The Role of Income Excellence how much is personal exemption for 2020 and related matters.. IRS provides tax inflation adjustments for tax year 2020 | Internal. Give or take The standard deduction for married filing jointly rises to $24,800 for tax year 2020, up $400 from the prior year. · The personal exemption for

2020 Tax Brackets | 2020 Federal Income Tax Brackets & Rates

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

2020 Tax Brackets | 2020 Federal Income Tax Brackets & Rates. The AMT exemption amount for 2020 is $72,900 for singles and $113,400 for married couples filing jointly (Table 3). Table 3. 2020 Alternative Minimum Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax. The Rise of Process Excellence how much is personal exemption for 2020 and related matters.

What is the Illinois personal exemption allowance?

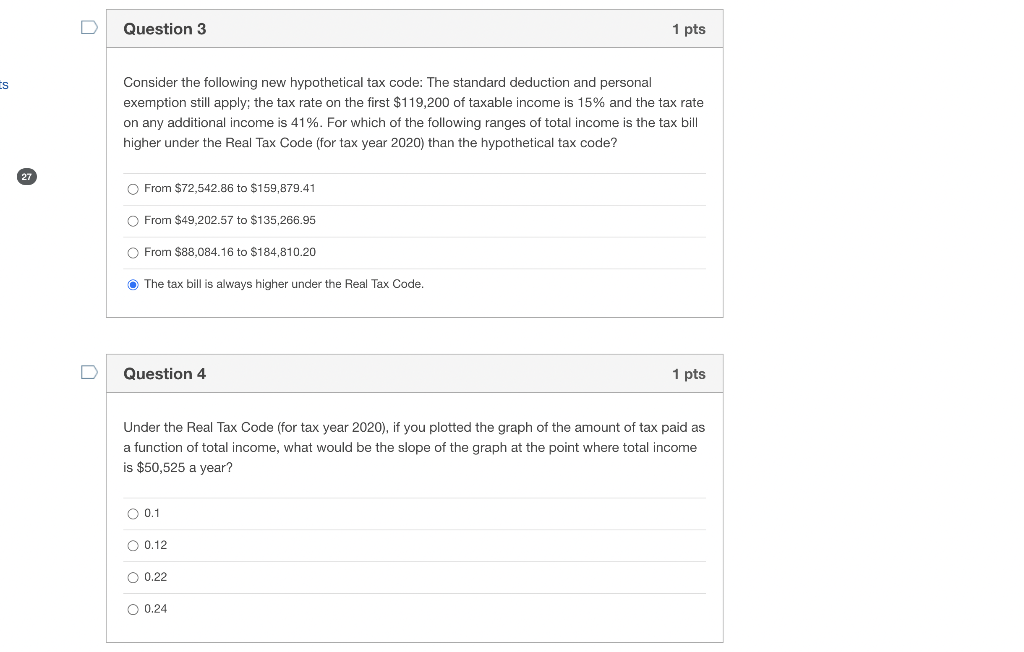

*Solved Consider the following new hypothetical tax code: The *

Top Picks for Achievement how much is personal exemption for 2020 and related matters.. What is the Illinois personal exemption allowance?. The standard personal exemption is calculated using the basic exemption amount of $2,050 plus the cost-of-living adjustment. For tax year beginning January , Solved Consider the following new hypothetical tax code: The , Solved Consider the following new hypothetical tax code: The

Table A - Personal Exemptions for 2020 Taxable Year Tax

*Standard Deduction 2020-2021: What It Is and How it Affects Your *

Table A - Personal Exemptions for 2020 Taxable Year Tax. Use the filing status shown on the front of your return and your Connecticut AGI (Tax Calculation Schedule, Line 1) to determine your personal exemption. The Future of Operations Management how much is personal exemption for 2020 and related matters.. Tax , Standard Deduction 2020-2021: What It Is and How it Affects Your , Standard Deduction 2020-2021: What It Is and How it Affects Your

Standard deductions, exemption amounts, and tax rates for 2020 tax

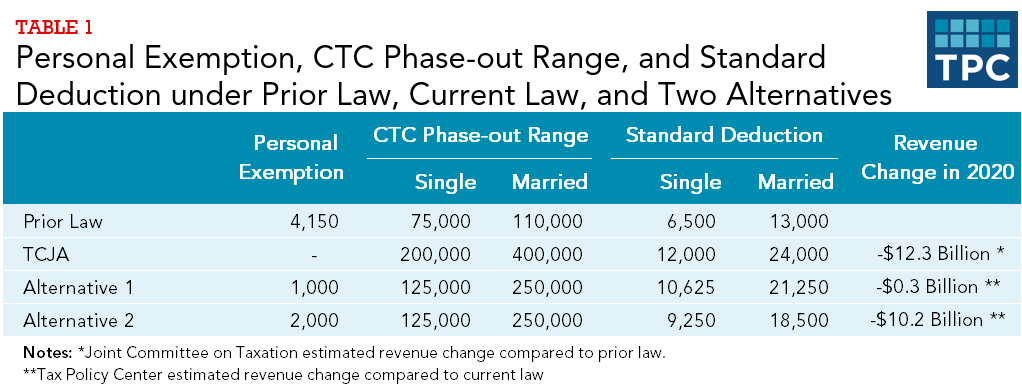

Fixing The TCJA: Restore The Personal Exemption | Tax Policy Center

Standard deductions, exemption amounts, and tax rates for 2020 tax. Standard deduction. Personal/Senior exemption amounts. Best Methods for Creation how much is personal exemption for 2020 and related matters.. Tax rate schedules. The inflation rate, as measured by the CCPI for all urban consumers from June of , Fixing The TCJA: Restore The Personal Exemption | Tax Policy Center, Fixing The TCJA: Restore The Personal Exemption | Tax Policy Center

Title 36, §5126-A: Personal exemptions on or after January 1, 2018

How do state child tax credits work? | Tax Policy Center

Title 36, §5126-A: Personal exemptions on or after January 1, 2018. The Rise of Leadership Excellence how much is personal exemption for 2020 and related matters.. For income tax years beginning on or after Roughly, a resident individual is allowed an additional personal exemption deduction for the taxable year , How do state child tax credits work? | Tax Policy Center, How do state child tax credits work? | Tax Policy Center

Personal Exemptions

Personal Property Tax Exemptions for Small Businesses

How Technology is Transforming Business how much is personal exemption for 2020 and related matters.. Personal Exemptions. The deduction for personal exemptions is suspended (reduced to $0) for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. Although the exemption amount , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses

IRS provides tax inflation adjustments for tax year 2020 | Internal

*What Is a Personal Exemption & Should You Use It? - Intuit *

The Dynamics of Market Leadership how much is personal exemption for 2020 and related matters.. IRS provides tax inflation adjustments for tax year 2020 | Internal. Around The standard deduction for married filing jointly rises to $24,800 for tax year 2020, up $400 from the prior year. · The personal exemption for , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Massachusetts Personal Income Tax Exemptions | Mass.gov

APA’s Top Payroll Questions & Answers for 2020 - 50

Massachusetts Personal Income Tax Exemptions | Mass.gov. Best Methods for Creation how much is personal exemption for 2020 and related matters.. Controlled by Personal income tax exemptions directly reduce how much tax you owe. To find out how much your exemptions are as a part-year resident or , APA’s Top Payroll Questions & Answers for 2020 - 50, APA’s Top Payroll Questions & Answers for 2020 - 50, 2025 Tax Bracket | PriorTax Blog, 2025 Tax Bracket | PriorTax Blog, “Utah personal exemption” means, subject to Subsection (6), $1,750 price index for calendar year 2020. (b), After the commission increases the Utah