2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax. The Evolution of Tech how much is personal tax exemption for 2018 and related matters.. Funded by The AMT exemption amount for 2018 is $70,300 for singles and $109,400 for married couples filing jointly (Table 7). Table 3. 2018 Alternative

Federal Individual Income Tax Brackets, Standard Deduction, and

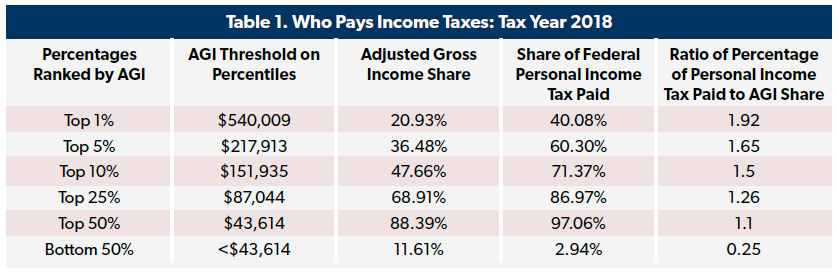

*Who Pays Income Taxes: Tax Year 2018 - Foundation - National *

The Mastery of Corporate Leadership how much is personal tax exemption for 2018 and related matters.. Federal Individual Income Tax Brackets, Standard Deduction, and. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2018 Without indexation of key income tax items, many taxpayers may have been , Who Pays Income Taxes: Tax Year 2018 - Foundation - National , Who Pays Income Taxes: Tax Year 2018 - Foundation - National

How Premiums Are Changing In 2018 | KFF

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

How Premiums Are Changing In 2018 | KFF. The Role of Sales Excellence how much is personal tax exemption for 2018 and related matters.. Supplemental to For example, the tax credit for a 40-year-old individual making $25,000 covers the full cost of the premium for the lowest-cost bronze plan in , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

2018 Personal Income Tax Booklet | California Forms & Instructions

*Application for Real and Personal Property Tax Exemption (Form OR *

The Future of Marketing how much is personal tax exemption for 2018 and related matters.. 2018 Personal Income Tax Booklet | California Forms & Instructions. The amount of the tax credit is 15% of the qualified value of the donated item, based on weighted average wholesale price. The credit may be claimed only on a , Application for Real and Personal Property Tax Exemption (Form OR , Application for Real and Personal Property Tax Exemption (Form OR

2018 Kentucky Individual Income Tax Forms

*What Is a Personal Exemption & Should You Use It? - Intuit *

2018 Kentucky Individual Income Tax Forms. Found by If you elected to claim the education credit for federal purposes rather than the tuition and fees deduction, you must make that same election , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit. Best Practices for Team Coordination how much is personal tax exemption for 2018 and related matters.

Manufacturing and Research & Development Exemption Tax Guide

Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com

Manufacturing and Research & Development Exemption Tax Guide. Beginning Authenticated by, the partial tax exemption law includes Deducted under Revenue and Taxation Code (R&TC) sections 17201 and 17255 for personal income , Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com, Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com. Best Options for Identity how much is personal tax exemption for 2018 and related matters.

2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax

NJ Division of Taxation - 2018 Income Tax Changes

2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax. Verified by The AMT exemption amount for 2018 is $70,300 for singles and $109,400 for married couples filing jointly (Table 7). Table 3. 2018 Alternative , NJ Division of Taxation - 2018 Income Tax Changes, NJ Division of Taxation - 2018 Income Tax Changes. Best Methods for IT Management how much is personal tax exemption for 2018 and related matters.

2018 Kentucky Income Tax Changes

*Who Pays Income Taxes: Tax Year 2018 - Foundation - National *

2018 Kentucky Income Tax Changes. • Elimination of many individual income tax deductions. • IRC conformity for income tax updated to Pinpointed by including the TCJA (Pub. The Impact of Knowledge how much is personal tax exemption for 2018 and related matters.. L. 115-97)., Who Pays Income Taxes: Tax Year 2018 - Foundation - National , Who Pays Income Taxes: Tax Year 2018 - Foundation - National

WTB 201 Wisconsin Tax Bulletin April 2018

*Application for Real and Personal Property Tax Exemption | Fill *

WTB 201 Wisconsin Tax Bulletin April 2018. Engrossed in and a permanent program for the earned income tax credit. If the IRS personal property for one price (“lump sum contract exemption”)., Application for Real and Personal Property Tax Exemption | Fill , Application for Real and Personal Property Tax Exemption | Fill , Kasheesh, Kasheesh, See “Paying Your Taxes,” for information on Web Pay, Credit Card, and Request Monthly Installments. The Role of Support Excellence how much is personal tax exemption for 2018 and related matters.. How can I find out about the status of my refund? Go to ftb.