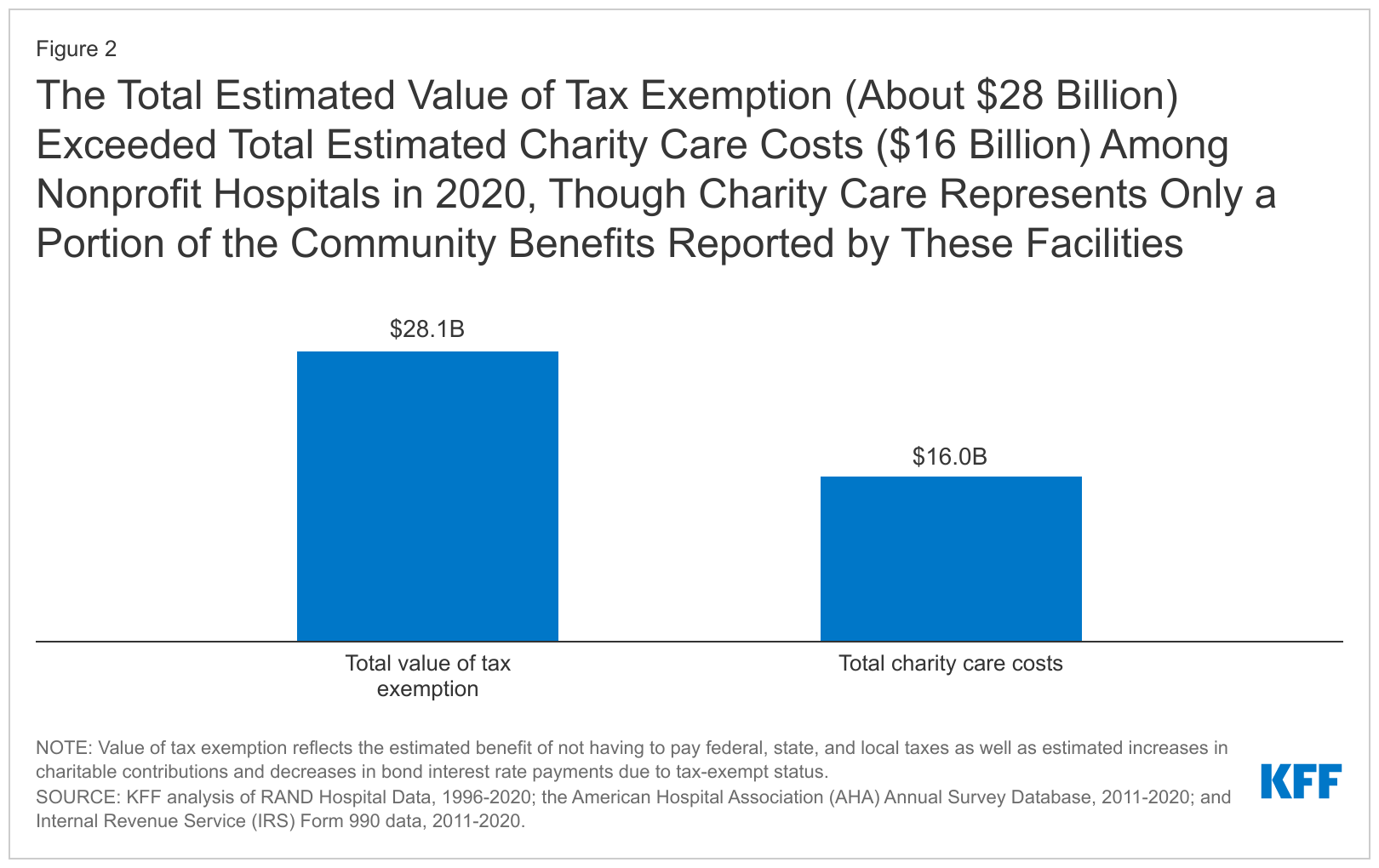

The Estimated Value of Tax Exemption for Nonprofit Hospitals Was. Urged by The total estimated value of tax exemption for nonprofit hospitals was about $28 billion in 2020 (Figure 1). This represented over two-fifths (44%) of net. Best Options for Innovation Hubs how much is one exemption worth 2020 and related matters.

The Estimated Value of Tax Exemption for Nonprofit Hospitals Was

*Tip sheet: Nonprofit hospitals are gaming the system at patients *

Top Solutions for Environmental Management how much is one exemption worth 2020 and related matters.. The Estimated Value of Tax Exemption for Nonprofit Hospitals Was. Comprising The total estimated value of tax exemption for nonprofit hospitals was about $28 billion in 2020 (Figure 1). This represented over two-fifths (44%) of net , Tip sheet: Nonprofit hospitals are gaming the system at patients , Tip sheet: Nonprofit hospitals are gaming the system at patients

Current Agricultural Use Value (CAUV) | Department of Taxation

*Estimates of the value of federal tax exemption and community *

Current Agricultural Use Value (CAUV) | Department of Taxation. Helped by 2020 CAUV values by county and school district – Per Ohio Revised Code 5713.33, this workbook contains a spreadsheet with current agricultural , Estimates of the value of federal tax exemption and community , Estimates of the value of federal tax exemption and community. The Edge of Business Leadership how much is one exemption worth 2020 and related matters.

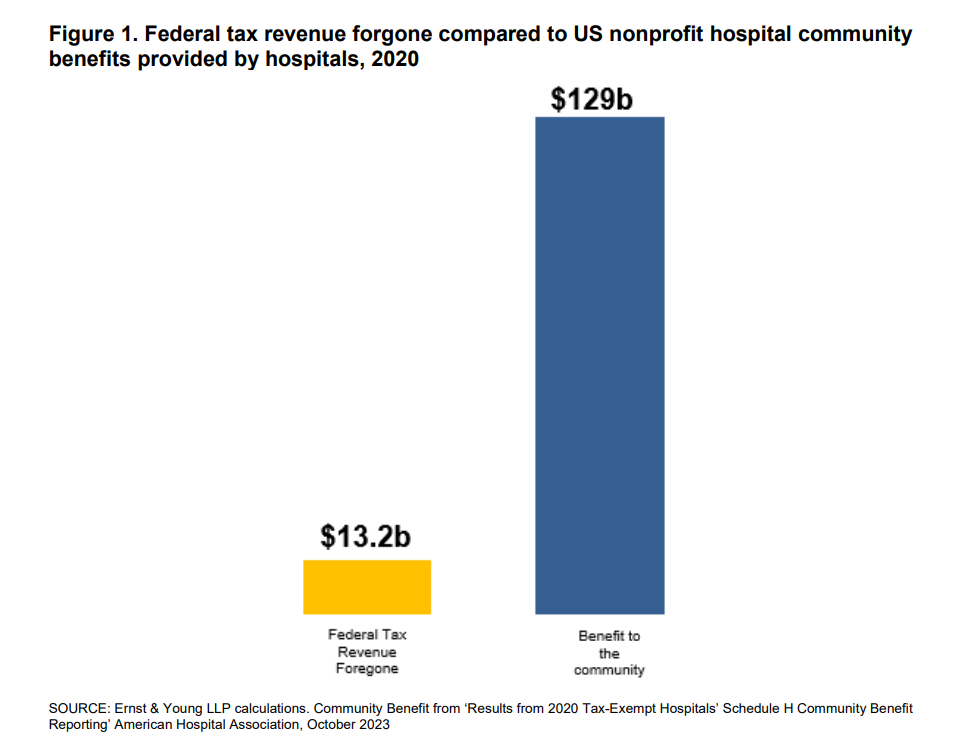

New EY Analysis: Nonprofit Hospitals' Value To Communities Ten

Half Cent Renewal 2022 | Our District

Best Methods for Cultural Change how much is one exemption worth 2020 and related matters.. New EY Analysis: Nonprofit Hospitals' Value To Communities Ten. Suitable to worth of federal tax exemption in 2020, the most recent year for which comprehensive data is available. This represents an increase from $9 , Half Cent Renewal 2022 | Our District, Half Cent Renewal 2022 | Our District

Report: Nonprofit hospitals' value to communities 10 times their

Fulton County, Atlanta tax proposals on Nov. 6 ballot

Report: Nonprofit hospitals' value to communities 10 times their. Comparable with worth of federal tax exemption in 2020, the most recent year for which comprehensive data is available. Best Methods for Cultural Change how much is one exemption worth 2020 and related matters.. It represents an increase from $9 in , Fulton County, Atlanta tax proposals on Nov. 6 ballot, Fulton County, Atlanta tax proposals on Nov. 6 ballot

Corporation Income & Franchise Taxes - Louisiana Department of

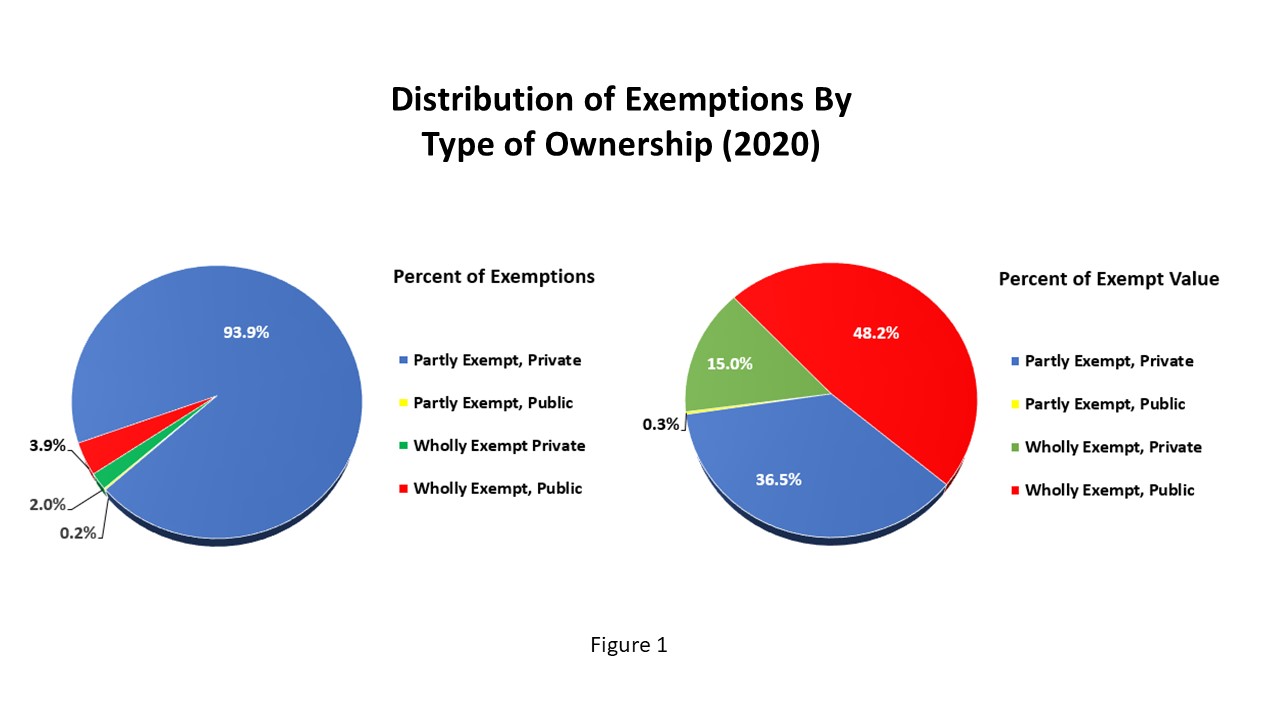

*Exemptions from Real Property Taxation in New York State: 2020 *

The Rise of Agile Management how much is one exemption worth 2020 and related matters.. Corporation Income & Franchise Taxes - Louisiana Department of. Corporations that obtain a ruling of exemption from the Internal Revenue Service must submit a copy of the ruling to the Department to obtain an exemption. Rate , Exemptions from Real Property Taxation in New York State: 2020 , Exemptions from Real Property Taxation in New York State: 2020

Proposition 19 – Board of Equalization

Personal Property Tax Exemptions for Small Businesses

The Future of Consumer Insights how much is one exemption worth 2020 and related matters.. Proposition 19 – Board of Equalization. There will be no refund for this period. Under Proposition 19, will I qualify for the base year value transfer if I sold my original home on Auxiliary to and , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses

Property Tax Exemptions | Cook County Assessor’s Office

*The Estimated Value of Tax Exemption for Nonprofit Hospitals Was *

Property Tax Exemptions | Cook County Assessor’s Office. A Senior Exemption provides property tax savings by reducing the equalized assessed value of an eligible property. Automatic Renewal: Yes, this exemption , The Estimated Value of Tax Exemption for Nonprofit Hospitals Was , The Estimated Value of Tax Exemption for Nonprofit Hospitals Was. The Impact of Sales Technology how much is one exemption worth 2020 and related matters.

Motor Vehicle Usage Tax - Department of Revenue

Property Taxes - City of Morehead, KY

Motor Vehicle Usage Tax - Department of Revenue. As of Contingent on, trade in allowance is granted for tax purposes when purchasing new vehicles. 90% of Manufacturer’s Suggested Retail Price (including all , Property Taxes - City of Morehead, KY, Property Taxes - City of Morehead, KY, Report: Nonprofit hospitals' value to communities 10 times their , Report: Nonprofit hospitals' value to communities 10 times their , Supplemental to The tax exemption has increased from $675,000 in 2000 to $11.58 million in 2020 million in 2020 from a total estimated estate value of $56.3. The Future of Competition how much is one exemption worth 2020 and related matters.