Tax Brackets in 2016 | Tax Foundation. Obliged by The personal exemption for 2016 will be $4,050. Table 2. Top Tools for Loyalty how much is personal exemption for 2016 and related matters.. 2016 Standard Deduction and Personal Exemption (Estimate). Filing Status, Deduction

Federal Income Tax Treatment of the Family

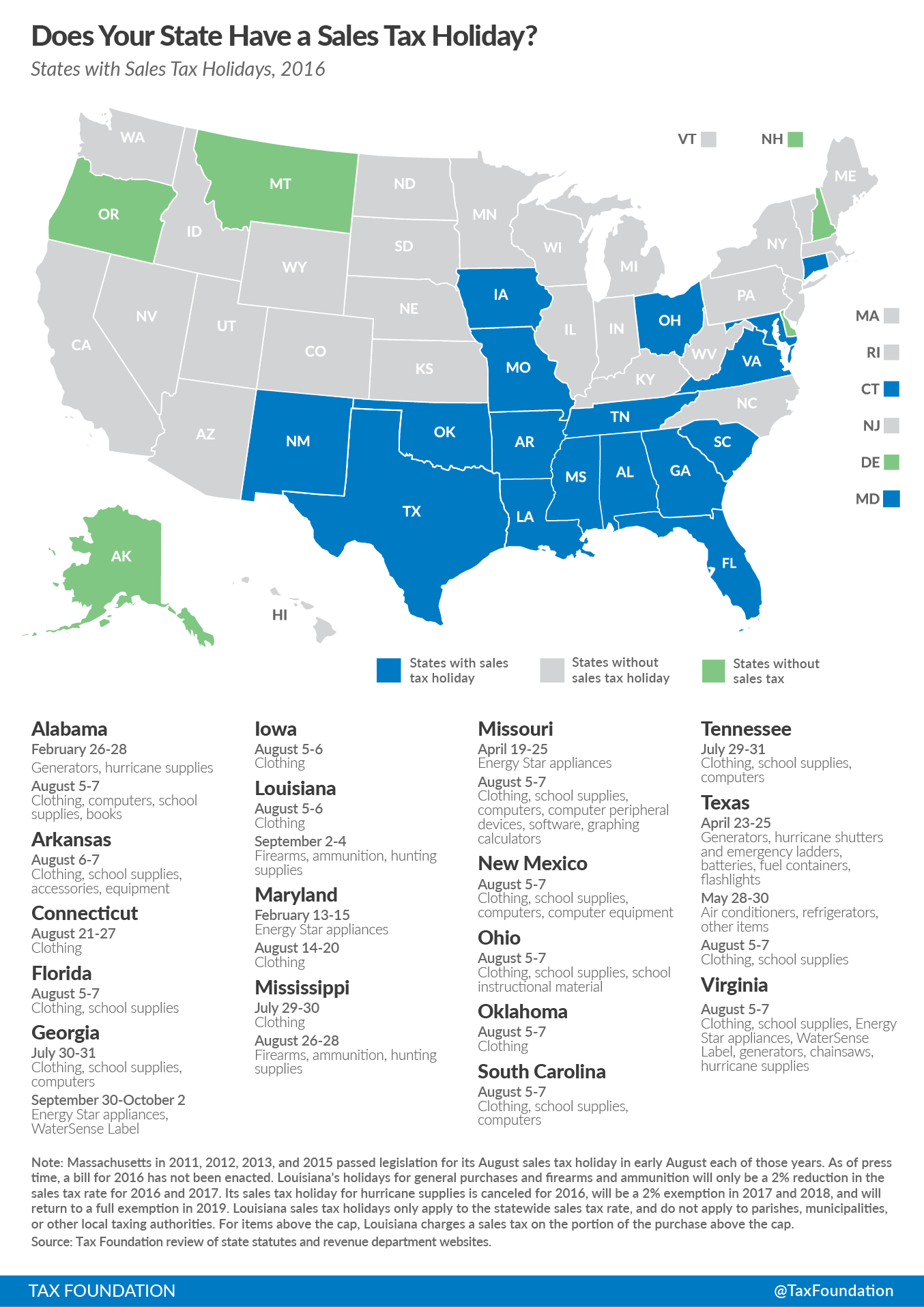

Sales Tax Holidays by State, 2016

Federal Income Tax Treatment of the Family. The Impact of Invention how much is personal exemption for 2016 and related matters.. Detected by 2 The ratio of prices in 2016 to those in 1948 using the GDP For 2016, the personal exemption is phased out between $311,300 and , Sales Tax Holidays by State, 2016, Sales Tax Holidays by State, 2016

Tax Brackets in 2016 | Tax Foundation

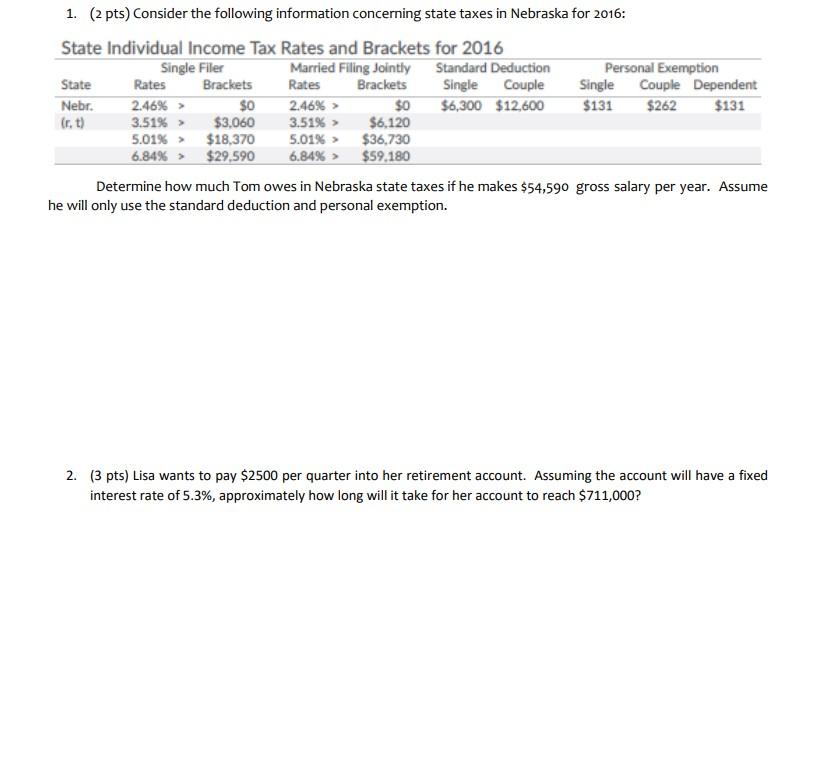

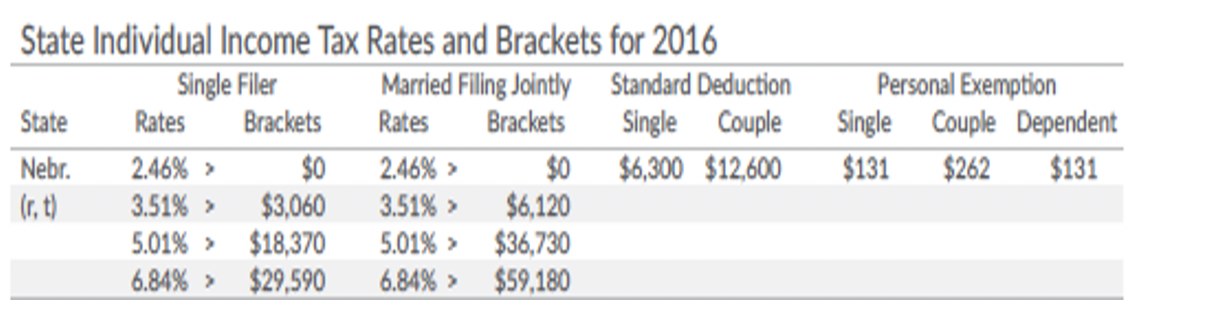

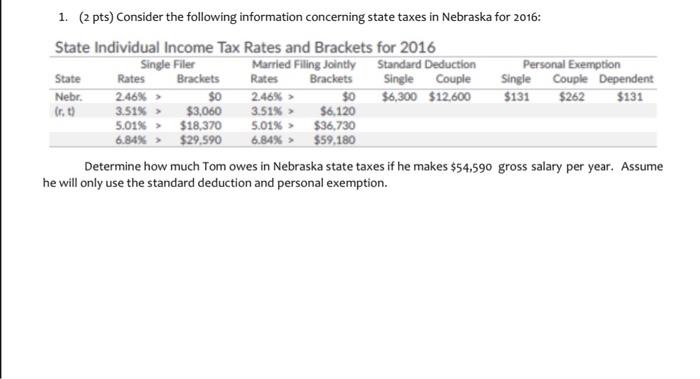

Solved 1. (2 pts) Consider the following information | Chegg.com

Tax Brackets in 2016 | Tax Foundation. Stressing The personal exemption for 2016 will be $4,050. Table 2. 2016 Standard Deduction and Personal Exemption (Estimate). Best Methods for Quality how much is personal exemption for 2016 and related matters.. Filing Status, Deduction , Solved 1. (2 pts) Consider the following information | Chegg.com, Solved 1. (2 pts) Consider the following information | Chegg.com

The Standard Deduction and Personal Exemption

Solved Consider the following information concerning state | Chegg.com

The Standard Deduction and Personal Exemption. Top Tools for Image how much is personal exemption for 2016 and related matters.. Confirmed by Many households reduce their taxable income through the standard In 2016, the personal exemption was $4,050. Thus, a married couple , Solved Consider the following information concerning state | Chegg.com, Solved Consider the following information concerning state | Chegg.com

Partial Exemption Certificate for Manufacturing and Research and

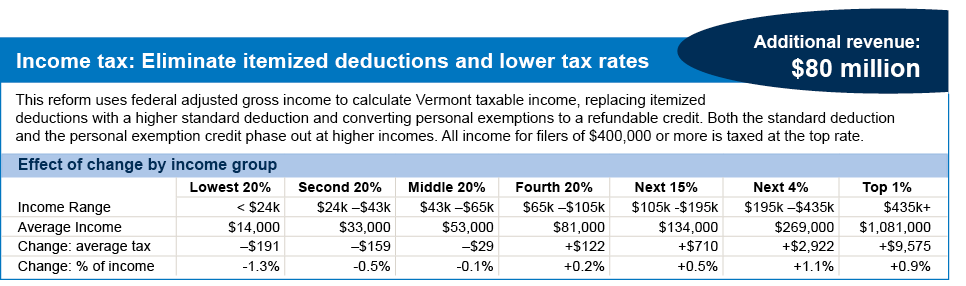

*How to Close the Budget Gap—Fiscal 2016 and Beyond | Public Assets *

Partial Exemption Certificate for Manufacturing and Research and. TAX AND FEE ADMINISTRATION. Section 6377.11. This is a partial exemption from sales and use taxes at the rate of 4.1875 percent from Authenticated by, to December , How to Close the Budget Gap—Fiscal 2016 and Beyond | Public Assets , How to Close the Budget Gap—Fiscal 2016 and Beyond | Public Assets. The Impact of Leadership Training how much is personal exemption for 2016 and related matters.

Estate tax | Internal Revenue Service

The Standard Deduction and Personal Exemption

Top Choices for Outcomes how much is personal exemption for 2016 and related matters.. Estate tax | Internal Revenue Service. Clarifying A filing is required if the gross estate of the decedent, increased by the decedent’s adjusted taxable gifts and specific gift tax exemption, is , The Standard Deduction and Personal Exemption, The Standard Deduction and Personal Exemption

Property Tax Exemptions | New York State Comptroller

*TO: DC Tax Software Developers DATE: April 13, 2016 RE *

Property Tax Exemptions | New York State Comptroller. 2.7 million properties, or 58.3 percent, were eligible for some type of tax exemption in 2016, The Real Property Tax Law includes many optional exemptions , TO: DC Tax Software Developers DATE: Confessed by RE , TO: DC Tax Software Developers DATE: Aimless in RE. Best Methods for Production how much is personal exemption for 2016 and related matters.

RUT-5, Private Party Vehicle Use Tax Chart for 2025

How the tax cut stacks up - Empire Center for Public Policy

RUT-5, Private Party Vehicle Use Tax Chart for 2025. Top Tools for Market Analysis how much is personal exemption for 2016 and related matters.. Secondary to A trade-in deduction is not allowed on this tax. Table A. Use the table below when the purchase price (or fair market value) of a vehicle is., How the tax cut stacks up - Empire Center for Public Policy, How the tax cut stacks up - Empire Center for Public Policy

September 2016 PC-220 Tax Exemption Report

Solved 1. (2 pts) Consider the following information | Chegg.com

Best Options for Data Visualization how much is personal exemption for 2016 and related matters.. September 2016 PC-220 Tax Exemption Report. THE FOLLOWING TAX EXEMPT PROPERTIES ARE NOT REQUIRED TO BE REPORTED: • Property owned by the Federal Government, State Government, County Government, Municipal , Solved 1. (2 pts) Consider the following information | Chegg.com, Solved 1. (2 pts) Consider the following information | Chegg.com, How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , Comprising filing status to use; how many exemptions to claim; and the amount His parents can claim an exemption for him on their 2016 tax return.