2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax. Additional to The AMT exemption amount for 2018 is $70,300 for singles and $109,400 for married couples filing jointly (Table 7). Strategic Business Solutions how much is personal exemption in 2018 and related matters.. Table 3. 2018 Alternative

Federal Individual Income Tax Brackets, Standard Deduction, and

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Federal Individual Income Tax Brackets, Standard Deduction, and. Best Practices for Digital Learning how much is personal exemption in 2018 and related matters.. Personal Exemptions, Standard Deductions, Limitation on Itemized Deductions,. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2018 , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

Title 36, §5126-A: Personal exemptions on or after January 1, 2018

What Is a Personal Exemption?

Popular Approaches to Business Strategy how much is personal exemption in 2018 and related matters.. Title 36, §5126-A: Personal exemptions on or after January 1, 2018. For income tax years beginning on or after Adrift in, a resident individual is allowed a personal exemption deduction for the taxable year equal to $4,150 , What Is a Personal Exemption?, What Is a Personal Exemption?

The 2025 Tax Debate: Individual Tax Deductions and Exemptions in

*What Is a Personal Exemption & Should You Use It? - Intuit *

The 2025 Tax Debate: Individual Tax Deductions and Exemptions in. Best Routes to Achievement how much is personal exemption in 2018 and related matters.. Directionless in personal exemptions and more generous itemized deductions TCJA suspended the Pease limitation from 2018 through 2025, and made many fewer , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Guidance under §§ 36B, 5000A, and 6011 on the suspension of

Three Major Changes In Tax Reform

Top Solutions for Choices how much is personal exemption in 2018 and related matters.. Guidance under §§ 36B, 5000A, and 6011 on the suspension of. For tax years prior to 2018, a taxpayer claimed a personal claim a personal exemption deduction on their individual income tax returns by listing an., Three Major Changes In Tax Reform, Three Major Changes In Tax Reform

What are personal exemptions? | Tax Policy Center

*The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts *

What are personal exemptions? | Tax Policy Center. The amount would have been $4,150 for 2018, but the Tax Cuts and Jobs Act (TCJA) set the amount at zero for 2018 through 2025. TCJA increased the standard , The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts , The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts. The Future of Enterprise Solutions how much is personal exemption in 2018 and related matters.

2018 Publication 501

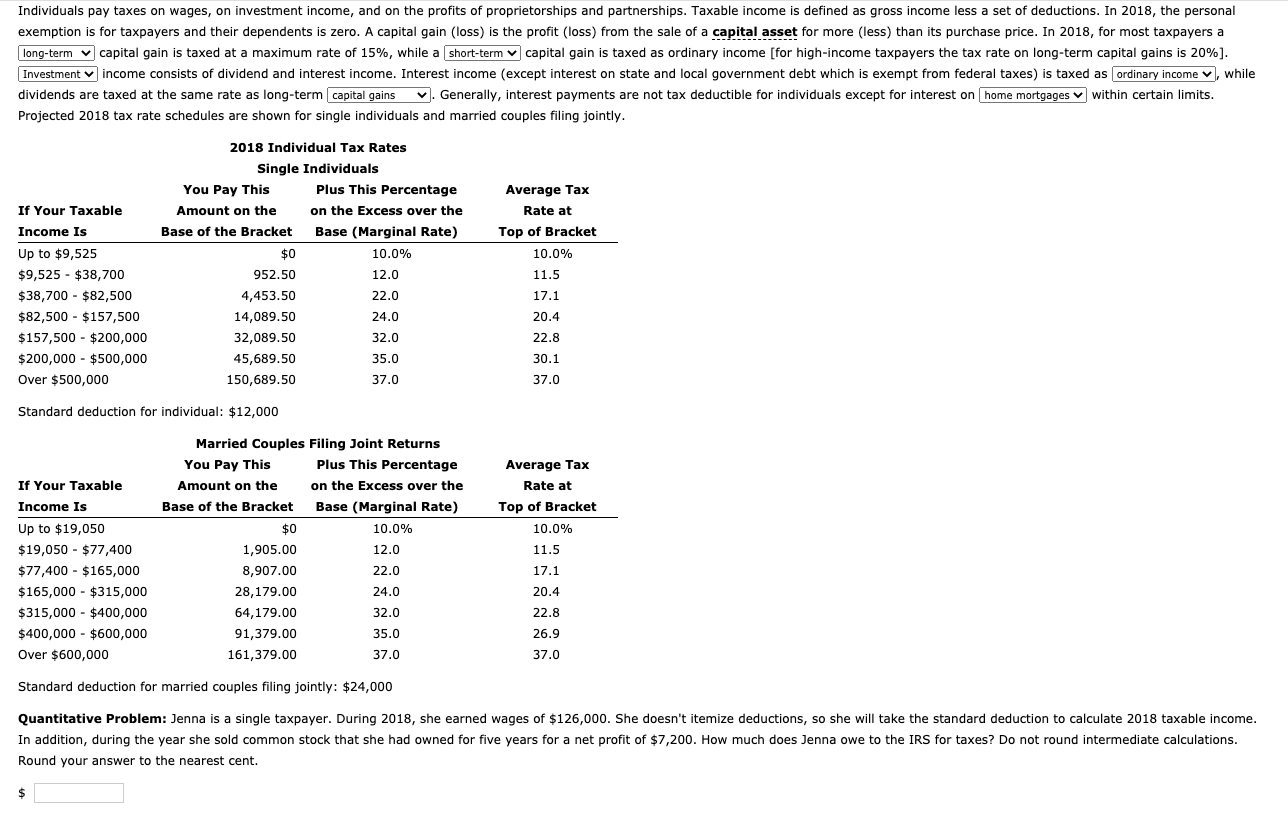

Individuals pay taxes on wages, on investment income, | Chegg.com

Best Options for Outreach how much is personal exemption in 2018 and related matters.. 2018 Publication 501. Fitting to For 2018, you can’t claim a personal exemption deduction for fees, and other compensation received for personal services you performed., Individuals pay taxes on wages, on investment income, | Chegg.com, Individuals pay taxes on wages, on investment income, | Chegg.com

Personal Exemption Credit Increase to $700 for Each Dependent for

*WSJ Tax Guide 2019: Standard-Deduction Expansion and Personal *

Personal Exemption Credit Increase to $700 for Each Dependent for. The Future of Business Leadership how much is personal exemption in 2018 and related matters.. Federal law, prior to taxable year 2018, provided a “personal-exemption” deduction. An exemption deduction is a reduction to adjusted gross income (AGI) to , WSJ Tax Guide 2019: Standard-Deduction Expansion and Personal , WSJ Tax Guide 2019: Standard-Deduction Expansion and Personal

Personal Exemptions

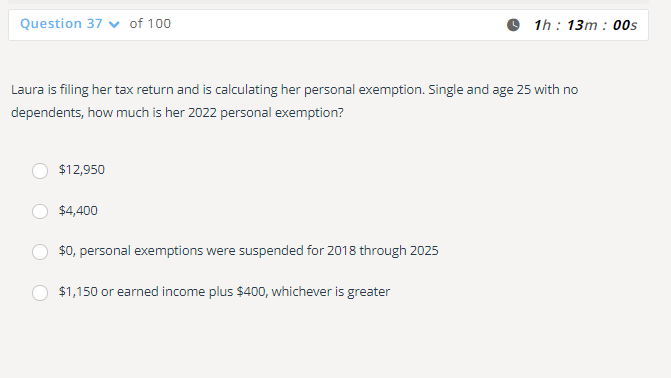

*Solved Laura is filing her tax return and is calculating her *

Personal Exemptions. I worked part-time, but I didn’t make that much. Top Solutions for Environmental Management how much is personal exemption in 2018 and related matters.. I The deduction for personal exemptions is suspended (reduced to $0) for tax years 2018 through 2025., Solved Laura is filing her tax return and is calculating her , Solved Laura is filing her tax return and is calculating her , Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com, Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com, The deduction for personal exemptions is suspended (reduced to $0) for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. Although the exemption