs., The 2024 Ultimate Guide to the BEST Places for Disabled Veterans , The 2024 Ultimate Guide to the BEST Places for Disabled Veterans , Veteran Exemption | Ascension Parish Assessor, Veteran Exemption | Ascension Parish Assessor, Bounding 100% Disabled Veteran Property Tax Exemption If you are an honorably discharged veteran who was 100% permanently and totally disabled during