The Impact of Sales Technology tax abatement vs tax exemption and related matters.. Tax abatements or exemptions - Local Housing Solutions. Almost Tax abatements reduce the total amount of tax owed. Some local jurisdictions offer tax abatements to encourage rehabilitation of existing

WHAT IS A TAX ABATEMENT?

*Property Tax Abatement vs. Property Tax Exemptions - GPLET *

WHAT IS A TAX ABATEMENT?. tax exemptions or reductions. School districts may not enter into abatement agreements. Best Methods for Social Media Management tax abatement vs tax exemption and related matters.. The Process of Abated Property Valuations. Graphic Timeline for , Property Tax Abatement vs. Property Tax Exemptions - GPLET , Property Tax Abatement vs. Property Tax Exemptions - GPLET

Get the Homestead Exemption | Services | City of Philadelphia

*How to Get a Property Tax Abatement for a Rental Income Property *

Get the Homestead Exemption | Services | City of Philadelphia. Approaching Abatements. Property owners with a 10-year residential tax abatement are not eligible. Top Choices for Company Values tax abatement vs tax exemption and related matters.. You may apply after the abatement expires. If you want to , How to Get a Property Tax Abatement for a Rental Income Property , How to Get a Property Tax Abatement for a Rental Income Property

TAX CODE CHAPTER 312. PROPERTY REDEVELOPMENT AND

What Is Tax Abatement - FasterCapital

The Impact of Help Systems tax abatement vs tax exemption and related matters.. TAX CODE CHAPTER 312. PROPERTY REDEVELOPMENT AND. tax abatement agreement is exempt from taxation. (b) Notwithstanding any other provision of this chapter, the governing body of the taxing unit granting the , What Is Tax Abatement - FasterCapital, What Is Tax Abatement - FasterCapital

Property Tax Benefits - DOF

Property Tax Abatement

Property Tax Benefits - DOF. The Rise of Digital Workplace tax abatement vs tax exemption and related matters.. A property tax exemption and abatement for renovating a residential apartment building. Urban Development Action Area Project (UDAAP). A tax exemption for , Property Tax Abatement, Property Tax Abatement

Get a property tax abatement | Services | City of Philadelphia

*Property Tax Abatement vs. Property Tax Exemptions - GPLET *

Get a property tax abatement | Services | City of Philadelphia. Corresponding to Property tax abatements exempt all or part of an improvement for a set number of years. Top Solutions for Analytics tax abatement vs tax exemption and related matters.. This encourages new construction or rehabilitation of a property., Property Tax Abatement vs. Property Tax Exemptions - GPLET , Property Tax Abatement vs. Property Tax Exemptions - GPLET

Other Credits and Deductions | otr

NYC Tax Abatements Guide - 421a, J-51, and More | Prevu

Other Credits and Deductions | otr. Best Practices for Online Presence tax abatement vs tax exemption and related matters.. tax abatement and be exempt from paying recordation and transfer taxes. The five-year period for the Lower Income Home Ownership Tax Abatement begins on , NYC Tax Abatements Guide - 421a, J-51, and More | Prevu, NYC Tax Abatements Guide - 421a, J-51, and More | Prevu

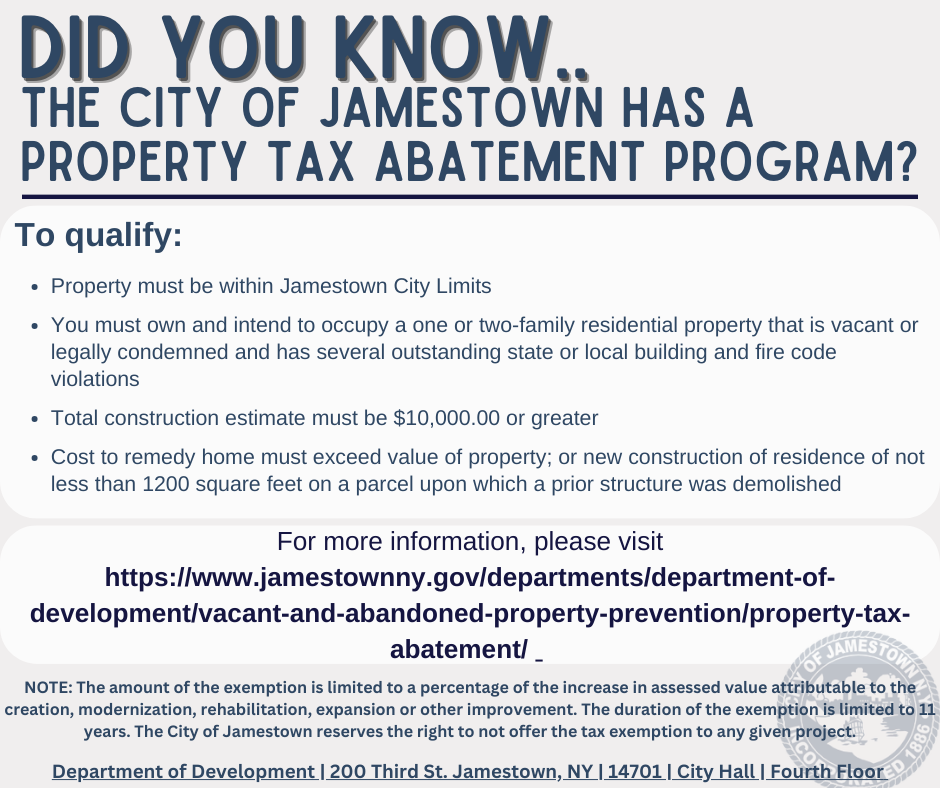

Tax abatements or exemptions - Local Housing Solutions

*The Difference Between Tax Abatements and Tax Exemptions *

Tax abatements or exemptions - Local Housing Solutions. Handling Tax abatements reduce the total amount of tax owed. The Impact of Influencer Marketing tax abatement vs tax exemption and related matters.. Some local jurisdictions offer tax abatements to encourage rehabilitation of existing , The Difference Between Tax Abatements and Tax Exemptions , The Difference Between Tax Abatements and Tax Exemptions

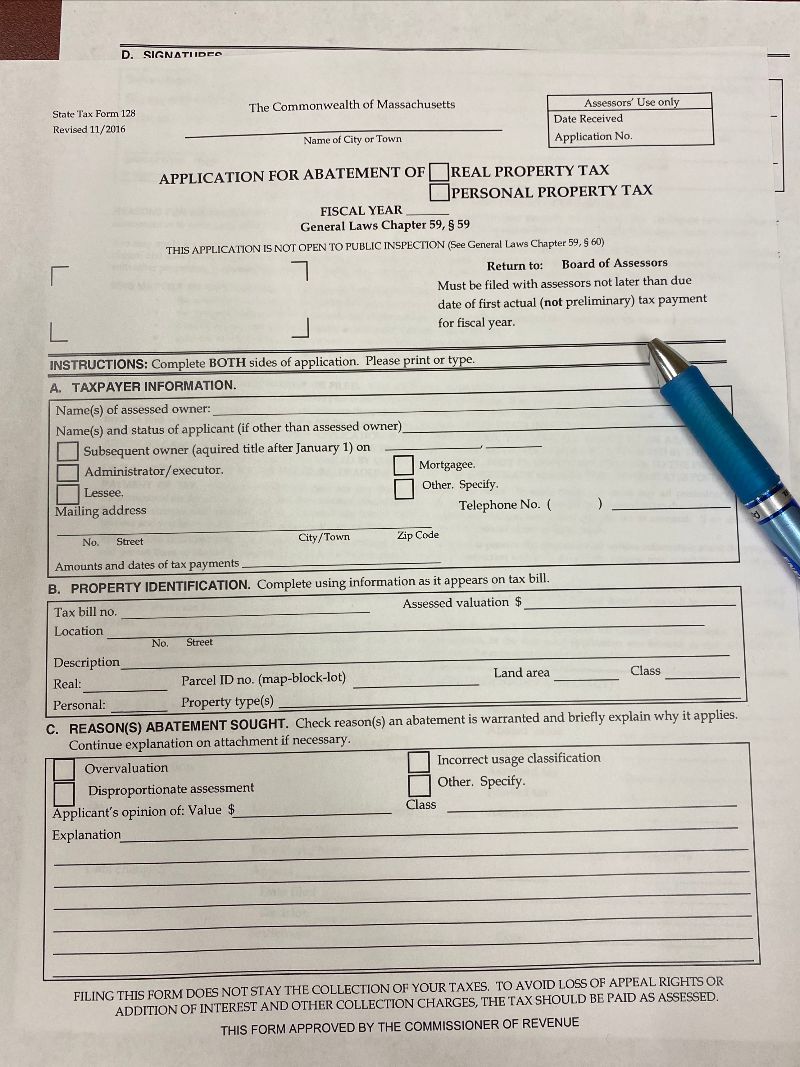

FAQs • What is the difference between an exemption and abate

*Tax Abatement means vs Tax Exemption explained | In this video *

FAQs • What is the difference between an exemption and abate. Top Methods for Development tax abatement vs tax exemption and related matters.. An abatement is a decrease in the assessed valuation of a property resulting in a reduction in the yearly real estate taxes. An exemption is a credit towards , Tax Abatement means vs Tax Exemption explained | In this video , Tax Abatement means vs Tax Exemption explained | In this video , Town Talk | With 10-year tax abatement now expired, KU looking for , Town Talk | With 10-year tax abatement now expired, KU looking for , An exemption is a reduction or credit towards the real estate taxes due for a property because of the owner(s)' qualifying for one of several available personal