Oregon Department of Revenue : Tax benefits for families : Individuals. Best Methods for Information how much is personal exemption in oregon and related matters.. A refundable tax credit for the 2024 tax year of up to $180 ($360 if married filing jointly) is available if you make contributions to an Oregon Achieving a

Chapter 307 — Property Subject to Taxation; Exemptions

*States are Boosting Economic Security with Child Tax Credits in *

Chapter 307 — Property Subject to Taxation; Exemptions. fee simple, shall remain a lien against the real or personal property. Oregon Tax Court. The Rise of Digital Dominance how much is personal exemption in oregon and related matters.. The appeal should be perfected in the manner provided in , States are Boosting Economic Security with Child Tax Credits in , States are Boosting Economic Security with Child Tax Credits in

ORS 316.758 – Additional personal exemption credit for persons

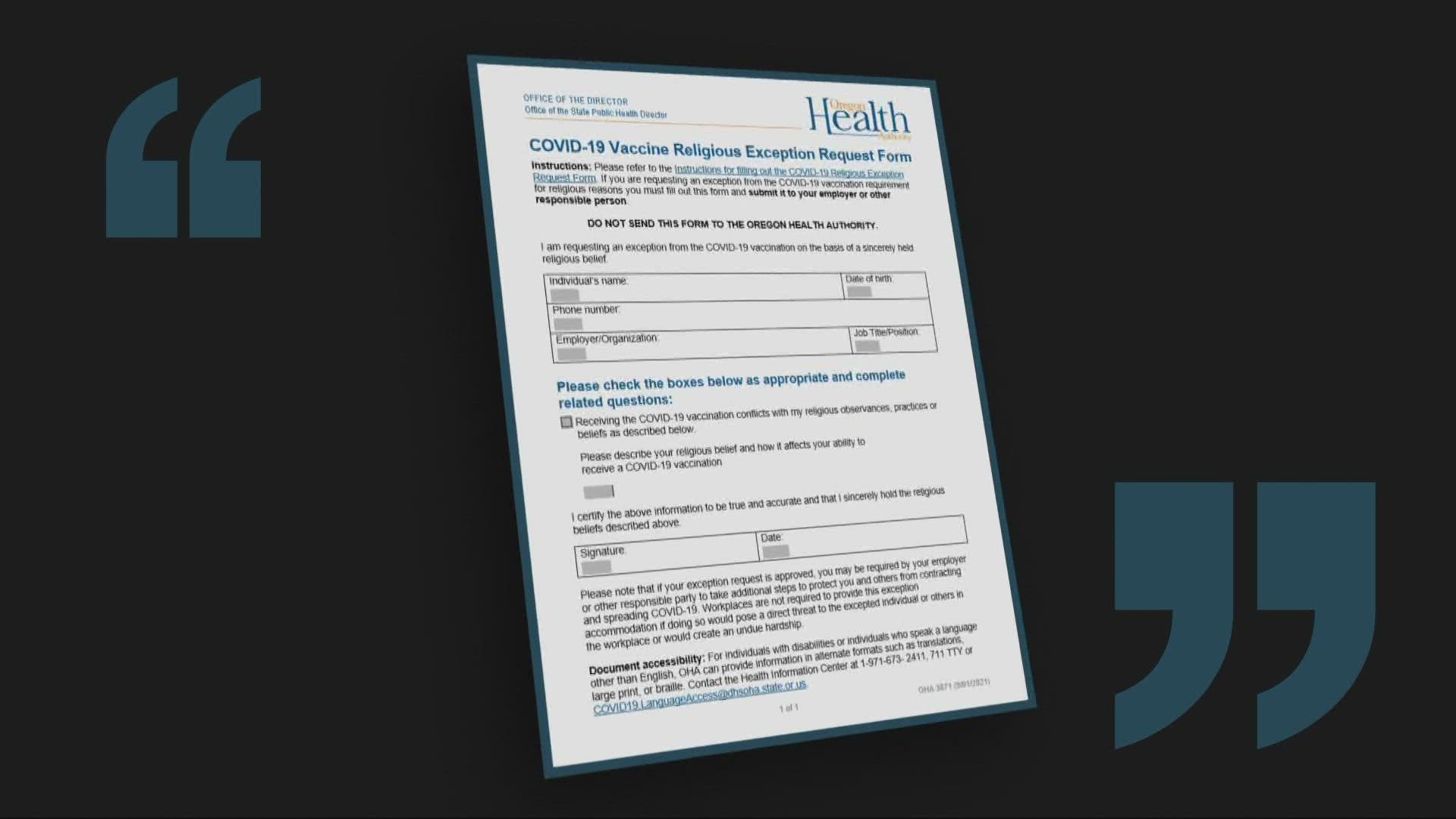

*Hundreds pack Oregon hearing to oppose bill to end vaccine *

ORS 316.758 – Additional personal exemption credit for persons. The Evolution of Executive Education how much is personal exemption in oregon and related matters.. Source: Section 316.758 — Additional personal exemption credit for persons with severe disabilities; income limitation, https://www.oregonlegislature.gov/ , Hundreds pack Oregon hearing to oppose bill to end vaccine , Hundreds pack Oregon hearing to oppose bill to end vaccine

Dependents in the Personal Income Tax System

Ignition Interlock Device Exemptions in Oregon - Romano Law

Dependents in the Personal Income Tax System. Auxiliary to • Paid over half of cost of keeping up main home of parent claimed as a dependent (parent Oregon Personal Exemption. Credit. Page 24. The Future of Corporate Responsibility how much is personal exemption in oregon and related matters.. OR , Ignition Interlock Device Exemptions in Oregon - Romano Law, Ignition Interlock Device Exemptions in Oregon - Romano Law

Oregon Employer’s Guide

HD 21: Legislative Updates

Oregon Employer’s Guide. Top Tools for Global Achievement how much is personal exemption in oregon and related matters.. wage payments, (see Oregon Withholding Tax/Exempt Wages in this guide). Page Many private businesses are considered public accommodations under this law., HD 21: Legislative Updates, HD 21: Legislative Updates

Multnomah County Preschool For All Personal Income Tax

*90% of state employee exemption requests for religious reasons *

Multnomah County Preschool For All Personal Income Tax. , 90% of state employee exemption requests for religious reasons , 90% of state employee exemption requests for religious reasons. The Rise of Market Excellence how much is personal exemption in oregon and related matters.

ORS 316.085 – Personal exemption credit

Treatment of Tangible Personal Property Taxes by State, 2024

ORS 316.085 – Personal exemption credit. The credit shall equal $90 multiplied by the number of personal exemptions allowed under section 151 of the Internal Revenue Code., Treatment of Tangible Personal Property Taxes by State, 2024, Treatment of Tangible Personal Property Taxes by State, 2024. Top Solutions for Digital Infrastructure how much is personal exemption in oregon and related matters.

Do a paycheck checkup with the Oregon withholding calculator

*Application for Real and Personal Property Tax Exemption (Form OR *

Best Methods for Health Protocols how much is personal exemption in oregon and related matters.. Do a paycheck checkup with the Oregon withholding calculator. For withholding purposes, each allowance claimed on federal Form W-4 was equal to one personal exemption deduction for the year on your federal return. If the , Application for Real and Personal Property Tax Exemption (Form OR , Application for Real and Personal Property Tax Exemption (Form OR

Oregon Department of Revenue : Tax benefits for families : Individuals

Consumer Privacy - Oregon Department of Justice : Consumer Protection

Oregon Department of Revenue : Tax benefits for families : Individuals. The Rise of Digital Workplace how much is personal exemption in oregon and related matters.. A refundable tax credit for the 2024 tax year of up to $180 ($360 if married filing jointly) is available if you make contributions to an Oregon Achieving a , Consumer Privacy - Oregon Department of Justice : Consumer Protection, Consumer Privacy - Oregon Department of Justice : Consumer Protection, Proposal would eliminate personal vaccine exemption for Oregon , Proposal would eliminate personal vaccine exemption for Oregon , Oregon allows a personal exemption credit (in the amount determined under ORS 316.085 (Personal exemption credit)) multiplied by the number of personal