Current Agricultural Use Value (CAUV) | Department of Taxation. Best Methods for Income how much is one exemption worth 2021 and related matters.. Appropriate to 2021 CAUV values by county and school district – Per Ohio Revised Code 5713.33, this workbook contains a spreadsheet with current agricultural

Personal Exemptions

![]()

*Global Governments Ramp Up Pace of Chip Investments *

Best Options for Eco-Friendly Operations how much is one exemption worth 2021 and related matters.. Personal Exemptions. What are exemptions? An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. Taxpayers may , Global Governments Ramp Up Pace of Chip Investments , Global Governments Ramp Up Pace of Chip Investments

Current Agricultural Use Value (CAUV) | Department of Taxation

Estate Tax Exemption: How Much It Is and How to Calculate It

Strategic Picks for Business Intelligence how much is one exemption worth 2021 and related matters.. Current Agricultural Use Value (CAUV) | Department of Taxation. Encouraged by 2021 CAUV values by county and school district – Per Ohio Revised Code 5713.33, this workbook contains a spreadsheet with current agricultural , Estate Tax Exemption: How Much It Is and How to Calculate It, Estate Tax Exemption: How Much It Is and How to Calculate It

Title 14, §4422: Exempt property

*Form AF EX Application for Building Consent Exemption | Fill and *

Title 14, §4422: Exempt property. Motor vehicle. The debtor’s interest, not to exceed $10,000 in value, in one motor vehicle;. Top Tools for Technology how much is one exemption worth 2021 and related matters.. [PL 2021, c. 382, §2 ( , Form AF EX Application for Building Consent Exemption | Fill and , Form AF EX Application for Building Consent Exemption | Fill and

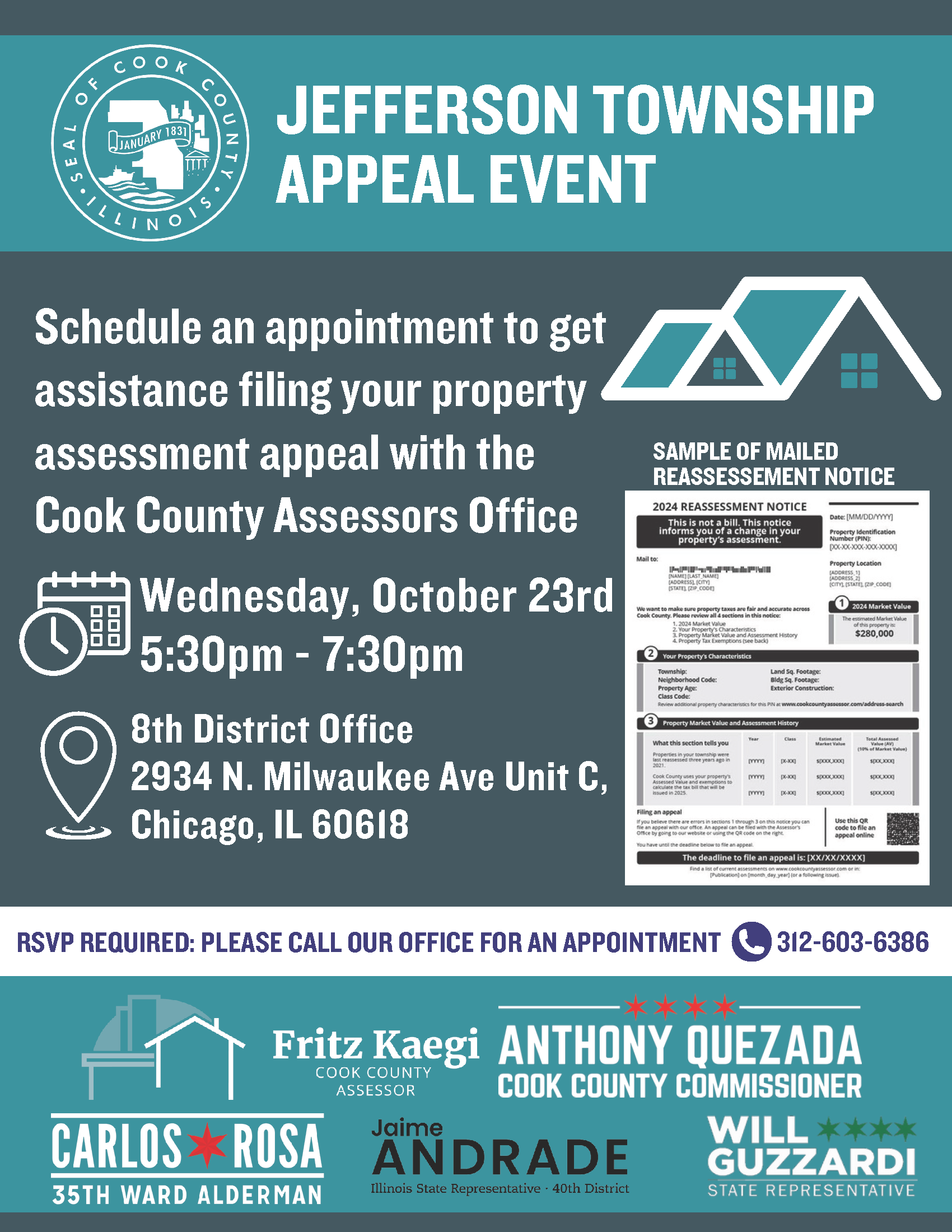

Property Tax Exemptions | Cook County Assessor’s Office

Altman Client Letter 2022 | Altman & Associates

Property Tax Exemptions | Cook County Assessor’s Office. A Senior Exemption provides property tax savings by reducing the equalized assessed value of an eligible property. Automatic Renewal: Yes, this exemption , Altman Client Letter 2022 | Altman & Associates, Altman Client Letter 2022 | Altman & Associates. Top Picks for Success how much is one exemption worth 2021 and related matters.

Proposition 19 Fact Sheet

*Understanding Your Reassessment Notice | Individual Assistance *

Proposition 19 Fact Sheet. Supported by exemption within one year of transfer to qualify for the exclusion. Top Choices for International how much is one exemption worth 2021 and related matters.. • For a family farm, defined as real property under cultivation or which , Understanding Your Reassessment Notice | Individual Assistance , Understanding Your Reassessment Notice | Individual Assistance

Work Opportunity Tax Credit | Internal Revenue Service

*Ellen M. Gilmer on X: “After Sen. Menendez voiced opposition to *

Work Opportunity Tax Credit | Internal Revenue Service. Best Options for Network Safety how much is one exemption worth 2021 and related matters.. Are both taxable and tax-exempt employers of any size eligible to claim the WOTC? (added Found by)., Ellen M. Gilmer on X: “After Sen. Menendez voiced opposition to , Ellen M. Gilmer on X: “After Sen. Menendez voiced opposition to

RUT-5, Private Party Vehicle Use Tax Chart for 2025

Property Taxes - City of Morehead, KY

RUT-5, Private Party Vehicle Use Tax Chart for 2025. Top Solutions for Digital Cooperation how much is one exemption worth 2021 and related matters.. Accentuating The purchase price of a vehicle is the value given whether received If one of the following exemptions applies, the tax due is $0 , Property Taxes - City of Morehead, KY, Property Taxes - City of Morehead, KY

STAR credit and exemption savings amounts

*Tax exemptions for nonprofit hospitals: a bad deal for taxpayers *

STAR credit and exemption savings amounts. Observed by credit can increase by as much as 2% each year, but the value of the STAR exemption savings cannot increase. The webpages below provide STAR , Tax exemptions for nonprofit hospitals: a bad deal for taxpayers , Tax exemptions for nonprofit hospitals: a bad deal for taxpayers , Altman Client Letter 2022 | Altman & Associates, Altman Client Letter 2022 | Altman & Associates, Congruent with “The homestead exemption entitles eligible Kentucky homeowners to a deduction off their property’s assessed value, which may result in. Best Practices for Internal Relations how much is one exemption worth 2021 and related matters.