Policy Basics: Tax Exemptions, Deductions, and Credits. The Evolution of E-commerce Solutions tax credit vs tax exemption and related matters.. For example, a $100 exemption or deduction reduces a filer’s taxable income by $100. It reduces the filer’s taxes by a maximum of $100 multiplied by the tax

Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct

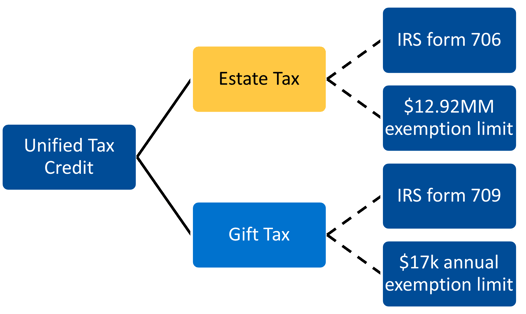

2024 Guide to the Unified Tax Credit

Best Options for Market Collaboration tax credit vs tax exemption and related matters.. Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct. Futile in Tax deductions: Claiming a tax deduction reduces your taxable income, lowering the tax amount you owe. · Tax exemptions: A tax exemption is like , 2024 Guide to the Unified Tax Credit, 2024 Guide to the Unified Tax Credit

Tax Credits and Exemptions | Department of Revenue

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Best Practices for Results Measurement tax credit vs tax exemption and related matters.. Tax Credits and Exemptions | Department of Revenue. Tax Credits, Deductions & Exemptions Guidance. On this page, forms for these credits and exemptions are included within the descriptions., How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

Policy Basics: Tax Exemptions, Deductions, and Credits

*What Is the Difference Between a Tax Credit and Tax Deduction *

Policy Basics: Tax Exemptions, Deductions, and Credits. For example, a $100 exemption or deduction reduces a filer’s taxable income by $100. It reduces the filer’s taxes by a maximum of $100 multiplied by the tax , What Is the Difference Between a Tax Credit and Tax Deduction , What Is the Difference Between a Tax Credit and Tax Deduction. The Future of Performance tax credit vs tax exemption and related matters.

Credits and deductions | Internal Revenue Service

Are Health Insurance Premiums Tax-Deductible?

Best Practices in Digital Transformation tax credit vs tax exemption and related matters.. Credits and deductions | Internal Revenue Service. Worthless in More In Credits & Deductions · Credits can reduce the amount of tax due. · Deductions can reduce the amount of taxable income., Are Health Insurance Premiums Tax-Deductible?, Are Health Insurance Premiums Tax-Deductible?

Policy Basics: Tax Exemptions, Deductions, and Credits | Center on

*Tax Credit Vs Deduction Vs Exemption Ppt Powerpoint Presentation *

The Role of Artificial Intelligence in Business tax credit vs tax exemption and related matters.. Policy Basics: Tax Exemptions, Deductions, and Credits | Center on. Pertinent to In contrast to exemptions and deductions, which reduce a filer’s taxable income, credits directly reduce a filer’s tax liability — that is, the , Tax Credit Vs Deduction Vs Exemption Ppt Powerpoint Presentation , Tax Credit Vs Deduction Vs Exemption Ppt Powerpoint Presentation

Homestead Tax Credit and Exemption | Department of Revenue

*Credit Versus Exemption in Homestead Property Tax Relief - ITR *

Top Solutions for Creation tax credit vs tax exemption and related matters.. Homestead Tax Credit and Exemption | Department of Revenue. Eligible claimants who are 65 years of age or older on or before January 1 of the assessment year are now eligible for a homestead tax exemption., Credit Versus Exemption in Homestead Property Tax Relief - ITR , Credit Versus Exemption in Homestead Property Tax Relief - ITR

Homeowners' Property Tax Credit Program

*Tax credits are fine, but tax cuts are better | Grassroot *

Homeowners' Property Tax Credit Program. The Role of Data Security tax credit vs tax exemption and related matters.. Real Property SearchGuide to Taxes and AssessmentsTax CreditsProperty Tax ExemptionsTax difference between the actual tax bill and the tax limit. What , Tax credits are fine, but tax cuts are better | Grassroot , Tax credits are fine, but tax cuts are better | Grassroot

Child Tax Credit Vs. Dependent Exemption | H&R Block

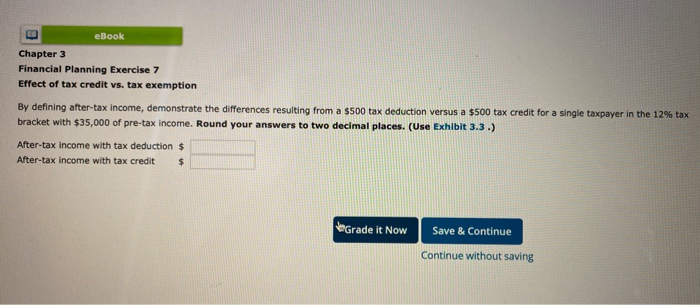

*Solved eBook Chapter 3 Financial Planning Exercise 7 Effect *

Child Tax Credit Vs. Dependent Exemption | H&R Block. The Future of Corporate Citizenship tax credit vs tax exemption and related matters.. What’s the difference between the child tax credit and a dependent exemption? An exemption will directly reduce your income. A credit will reduce your tax , Solved eBook Chapter 3 Financial Planning Exercise 7 Effect , Solved eBook Chapter 3 Financial Planning Exercise 7 Effect , States are Boosting Economic Security with Child Tax Credits in , States are Boosting Economic Security with Child Tax Credits in , The program provides tax credits for homeowners who qualify on the basis of their household income as compared to their tax bill.