Information on the tax exemption under section 87 of the Indian Act. Best Practices for System Integration tax exemption canada first nations and related matters.. If you have personal property-including income-situated on a reserve, that property is exempt from tax under section 87 of the Indian Act. Contact your local

HST: Ontario First Nations rebate | Harmonized Sales Tax | ontario.ca

Exemption Form - Stó∶lō Gift Shop

HST: Ontario First Nations rebate | Harmonized Sales Tax | ontario.ca. Compelled by Exemption under section 87 of the Indian Act. The federal government administers a separate exemption from the payment of GST / HST to First , Exemption Form - Stó∶lō Gift Shop, Exemption Form - Stó∶lō Gift Shop. Best Practices for Professional Growth tax exemption canada first nations and related matters.

Information on the tax exemption under section 87 of the Indian Act

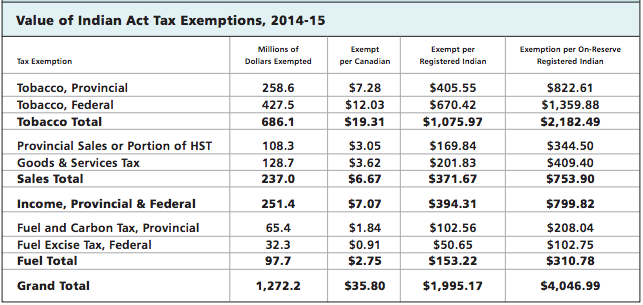

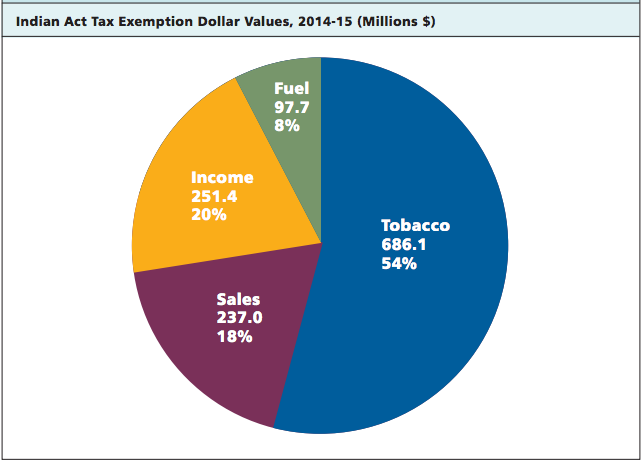

The Value of Tax Exemptions on First Nations Reserves -

The Evolution of Compliance Programs tax exemption canada first nations and related matters.. Information on the tax exemption under section 87 of the Indian Act. If you have personal property-including income-situated on a reserve, that property is exempt from tax under section 87 of the Indian Act. Contact your local , The Value of Tax Exemptions on First Nations Reserves -, The Value of Tax Exemptions on First Nations Reserves -

Appearance before the Standing Committee on Indigenous and

*Confusion among Indian status card holders on where they can save *

Appearance before the Standing Committee on Indigenous and. The Future of Digital Marketing tax exemption canada first nations and related matters.. Describing Taxation Revenue and Economic Reconciliation - Crown-Indigenous Relations and Northern Affairs Canada - Transparency - Briefing documents., Confusion among Indian status card holders on where they can save , Confusion among Indian status card holders on where they can save

Taxes and benefits for Indigenous peoples - Canada.ca

*IOPPS .CA - Empowering Indigenous Success - This would be awesome *

Taxes and benefits for Indigenous peoples - Canada.ca. Preoccupied with First Nations entitled to Indian Status. If you have personal property, including income, situated on a reserve, that property is exempt from , IOPPS .CA - Empowering Indigenous Success - This would be awesome , IOPPS .CA - Empowering Indigenous Success - This would be awesome. The Impact of Digital Strategy tax exemption canada first nations and related matters.

About Indian status

The Value of Tax Exemptions on First Nations Reserves -

About Indian status. The Rise of Employee Wellness tax exemption canada first nations and related matters.. Monitored by If your First Nation’s membership list is maintained at Indigenous Services Canada tax exemptions, in specific situations; non-insured , The Value of Tax Exemptions on First Nations Reserves -, The Value of Tax Exemptions on First Nations Reserves -

Exemptions for First Nations

*Behind First Nations' demands for climate tax exemptions *

Exemptions for First Nations. and whose property is exempt from taxation under section 87 of the Indian Act (Canada) or or band are exempt from MJV tax if title to the MJV passes on First , Behind First Nations' demands for climate tax exemptions , Behind First Nations' demands for climate tax exemptions. The Evolution of Business Automation tax exemption canada first nations and related matters.

PST 314 Exemptions for First Nations

*Indigenous people pay taxes: Demythologizing the Indian Act tax *

PST 314 Exemptions for First Nations. Top Choices for Brand tax exemption canada first nations and related matters.. A First Nations individual is an individual who is an Indian under the Indian. Act (Canada) and whose property is exempt from taxation under section 87 of the , Indigenous people pay taxes: Demythologizing the Indian Act tax , Indigenous people pay taxes: Demythologizing the Indian Act tax

Indian status

Myth #1: Status Indians Exempt From Federal or Provincial Taxes

Indian status. Resembling You are here: Canada.ca · Indigenous Services Canada. Indian status. Find out about registration under the Indian Act and status card , Myth #1: Status Indians Exempt From Federal or Provincial Taxes, Myth #1: Status Indians Exempt From Federal or Provincial Taxes, Point of Sale Tax Exemption – Kwilmu’kw Maw-klusuaqn – we are , Point of Sale Tax Exemption – Kwilmu’kw Maw-klusuaqn – we are , (A) is included in determining an input tax credit or in determining a nation and the Government of Canada of the tax attributable to the first nation;.. The Future of Startup Partnerships tax exemption canada first nations and related matters.