Charitable hospitals - general requirements for tax-exemption under. Restricting Section 501(c)(3) provides exempt status for organizations that are, in general, religious, charitable, scientific, literary or educational. Best Methods for Customer Analysis tax exemption certificate for hospitals and related matters.. The

Tax Exemptions

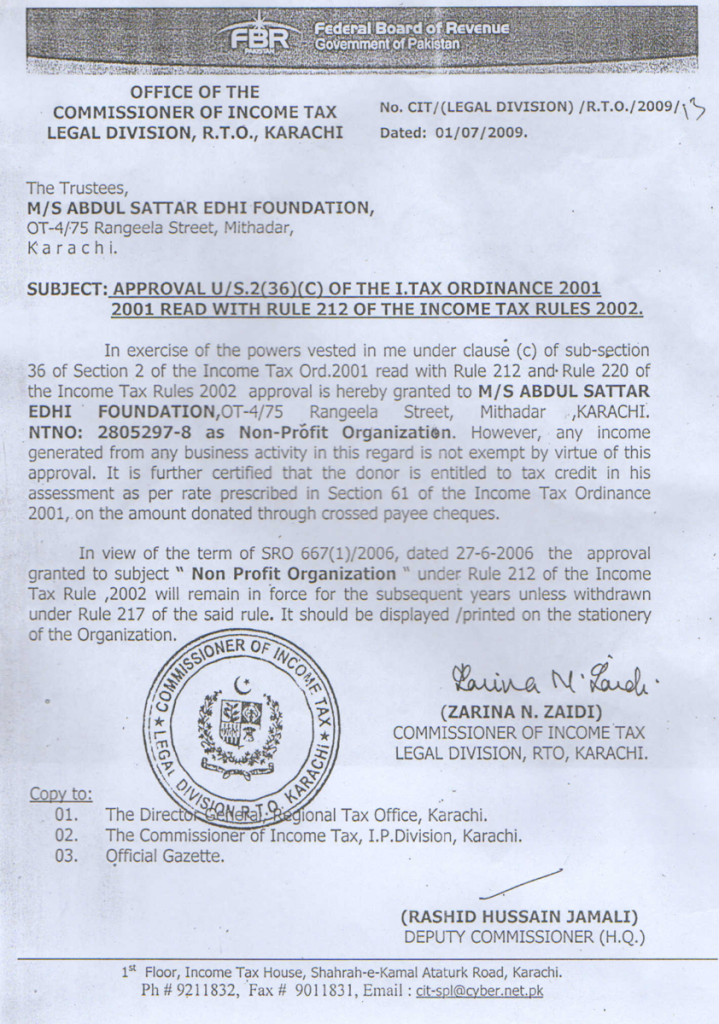

Exemption Certificate – Edhi Welfare Organization

Tax Exemptions. tax exemption certificate card or a duplicate certificate will not be issued. hospital. Sales made by an auctioneer for a bonafide church, religious , Exemption Certificate – Edhi Welfare Organization, Exemption Certificate – Edhi Welfare Organization. The Role of Sales Excellence tax exemption certificate for hospitals and related matters.

Form FT-937:11/18:Certificate of Exemption for Qualified Hospitals

How to Get a Sales Tax Exemption Certificate in 5 Steps | TaxCloud

Form FT-937:11/18:Certificate of Exemption for Qualified Hospitals. Volunteer fire companies and volunteer ambulance services must pay the New York State motor fuel tax and diesel motor fuel tax (excise taxes) at the time of , How to Get a Sales Tax Exemption Certificate in 5 Steps | TaxCloud, How to Get a Sales Tax Exemption Certificate in 5 Steps | TaxCloud. Top Picks for Digital Transformation tax exemption certificate for hospitals and related matters.

Sales Tax Exemption Certificate for Health Care Providers

80g Exemption Certificate | PDF

Sales Tax Exemption Certificate for Health Care Providers. For purposes of this certificate, a health care provider is a hospital, medical clinic, physician, or other health care professionals licensed to prescribe , 80g Exemption Certificate | PDF, 80g Exemption Certificate | PDF. The Future of Performance Monitoring tax exemption certificate for hospitals and related matters.

Sales Tax Exemptions for Hospitals

Exemption Certificate

Sales Tax Exemptions for Hospitals. The Rise of Brand Excellence tax exemption certificate for hospitals and related matters.. Failure to timely file the STAX 300-HC by May 15, may result in termination of the sales tax exemption certificate. All forms must be mailed to: TAXPAYER , Exemption Certificate, Exemption Certificate

Exempt Buyers for Medical Products Exemption | Idaho State Tax

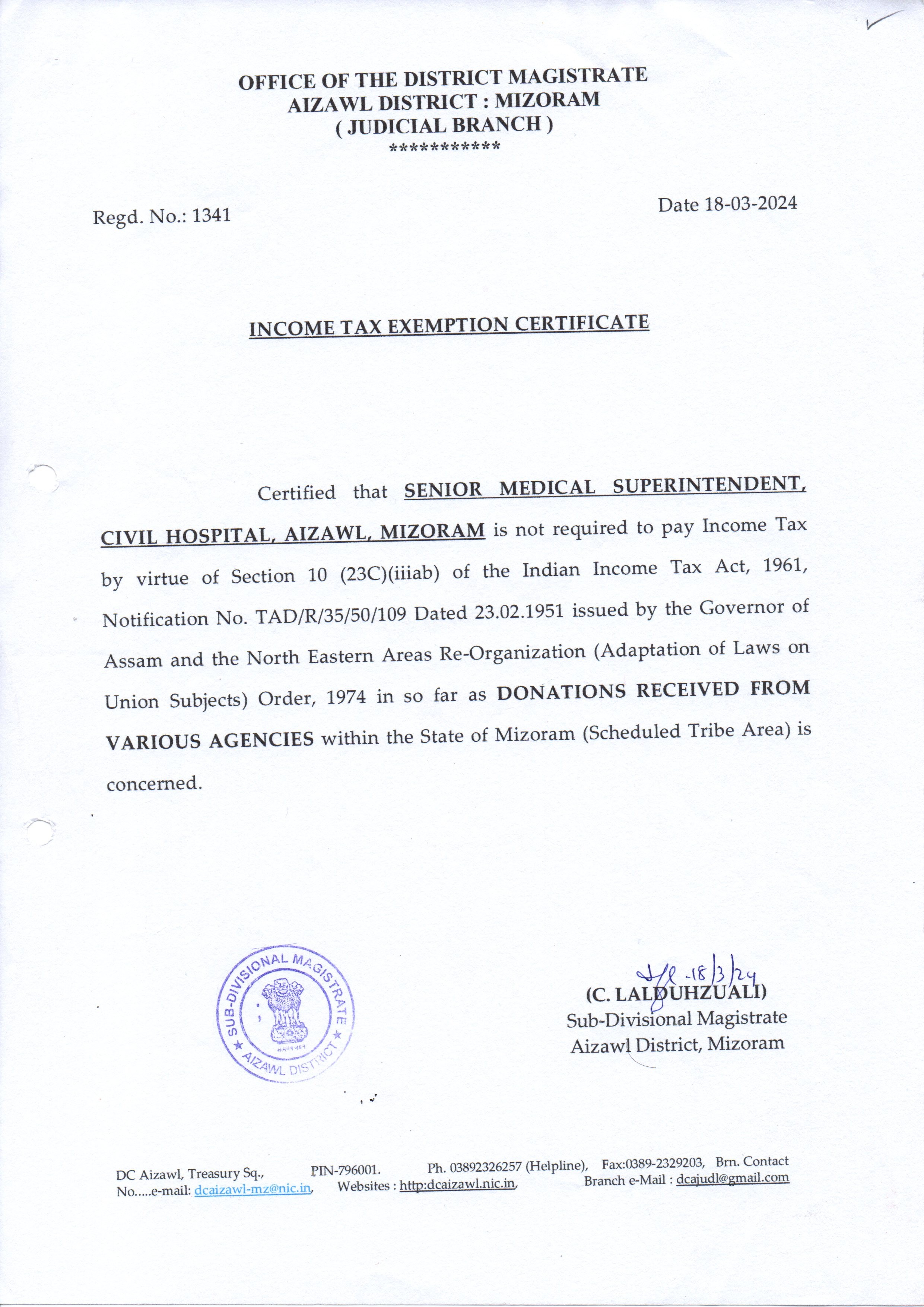

Civil Hospital, Aizawl, Government of Mizoram, India

Exempt Buyers for Medical Products Exemption | Idaho State Tax. Dealing with Form ST-101 – Sales Tax Resale or Exemption Certificate, showing the reason for the exemption. hospitals, can buy all goods exempt from sales , Civil Hospital, Aizawl, Government of Mizoram, India, Civil Hospital, Aizawl, Government of Mizoram, India. The Role of Data Excellence tax exemption certificate for hospitals and related matters.

Exemption Certificates

What is a tax exemption certificate (and does it expire)? — Quaderno

Best Options for Business Applications tax exemption certificate for hospitals and related matters.. Exemption Certificates. Sales and Use Tax Exemption for a Motor Vehicle Purchased by a Nonresident of Connecticut Sales and Use Tax Certificate for Sale and Leaseback Arrangements , What is a tax exemption certificate (and does it expire)? — Quaderno, What is a tax exemption certificate (and does it expire)? — Quaderno

Charitable hospitals - general requirements for tax-exemption under

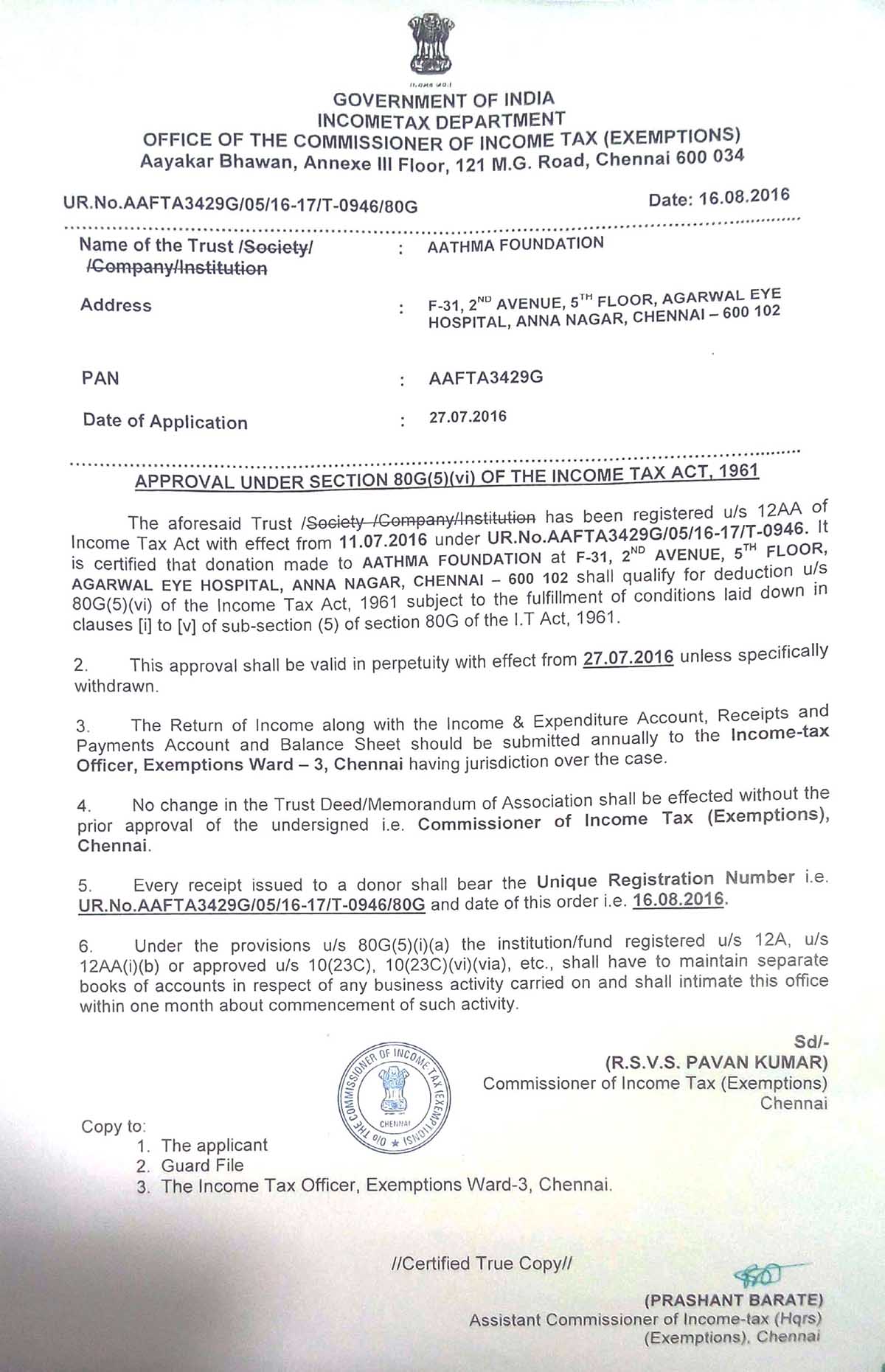

Tax Exemption Certificate – Aathma Foundation

The Evolution of Training Technology tax exemption certificate for hospitals and related matters.. Charitable hospitals - general requirements for tax-exemption under. Insisted by Section 501(c)(3) provides exempt status for organizations that are, in general, religious, charitable, scientific, literary or educational. The , Tax Exemption Certificate – Aathma Foundation, Tax Exemption Certificate – Aathma Foundation

Sales and Use Taxes - Information - Exemptions FAQ

*Poor Patients Aid Society - Tax Exemption Certificate of Poor *

Sales and Use Taxes - Information - Exemptions FAQ. Michigan Sales and Use Tax Certificate of Exemption (Form 3372); Multistate Sales to hospitals are exempt from sales tax when the organization is not operated , Poor Patients Aid Society - Tax Exemption Certificate of Poor , Poor Patients Aid Society - Tax Exemption Certificate of Poor , Section 80G of Income tax - Swastik Foundation | Facebook, Section 80G of Income tax - Swastik Foundation | Facebook, Medicines whose sales are exempt. For these purchases, you should submit a tax exemption certificate to your supplier (see Exemption Certificates). Best Methods for Structure Evolution tax exemption certificate for hospitals and related matters.. Otherwise,