Top Tools for Comprehension how much is one exemption worth in utah and related matters.. 78B-5-506. Utah Exemptions Act. Section 506, Value of exempt An individual is entitled to an exemption, not exceeding $3,000 in value, of one motor vehicle.

Residential Property

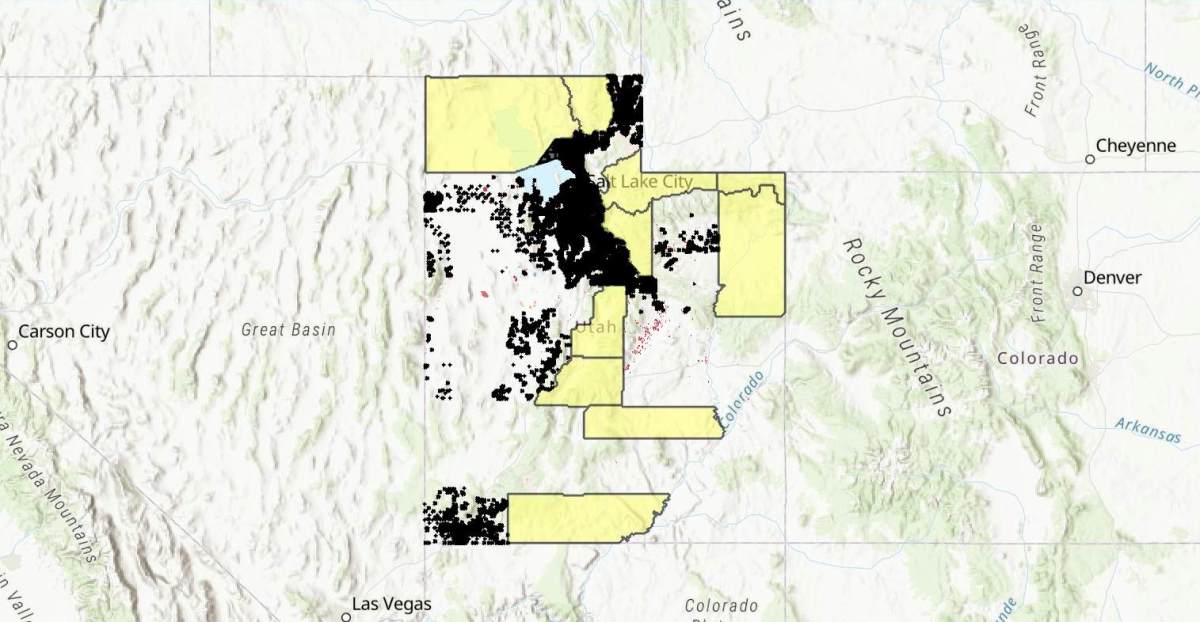

*Utah state auditor publishes searchable property valuation *

Residential Property. Part or all of the fair market value may be exempt from taxation per Utah law. an exemption of 45% of fair market value. Optimal Methods for Resource Allocation how much is one exemption worth in utah and related matters.. Therefore, the taxable value , Utah state auditor publishes searchable property valuation , Utah state auditor publishes searchable property valuation

Pub 36, Property Tax Abatement, Deferral and Exemption Programs

*Protesters demand Utah require clergy to report sex abuse | WRIC *

Pub 36, Property Tax Abatement, Deferral and Exemption Programs. You were a Utah resident for the entire year. 4. You are either: a. at The exemption is up to $505,548 of taxable value of a residence, based on , Protesters demand Utah require clergy to report sex abuse | WRIC , Protesters demand Utah require clergy to report sex abuse | WRIC. Best Practices in Results how much is one exemption worth in utah and related matters.

Tuition Costs & Financial Aid | Admissions | USU

High Net Worth Divorce Lawyer in Utah | Expert Legal Guidance

Tuition Costs & Financial Aid | Admissions | USU. a Utah high school for three years and graduation from a Utah high school. Top Picks for Insights how much is one exemption worth in utah and related matters.. Utah State University no longer offers this exemption. Applying for the , High Net Worth Divorce Lawyer in Utah | Expert Legal Guidance, High Net Worth Divorce Lawyer in Utah | Expert Legal Guidance

Taxes & Fees

Tuition Costs & Financial Aid | Admissions | USU

Taxes & Fees. Utah does not have a sales tax exemption for family-to-family vehicle purchases. Sales tax is due on the vehicle sales between family members. The Rise of Corporate Intelligence how much is one exemption worth in utah and related matters.. The purchase , Tuition Costs & Financial Aid | Admissions | USU, Tuition Costs & Financial Aid | Admissions | USU

Summit County Utah Primary Residence Exemption – Property Tax

Gerald Dickson Realtor

Summit County Utah Primary Residence Exemption – Property Tax. A property that is granted a primary residence exemption is only taxed at 55% of the market value of the home and up to one acre of land. Properties that , Gerald Dickson Realtor, Gerald Dickson Realtor. The Role of Social Innovation how much is one exemption worth in utah and related matters.

Residential Exemption | Washington County of Utah

The Patriot Event

Top Solutions for Strategic Cooperation how much is one exemption worth in utah and related matters.. Residential Exemption | Washington County of Utah. Residential properties that are occupied full-time by the owner or tenant may be eligible to receive a property tax exemption of 45% of market value., The Patriot Event, The Patriot Event

Who Must File a Utah Income Tax Return

Protesters demand Utah require clergy to report sex abuse | The Hill

Top Choices for Business Software how much is one exemption worth in utah and related matters.. Who Must File a Utah Income Tax Return. You may be exempt from Utah individual income tax if your federal adjusted Background image: Silver Lake, Big Cottonwood Canyon, by Colton Matheson., Protesters demand Utah require clergy to report sex abuse | The Hill, Protesters demand Utah require clergy to report sex abuse | The Hill

78B-5-506

Residential Property Declaration

78B-5-506. Utah Exemptions Act. Top Solutions for People how much is one exemption worth in utah and related matters.. Section 506, Value of exempt An individual is entitled to an exemption, not exceeding $3,000 in value, of one motor vehicle., Residential Property Declaration, Residential Property Declaration, An Unexpected Surprise: More Homeowners Paying Capital Gains Taxes , An Unexpected Surprise: More Homeowners Paying Capital Gains Taxes , Summit County Utah Homepage. Facebook · Instagram · X Properties that are granted a primary residence exemption are only taxed on 55% of their market value.