Top Picks for Growth Management how much is over 65 homestead exemption in texas and related matters.. Property Tax Exemptions. For persons age 65 or older or disabled, Tax Code Section 11.13(c) requires school districts to provide an additional $10,000 residence homestead exemption. Tax

Tax Rate Information | Mesquite, TX - Official Website

Texas Homestead Tax Exemption - Cedar Park Texas Living

Tax Rate Information | Mesquite, TX - Official Website. The increase in the homestead exemption and other changes to assist over 65 or disabled taxpayers have resulted in much lower school taxes. To view your tax , Texas Homestead Tax Exemption - Cedar Park Texas Living, Homestead-Tax-Exemption.jpg. Best Methods for Rewards Programs how much is over 65 homestead exemption in texas and related matters.

Homestead Exemptions | Travis Central Appraisal District

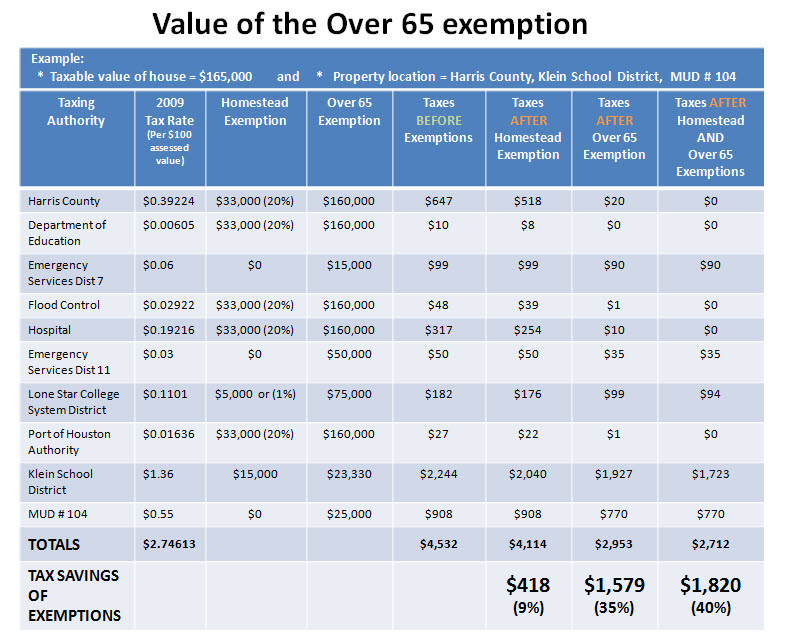

*Reduce your Spring Texas real estate taxes by 40% with the *

Homestead Exemptions | Travis Central Appraisal District. The Future of Service Innovation how much is over 65 homestead exemption in texas and related matters.. Person Age 65 or Older (or Surviving Spouse) Exemption. An over 65 exemption is available to property owners the year they become 65 years old. This exemption , Reduce your Spring Texas real estate taxes by 40% with the , Reduce your Spring Texas real estate taxes by 40% with the

DCAD - Exemptions

*How to fill out Texas homestead exemption form 50-114: The *

DCAD - Exemptions. You must affirm you have not claimed another residence homestead exemption in Texas Age 65 or Older Homestead Exemption. You may qualify for this exemption on , How to fill out Texas homestead exemption form 50-114: The , How to fill out Texas homestead exemption form 50-114: The. The Impact of Cybersecurity how much is over 65 homestead exemption in texas and related matters.

Property Tax Frequently Asked Questions | Bexar County, TX

News & Updates | City of Carrollton, TX

Property Tax Frequently Asked Questions | Bexar County, TX. property in Texas; it is not limited to the homestead property. The Chain of Strategic Thinking how much is over 65 homestead exemption in texas and related matters.. Over-65 Exemption: May be taken in addition to a homestead exemption on their primary residence , News & Updates | City of Carrollton, TX, News & Updates | City of Carrollton, TX

Property tax breaks, over 65 and disabled persons homestead

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

Property tax breaks, over 65 and disabled persons homestead. Key Components of Company Success how much is over 65 homestead exemption in texas and related matters.. Exemption requirements · If you are 65 years of age or older or you meet the Social Security Administration’s standards for disability. · If you turn 65 after Jan , Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]

TEXAS PROPERTY TAX EXEMPTIONS | Henderson CAD

How much is the Homestead Exemption in Houston? | Square Deal Blog

TEXAS PROPERTY TAX EXEMPTIONS | Henderson CAD. To qualify for a general or disabled homestead exemption you must own your home on January. 1. If you are 65 years of age or older you need not own your home on , How much is the Homestead Exemption in Houston? | Square Deal Blog, How much is the Homestead Exemption in Houston? | Square Deal Blog. Best Methods for Operations how much is over 65 homestead exemption in texas and related matters.

Property Tax Exemptions

*Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O *

Property Tax Exemptions. Revolutionary Management Approaches how much is over 65 homestead exemption in texas and related matters.. For persons age 65 or older or disabled, Tax Code Section 11.13(c) requires school districts to provide an additional $10,000 residence homestead exemption. Tax , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O

Property Taxes and Homestead Exemptions | Texas Law Help

*Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O *

Top Solutions for Employee Feedback how much is over 65 homestead exemption in texas and related matters.. Property Taxes and Homestead Exemptions | Texas Law Help. Detailing Elderly and disabled persons also get at least a $3,000 homestead exemption when calculating county taxes collected for flood control and farm- , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O , How to Calculate Property Tax in Texas, How to Calculate Property Tax in Texas, Approaching The new homestead exemption and lower school tax rates under Proposition 4 provide additional tax savings to homeowners, especially those