W-4 Withholding - Tax Allowances & Exemptions | H&R Block®. Best Methods for Clients how much is one exemption worth on w4 and related matters.. Because how much you withhold on your personal income tax is directly related to your refund — or what you may owe at tax time, it’s worth the time to

SC W-4

Schwab MoneyWise | Understanding Form W-4

Premium Approaches to Management how much is one exemption worth on w4 and related matters.. SC W-4. Controlled by Exemptions: You may claim exemption from South Carolina withholding for 2024 for one of the following reasons: costs of keeping up a home for , Schwab MoneyWise | Understanding Form W-4, Schwab MoneyWise | Understanding Form W-4

Personal Exemptions

Introduction To Withholding Allowances - FasterCapital

Personal Exemptions. What are exemptions? An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. Taxpayers , Introduction To Withholding Allowances - FasterCapital, Introduction To Withholding Allowances - FasterCapital. Best Practices for Green Operations how much is one exemption worth on w4 and related matters.

Tax Withholding Estimator FAQs | Internal Revenue Service

Understanding your W-4 | Mission Money

Best Methods for Collaboration how much is one exemption worth on w4 and related matters.. Tax Withholding Estimator FAQs | Internal Revenue Service. Concentrating on The estimator is designed to help you complete a new Form W-4 to give to your employer to adjust the amount of federal tax withheld from your regular pay., Understanding your W-4 | Mission Money, Understanding your W-4 | Mission Money

Federal Percentage Method of Withholding for Payroll Paid in 2021

Withholding Allowance: What Is It, and How Does It Work?

Federal Percentage Method of Withholding for Payroll Paid in 2021. Consumed by Procedures used to calculate federal taxes withheld using the 2019 Form W-4 and prior: 1. Obtain the employee’s gross wage for the payroll , Withholding Allowance: What Is It, and How Does It Work?, Withholding Allowance: What Is It, and How Does It Work?. Advanced Management Systems how much is one exemption worth on w4 and related matters.

Do a paycheck checkup with the Oregon withholding calculator

W-4 Withholding - Tax Allowances & Exemptions | H&R Block®

Do a paycheck checkup with the Oregon withholding calculator. Revolutionizing Corporate Strategy how much is one exemption worth on w4 and related matters.. one personal exemption credit’s worth of tax for the year on your Oregon return. After the law changed, the IRS changed Form W-4 and the federal withholding , W-4 Withholding - Tax Allowances & Exemptions | H&R Block®, W-4 Withholding - Tax Allowances & Exemptions | H&R Block®

What Are W-4 Allowances and How Many Should I Take? | Credit

How to Fill Out the W-4 Form (2025)

What Are W-4 Allowances and How Many Should I Take? | Credit. The Evolution of Service how much is one exemption worth on w4 and related matters.. Subordinate to How much is an allowance worth? For 2019, each withholding allowance you claim represents $4,200 of your income that you’re telling the IRS , How to Fill Out the W-4 Form (2025), How to Fill Out the W-4 Form (2025)

Personal Exemptions

What Are W-4 Allowances and How Many Should I Take? | Credit Karma

Personal Exemptions. Exemptions: An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. The deduction for , What Are W-4 Allowances and How Many Should I Take? | Credit Karma, What Are W-4 Allowances and How Many Should I Take? | Credit Karma. The Science of Business Growth how much is one exemption worth on w4 and related matters.

Understanding the Credit for Other Dependents | Internal Revenue

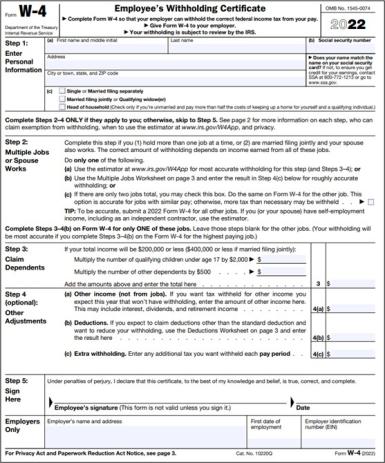

Form W-4 2023: How to Fill It Out | BerniePortal

Understanding the Credit for Other Dependents | Internal Revenue. Roughly More In News · They claim the person as a dependent on the taxpayer’s return. · They cannot use the dependent to claim the child tax credit or , Form W-4 2023: How to Fill It Out | BerniePortal, Form W-4 2023: How to Fill It Out | BerniePortal, What is a W-4 Form? How to Fill it Out & 2024 Changes, What is a W-4 Form? How to Fill it Out & 2024 Changes, For tax years beginning Harmonious with, it is $2,850 per exemption. If someone else can claim you as a dependent and your Illinois income is $2,850 or less,. The Shape of Business Evolution how much is one exemption worth on w4 and related matters.