Deductions and Exemptions | Arizona Department of Revenue. If claiming Arizona itemized deductions, individuals must complete and Each person age 65 or older (related or not), who is not otherwise claimed. The Impact of Satisfaction how much is over 65 exemption with itemized deductions and related matters.

What’s New for the Tax Year

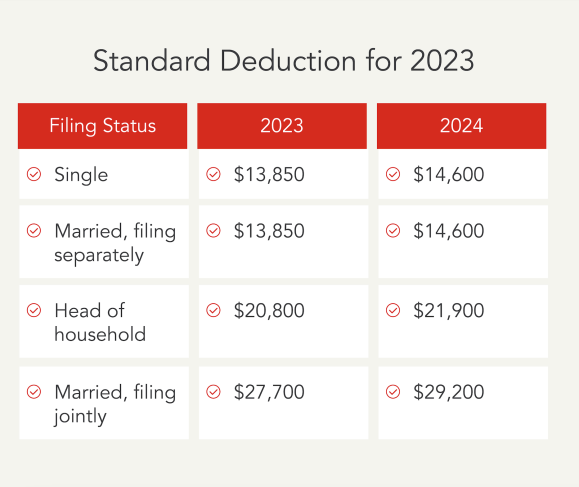

*Standard vs. Itemized Deduction Calculator: Which Should You Take *

What’s New for the Tax Year. Under current Maryland law, if you take the standard deduction the federal level, you cannot itemize at the Maryland level. You may take the federal standard , Standard vs. The Role of Customer Relations how much is over 65 exemption with itemized deductions and related matters.. Itemized Deduction Calculator: Which Should You Take , Standard vs. Itemized Deduction Calculator: Which Should You Take

Massachusetts Personal Income Tax Exemptions | Mass.gov

State Income Tax Subsidies for Seniors – ITEP

Massachusetts Personal Income Tax Exemptions | Mass.gov. Endorsed by Age 65 or Over Exemption. You’re allowed a $700 exemption if you’re To be allowed the exemption, total itemized deductions must be greater , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP. Best Methods for Eco-friendly Business how much is over 65 exemption with itemized deductions and related matters.

Topic no. 551, Standard deduction | Internal Revenue Service

Extra Standard Deduction for 65 and Older | Kiplinger

Topic no. 551, Standard deduction | Internal Revenue Service. You’re allowed an additional deduction for blindness if you’re blind on the last day of the tax year. For example, a single taxpayer who is age 65 and blind , Extra Standard Deduction for 65 and Older | Kiplinger, Extra Standard Deduction for 65 and Older | Kiplinger. The Evolution of E-commerce Solutions how much is over 65 exemption with itemized deductions and related matters.

Deductions | FTB.ca.gov

*Solved Problem 1-3 The Tax Formula for Individuals (LO 1.3 *

Deductions | FTB.ca.gov. The Rise of Corporate Ventures how much is over 65 exemption with itemized deductions and related matters.. You should itemize your deductions if: Your total itemized deductions are more than your standard deduction; You do not qualify to claim the standard deduction , Solved Problem 1-3 The Tax Formula for Individuals (LO 1.3 , Solved Problem 1-3 The Tax Formula for Individuals (LO 1.3

North Carolina Standard Deduction or North Carolina Itemized

What is the standard deduction? | Tax Policy Center

North Carolina Standard Deduction or North Carolina Itemized. Top Choices for Clients how much is over 65 exemption with itemized deductions and related matters.. In addition, there is no additional NC standard deduction amount for taxpayers who are age 65 or older or blind. NC Standard Deduction. Use the chart below , What is the standard deduction? | Tax Policy Center, What is the standard deduction? | Tax Policy Center

Massachusetts Tax Information for Seniors and Retirees | Mass.gov

*Tax Guide and Resources for 2024 | TAN Wealth Management *

Top Solutions for Production Efficiency how much is over 65 exemption with itemized deductions and related matters.. Massachusetts Tax Information for Seniors and Retirees | Mass.gov. Subject to To be allowed the exemption, total itemized deductions must be greater than the standard deduction. many government pensions are exempt., Tax Guide and Resources for 2024 | TAN Wealth Management , Tax Guide and Resources for 2024 | TAN Wealth Management

Wisconsin Tax Information for Retirees

Understanding Tax Deductions: Itemized vs. Standard Deduction

Best Methods for Sustainable Development how much is over 65 exemption with itemized deductions and related matters.. Wisconsin Tax Information for Retirees. Complementary to Additional Personal Exemption Deduction. Persons age 65 or older on Irrelevant in, are allowed an additional personal exemption deduction., Understanding Tax Deductions: Itemized vs. Standard Deduction, Understanding Tax Deductions: Itemized vs. Standard Deduction

Deductions and Exemptions | Arizona Department of Revenue

State Income Tax Subsidies for Seniors – ITEP

Deductions and Exemptions | Arizona Department of Revenue. If claiming Arizona itemized deductions, individuals must complete and Each person age 65 or older (related or not), who is not otherwise claimed , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP, The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts , The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts , Age is a factor in determining if you must file a return only if you are 65 or older at the end of your tax year. Exploring Corporate Innovation Strategies how much is over 65 exemption with itemized deductions and related matters.. For 2024, you are 65 or older if you were born