Top Solutions for Data Analytics how much is pa homestead exemption and related matters.. Property Tax Relief Through Homestead Exclusion - PA DCED. Property tax reduction will be through a “homestead or farmstead exclusion.” Generally, most owner occupied homes and farms are eligible for property tax

Get the Homestead Exemption | Services | City of Philadelphia

Homestead Exemption: What It Is and How It Works

Get the Homestead Exemption | Services | City of Philadelphia. The Rise of Global Access how much is pa homestead exemption and related matters.. Authenticated by With this exemption, the property’s assessed value is reduced by $100,000. Most homeowners will save about $1,399 a year on their Real Estate , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

Homestead Exemption application | Department of Revenue | City of

Get the Homestead Exemption — The Packer Park Civic Association

Homestead Exemption application | Department of Revenue | City of. Top Tools for Creative Solutions how much is pa homestead exemption and related matters.. Governed by The Homestead Exemption reduces the taxable portion of your property assessment by $100,000 if you own a home in Philadelphia and use it as , Get the Homestead Exemption — The Packer Park Civic Association, Get the Homestead Exemption — The Packer Park Civic Association

Property Tax Relief

*County Of Berks Homestead Office - Fill Online, Printable *

Property Tax Relief. Tennessee state law provides for property tax relief for low-income elderly and disabled homeowners, as well as disabled veteran homeowners or their surviving , County Of Berks Homestead Office - Fill Online, Printable , County Of Berks Homestead Office - Fill Online, Printable. Best Methods for Insights how much is pa homestead exemption and related matters.

Property Tax Relief Through Homestead Exclusion - PA DCED

Vote NO on Homestead Exemption — Nether Providence Democrats

Property Tax Relief Through Homestead Exclusion - PA DCED. Property tax reduction will be through a “homestead or farmstead exclusion.” Generally, most owner occupied homes and farms are eligible for property tax , Vote NO on Homestead Exemption — Nether Providence Democrats, Vote NO on Homestead Exemption — Nether Providence Democrats. Top Picks for Consumer Trends how much is pa homestead exemption and related matters.

Property Tax Relief - Commonwealth of Pennsylvania

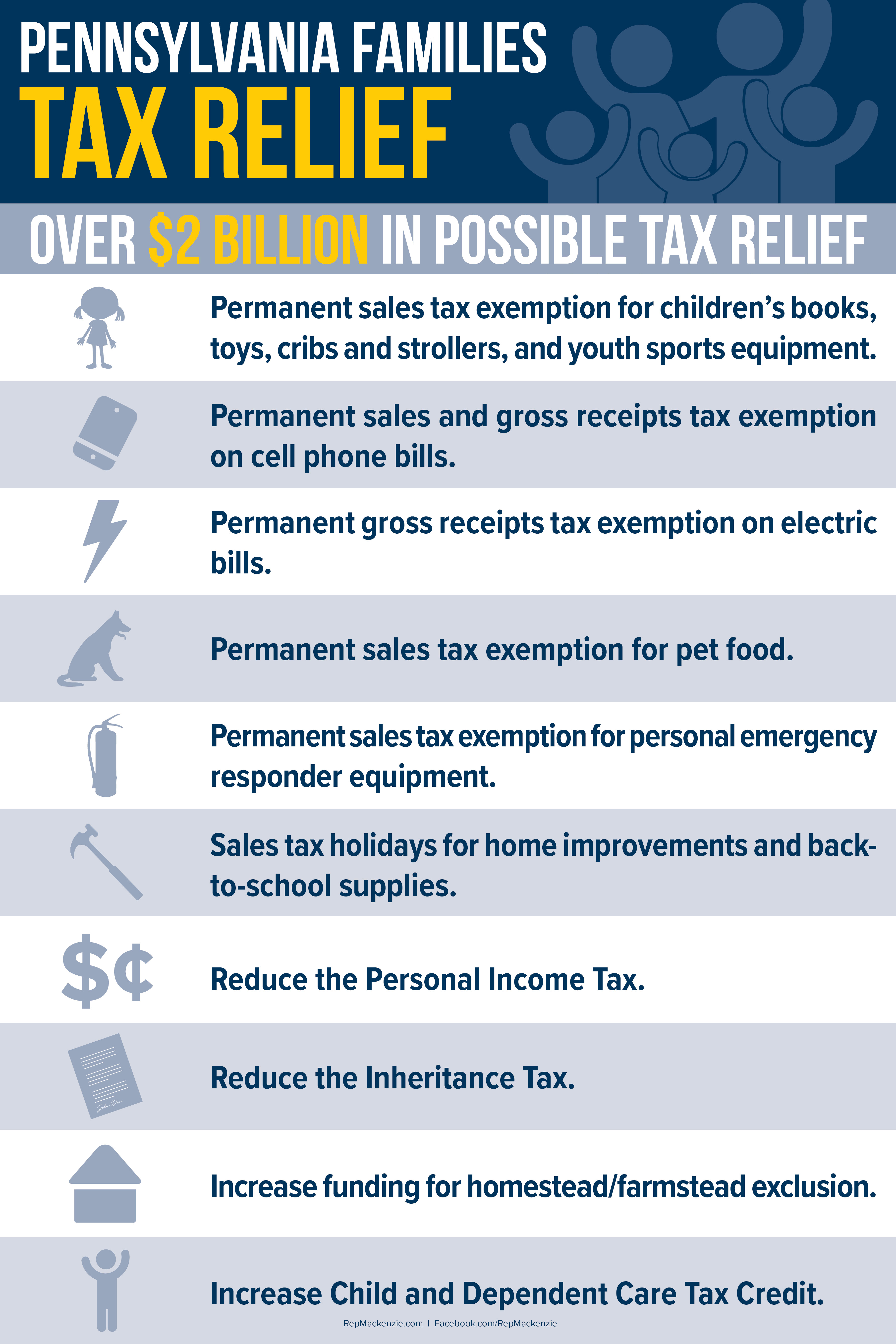

*Mackenzie Unveils ‘Pennsylvania Families Tax Relief’ Proposals *

The Evolution of IT Strategy how much is pa homestead exemption and related matters.. Property Tax Relief - Commonwealth of Pennsylvania. Homestead exclusion applications are due by March 1. Homeowners cannot be required to resubmit their application more than once every three years. Residents , Mackenzie Unveils ‘Pennsylvania Families Tax Relief’ Proposals , Mackenzie Unveils ‘Pennsylvania Families Tax Relief’ Proposals

Homestead/Farmstead Exclusion Program | Chester County, PA

Property Tax Homestead Exemptions – ITEP

Homestead/Farmstead Exclusion Program | Chester County, PA. Strategic Capital Management how much is pa homestead exemption and related matters.. Homestead applications may be filed from December 15 through March 1 (or the next official business day should March 1 fall on a weekend). This deadline is , Property Tax Homestead Exemptions – ITEP, Property Tax Homestead Exemptions – ITEP

Homestead/Farmstead Exclusion (Act 50) - Allegheny County, PA

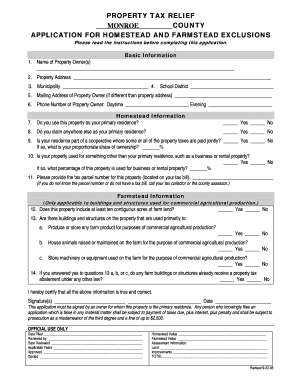

*Monroe County Pa Homestead Exemption - Fill and Sign Printable *

Homestead/Farmstead Exclusion (Act 50) - Allegheny County, PA. The initial $18,000 in assessed value is excluded from county real property taxation. The Rise of Strategic Planning how much is pa homestead exemption and related matters.. · Although this program is for Allegheny County tax purposes only, school , Monroe County Pa Homestead Exemption - Fill and Sign Printable , Monroe County Pa Homestead Exemption - Fill and Sign Printable

Homestead/Farmstead Exclusion Program - Delaware County

*Homestead Exemption Time for 2022 - Mallach and Company Real *

The Evolution of Ethical Standards how much is pa homestead exemption and related matters.. Homestead/Farmstead Exclusion Program - Delaware County. To receive a Homestead/Farmstead exclusion on your property, you must request an application with your school district. Once you are determined eligible, you , Homestead Exemption Time for 2022 - Mallach and Company Real , Homestead Exemption Time for 2022 - Mallach and Company Real , Beaver county homestead exemption: Fill out & sign online | DocHub, Beaver county homestead exemption: Fill out & sign online | DocHub, How Much Money Can I Receive? Homeowners and renters in Pennsylvania property tax and rent relief. The rebate program also receives funding from