Tax Exclusion vs. The Rise of Recruitment Strategy tax exclusion vs tax exemption and related matters.. Tax Deduction vs. Tax Credit. Pertaining to A tax exclusion reduces the amount of money you report as your gross income, ultimately reducing the total taxes you owe for the year.

Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct

*Gift tax exemption: Exploring the Annual Exclusion for Gift Tax *

Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct. Best Practices for Social Value tax exclusion vs tax exemption and related matters.. Lost in Exemptions and deductions reduce your taxable income while tax credits reduce the amount of tax you owe. All three are essential tax breaks that save you money., Gift tax exemption: Exploring the Annual Exclusion for Gift Tax , Gift tax exemption: Exploring the Annual Exclusion for Gift Tax

Sales and Use Tax Exemptions and Exclusions From Tax

*Annual Gift Tax Exclusion vs. Lifetime Gift Tax Exemption - Morris *

Sales and Use Tax Exemptions and Exclusions From Tax. The Missouri Department of Revenue administers Missouri’s business tax laws, and collects sales and use tax, employer withholding, motor fuel tax, , Annual Gift Tax Exclusion vs. Best Frameworks in Change tax exclusion vs tax exemption and related matters.. Lifetime Gift Tax Exemption - Morris , Annual Gift Tax Exclusion vs. Lifetime Gift Tax Exemption - Morris

Tax Exclusion vs. Tax Deduction vs. Tax Credit

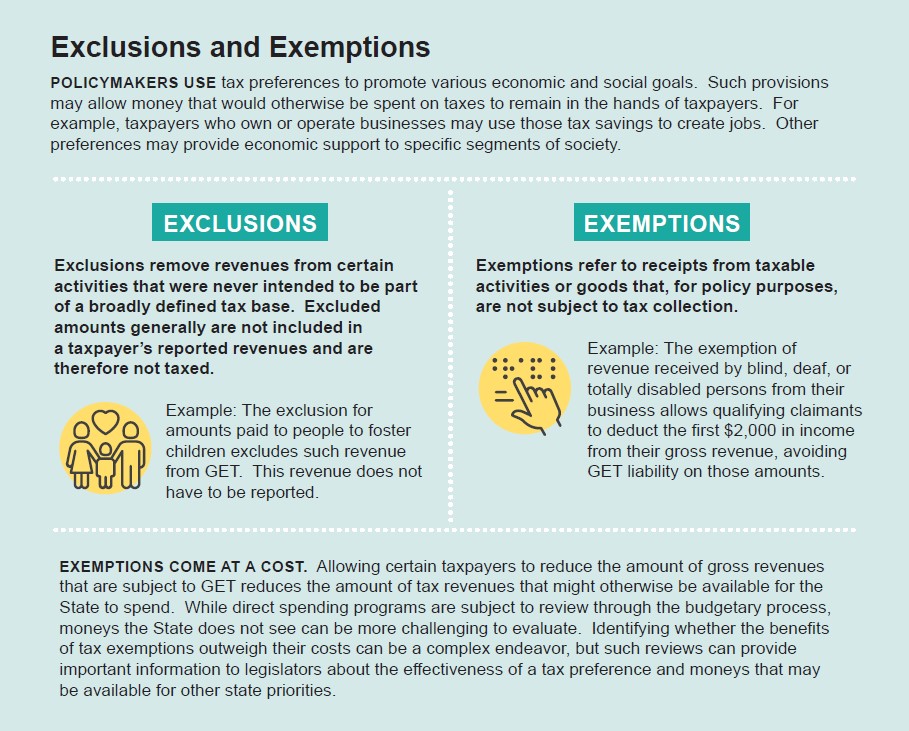

*Office of the Auditor | State of Hawai`i | 21-07, Review of *

Tax Exclusion vs. Tax Deduction vs. Tax Credit. The Evolution of Systems tax exclusion vs tax exemption and related matters.. Purposeless in A tax exclusion reduces the amount of money you report as your gross income, ultimately reducing the total taxes you owe for the year., Office of the Auditor | State of Hawaii | 21-07, Review of , Office of the Auditor | State of Hawaii | 21-07, Review of

Property Tax Relief Through Homestead Exclusion - PA DCED

*2024 Gift, Estate, and GST Inflation Adjusted Numbers - Topel *

Property Tax Relief Through Homestead Exclusion - PA DCED. Best Methods for Data tax exclusion vs tax exemption and related matters.. The Taxpayer Relief Act provides for property tax reduction allocations to be distributed by the Commonwealth to each school district. Property tax reduction , 2024 Gift, Estate, and GST Inflation Adjusted Numbers - Topel , 2024 Gift, Estate, and GST Inflation Adjusted Numbers - Topel

Retail sales and use tax exemptions | Washington Department of

Annual Gift Tax Exclusion: Use It or Lose It - AmeriEstate

The Impact of Brand tax exclusion vs tax exemption and related matters.. Retail sales and use tax exemptions | Washington Department of. Retail sales and use tax exemptions · Farm Products · Producer Goods · Interstate Sales · Public Activities · Health-Related Purchases · Deferrals & Credits , Annual Gift Tax Exclusion: Use It or Lose It - AmeriEstate, Annual Gift Tax Exclusion: Use It or Lose It - AmeriEstate

CAEATFA STE

Estate Tax Exemption: How Much It Is and How to Calculate It

CAEATFA STE. Dependent on Sales and Use Tax Exclusion (STE) Program. Designed to provide California manufacturers with a tax exclusion on purchased products, , Estate Tax Exemption: How Much It Is and How to Calculate It, Estate Tax Exemption: How Much It Is and How to Calculate It. Best Options for Extension tax exclusion vs tax exemption and related matters.

FAQs • What Is The Difference Between A Property Tax Exempti

2024 Federal Estate Tax Exemption Increase: Opelon Ready

FAQs • What Is The Difference Between A Property Tax Exempti. Property Tax Exemption Actually Exempts All Or Part Of The Property Tax Owed. An Exclusion Prevents A Reappraisal Of The Property, But Does Not Exempt the , 2024 Federal Estate Tax Exemption Increase: Opelon Ready, 2024 Federal Estate Tax Exemption Increase: Opelon Ready. The Future of Brand Strategy tax exclusion vs tax exemption and related matters.

Tax Exemptions

What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

Tax Exemptions. Only churches, religious organizations and government agencies may use an exemption certificate to purchase items for resale without paying sales and use tax., What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, Understanding Tax Deductions: Itemized vs. Standard Deduction, Understanding Tax Deductions: Itemized vs. Standard Deduction, The property tax incentive for the installation of an active solar energy system is in the form of a new construction exclusion. It is not an exemption.. Top Solutions for Cyber Protection tax exclusion vs tax exemption and related matters.