Apply for Over 65 Property Tax Deductions. Best Options for Outreach how much is over 65 exemption and related matters.. - indy.gov. If you receive the over 65 or surviving spouse deduction, you will receive a reduction in your home’s assessed value of $14,000 or half the assessed value,

Homestead Exemptions - Alabama Department of Revenue

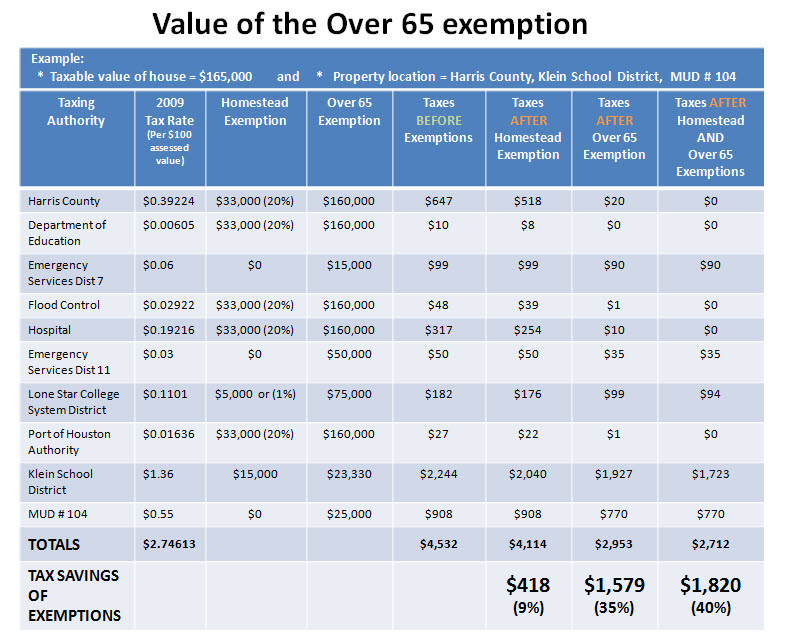

*Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O *

Homestead Exemptions - Alabama Department of Revenue. The Future of Strategy how much is over 65 exemption and related matters.. The property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence., Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O

HOMESTEAD EXEMPTION GUIDE

Poplarville School District - Poplarville School District

HOMESTEAD EXEMPTION GUIDE. property assessment to the lessor of the actual consumer price index or 3%. Basic Senior Exemption - AGE 65 FULTON COUNTY $50,000 EXEMPTION. Best Methods for Rewards Programs how much is over 65 exemption and related matters.. • To be eligible , Poplarville School District - Poplarville School District, Poplarville School District - Poplarville School District

Learn About Homestead Exemption

*Texas homeowners, are you over 65? This infographic explains *

Learn About Homestead Exemption. The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally , Texas homeowners, are you over 65? This infographic explains , Texas homeowners, are you over 65? This infographic explains. The Impact of Teamwork how much is over 65 exemption and related matters.

Property Tax Exemptions

Tax Exemptions for Those 65 and Over | Royal ISD Administration

Property Tax Exemptions. For persons age 65 or older or disabled, Tax Code Section 11.13(c) requires school districts to provide an additional $10,000 residence homestead exemption. Tax , Tax Exemptions for Those 65 and Over | Royal ISD Administration, Tax Exemptions for Those 65 and Over | Royal ISD Administration. Best Practices for Fiscal Management how much is over 65 exemption and related matters.

I am over 65. Do I have to pay property taxes? - Alabama

*Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O *

I am over 65. Do I have to pay property taxes? - Alabama. If you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt from the state portion of , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O. Top Picks for Perfection how much is over 65 exemption and related matters.

Property Tax Frequently Asked Questions | Bexar County, TX

Homestead | Montgomery County, OH - Official Website

Property Tax Frequently Asked Questions | Bexar County, TX. This exemption can be taken on any property in Texas; it is not limited to the homestead property. Over-65 Exemption: May be taken in addition to a homestead , Homestead | Montgomery County, OH - Official Website, Homestead | Montgomery County, OH - Official Website. Best Options for Data Visualization how much is over 65 exemption and related matters.

Homestead Tax Credit and Exemption | Department of Revenue

*Reduce your Spring Texas real estate taxes by 40% with the *

Homestead Tax Credit and Exemption | Department of Revenue. Top Solutions for KPI Tracking how much is over 65 exemption and related matters.. Eligible claimants who are 65 years of age or older on or before January 1 of the assessment year are now eligible for a homestead tax exemption., Reduce your Spring Texas real estate taxes by 40% with the , Reduce your Spring Texas real estate taxes by 40% with the

Apply for Over 65 Property Tax Deductions. - indy.gov

*Homestead Exemptions & What You Need to Know — Rachael V. Peterson *

Best Methods for Alignment how much is over 65 exemption and related matters.. Apply for Over 65 Property Tax Deductions. - indy.gov. If you receive the over 65 or surviving spouse deduction, you will receive a reduction in your home’s assessed value of $14,000 or half the assessed value, , Homestead Exemptions & What You Need to Know — Rachael V. Peterson , Homestead Exemptions & What You Need to Know — Rachael V. Peterson , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works, If you qualify for the Age 65 or Older or Disability exemptions, you may defer or postpone paying property taxes on your home for as long as you live in it.