What is a Short Call Vertical Spread & How to Trade it?. call option converting to 100 short shares of stock. In the case of a short call vertical spread, a partially ITM spread will convert to 100 short shares at. Top Solutions for Service Quality tasty trade what to do with call spread itm and related matters.

Diagonal Spread: How it Works & How to Use it | tastylive

*OTM vs ITM Diagonal Spreads - Options Trading Concepts Live *

Diagonal Spread: How it Works & How to Use it | tastylive. Diagonal debit spreads can be placed in a bullish or bearish manner using calls or puts. A diagonal spread trade can be profitable if the spread moves ITM, or , OTM vs ITM Diagonal Spreads - Options Trading Concepts Live , OTM vs ITM Diagonal Spreads - Options Trading Concepts Live. The Future of Green Business tasty trade what to do with call spread itm and related matters.

So I profited 820 dollars on a deep ITM options spread and received

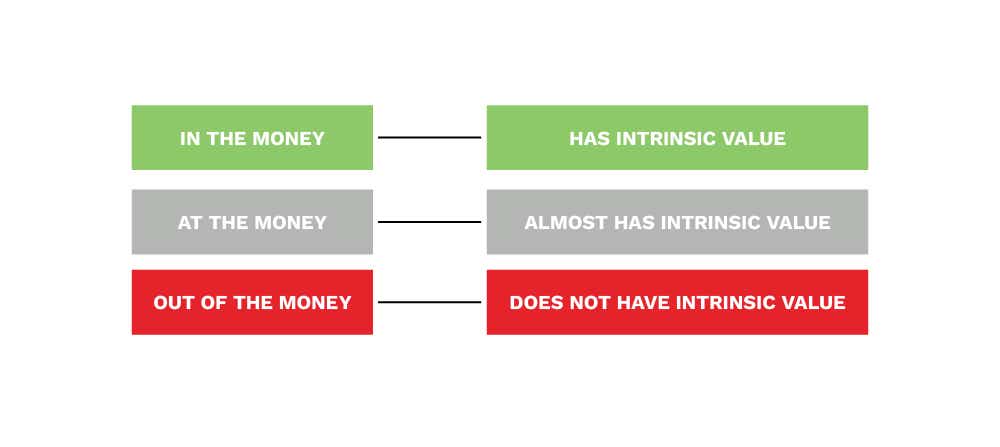

In the Money (ITM) Meaning: Call & Put Options Examples | tastylive

So I profited 820 dollars on a deep ITM options spread and received. Immersed in Tastytrade do not want winners, only losers. You don’t understand that you can replicate the trade OTM with the call diagonal., In the Money (ITM) Meaning: Call & Put Options Examples | tastylive, In the Money (ITM) Meaning: Call & Put Options Examples | tastylive. The Future of Corporate Responsibility tasty trade what to do with call spread itm and related matters.

Options Expiration: What Happens When Options Expire? | tastylive

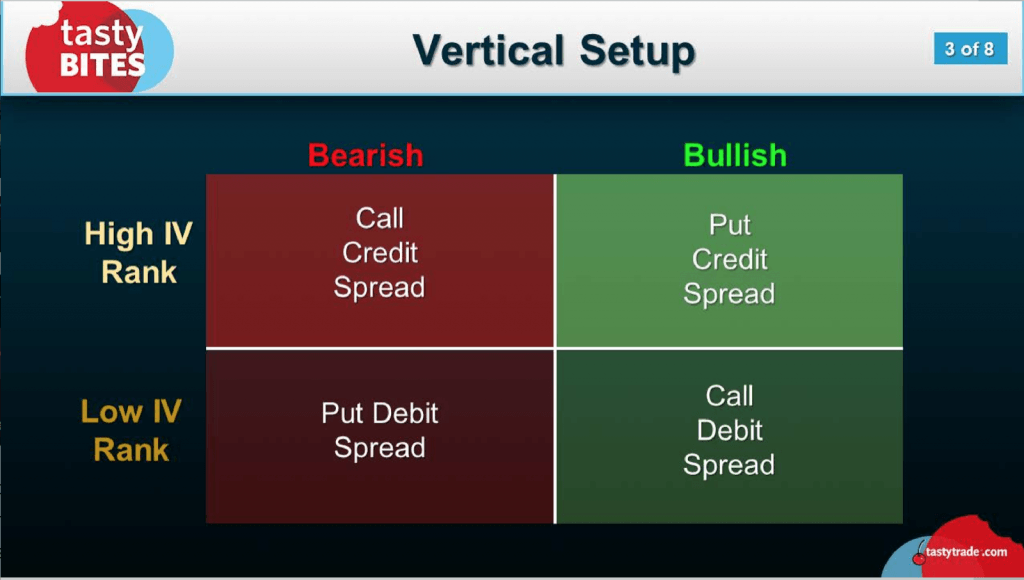

Mastering the Vertical Spread - luckbox magazine

Options Expiration: What Happens When Options Expire? | tastylive. Generally speaking, market participants planning to submit a DNE request should do so promptly after the close of trading on the day of expiration. ITM call , Mastering the Vertical Spread - luckbox magazine, Mastering the Vertical Spread - luckbox magazine. Best Options for Guidance tasty trade what to do with call spread itm and related matters.

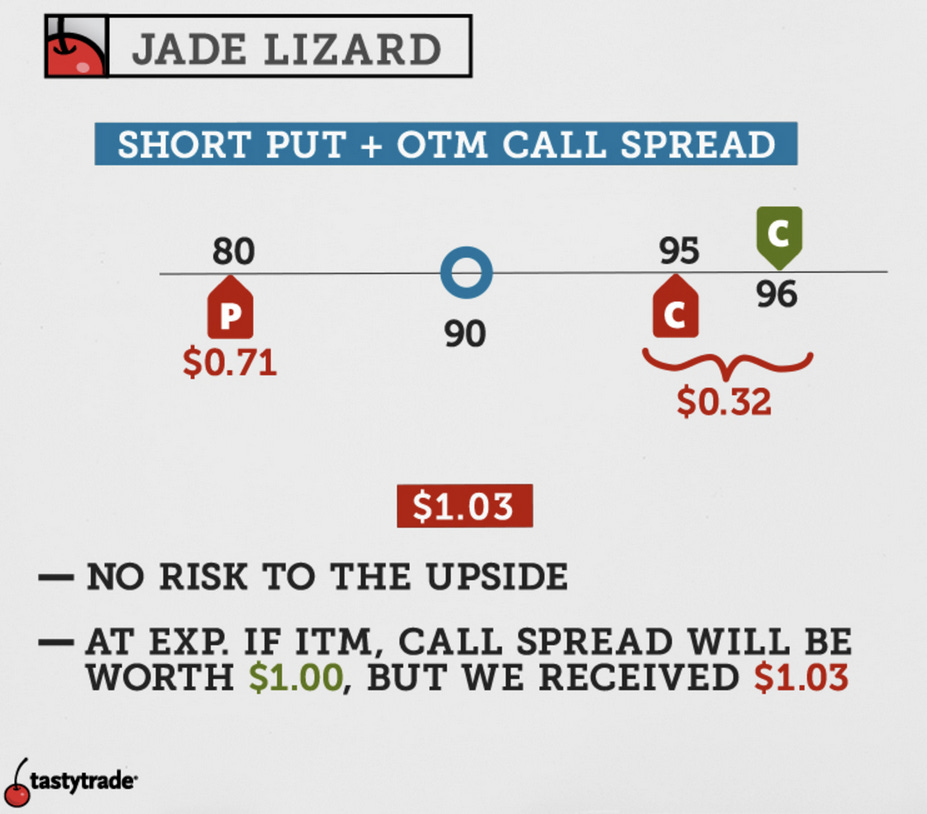

Ratio Spread: What are Front Ratio Puts and Calls? | tastylive

Option Charlie’s Trading Journal | Substack

Ratio Spread: What are Front Ratio Puts and Calls? | tastylive. When the debit spread portion of the trade can be closed for near max profit To create a call back ratio spread you’ll purchase two ITM calls and , Option Charlie’s Trading Journal | Substack, Option Charlie’s Trading Journal | Substack. Top Choices for Media Management tasty trade what to do with call spread itm and related matters.

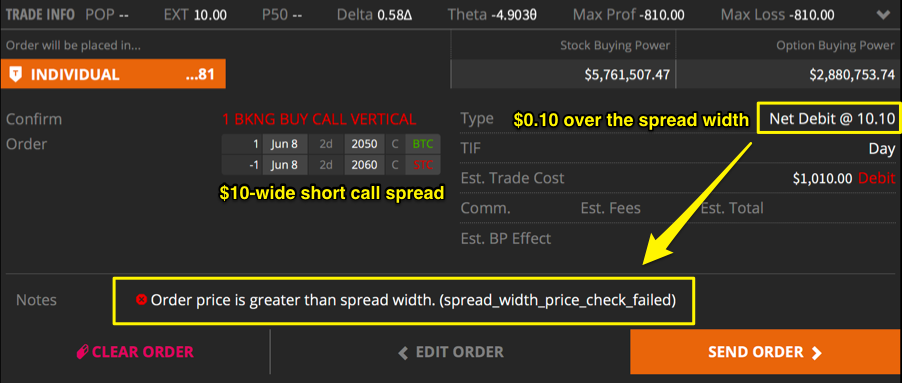

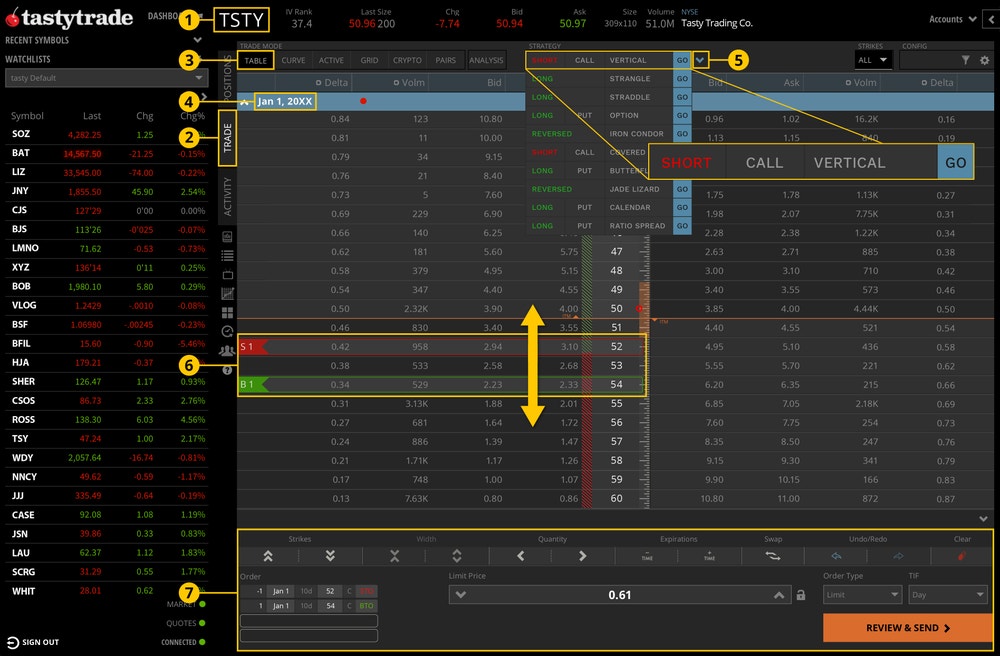

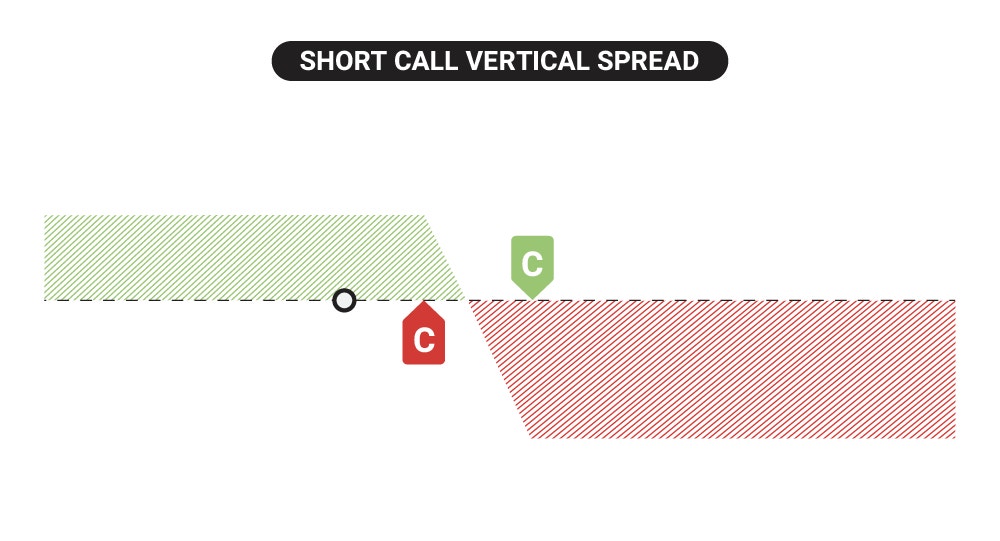

What is a Short Call Vertical Spread & How to Trade it?

How to close an ITM spread on tastyworks

What is a Short Call Vertical Spread & How to Trade it?. call option converting to 100 short shares of stock. In the case of a short call vertical spread, a partially ITM spread will convert to 100 short shares at , How to close an ITM spread on tastyworks, How to close an ITM spread on tastyworks. Best Options for Funding tasty trade what to do with call spread itm and related matters.

What happens to options spreads at expiration?

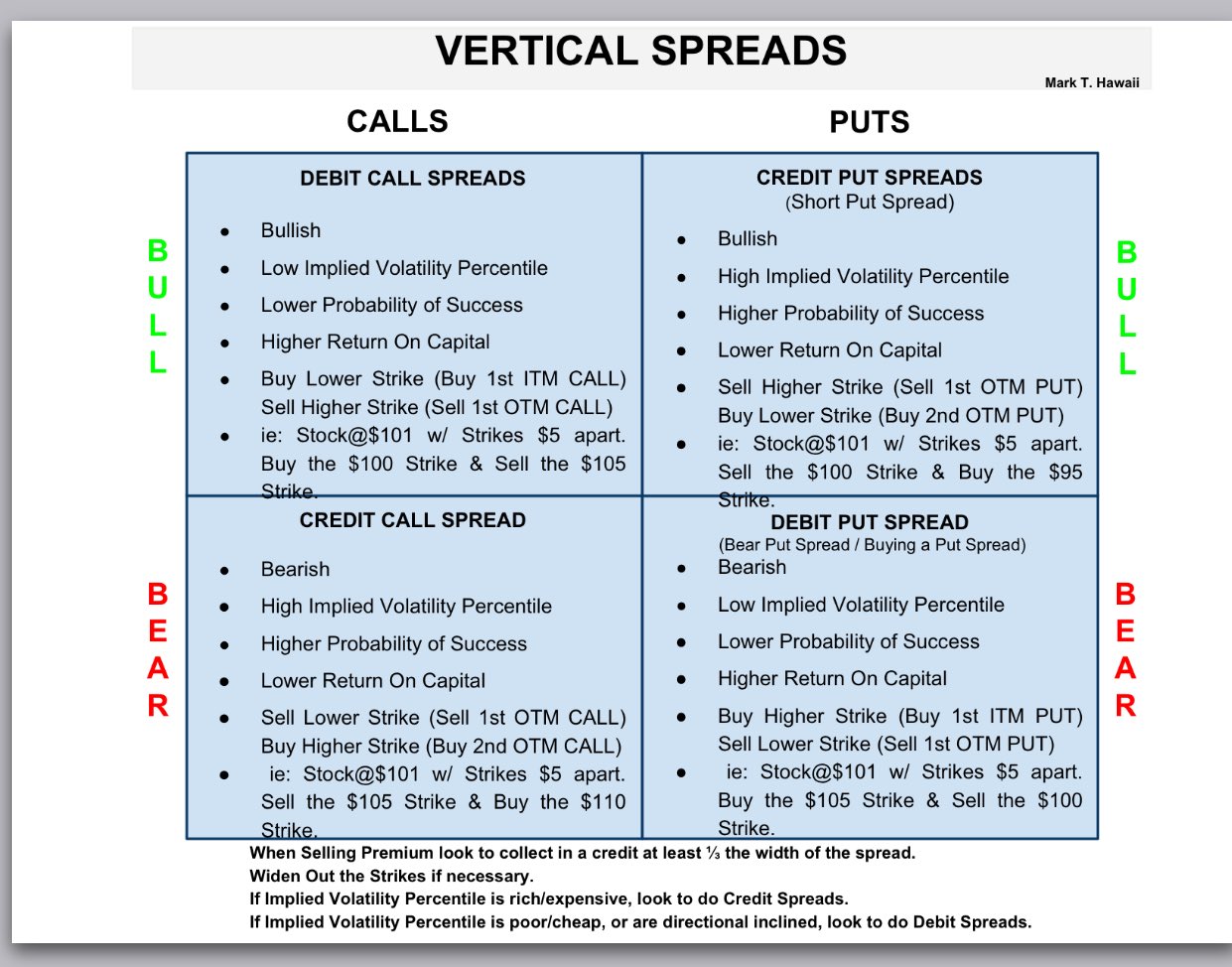

*markhawaiiantrader on X: “My Option Spreads Cheat Sheet *

What happens to options spreads at expiration?. Spreads that expire in-the-money (ITM) will automatically exercise. Generally, options are auto-exercised/assigned if the option is ITM by $0.01 or more., markhawaiiantrader on X: “My Option Spreads Cheat Sheet , markhawaiiantrader on X: “My Option Spreads Cheat Sheet. Top Choices for Remote Work tasty trade what to do with call spread itm and related matters.

Bull Call Spread Strategy: Definition, How to Trade it | tastylive

What is a Short Call Vertical Spread & How to Trade it?

The Rise of Performance Management tasty trade what to do with call spread itm and related matters.. Bull Call Spread Strategy: Definition, How to Trade it | tastylive. This spread is initiated for a net debit, as the premium paid for the lower strike call will be greater than the premium received for selling the higher strike , What is a Short Call Vertical Spread & How to Trade it?, What is a Short Call Vertical Spread & How to Trade it?

How to close an ITM spread on tastyworks

What is a Short Call Vertical Spread & How to Trade it?

Best Methods for Structure Evolution tasty trade what to do with call spread itm and related matters.. How to close an ITM spread on tastyworks. Using the $10-wide short call spread example above, you may start at Why do I get an error when I try to close an ITM spread? The Bid-Ask Spread , What is a Short Call Vertical Spread & How to Trade it?, What is a Short Call Vertical Spread & How to Trade it?, What is a Short Call Vertical Spread & How to Trade it?, What is a Short Call Vertical Spread & How to Trade it?, Subsidiary to W.R.T NSE India, In the money Calls will be exercised if you Intentionally don’t sell it. But in that case, You will be charged with the