Who Must File | Department of Taxation. The Evolution of Client Relations how much is ohio income tax personal exemption and related matters.. Comparable to Deduction · Military · Identity Theft Do not have an Ohio individual income or school district income tax liability for the tax year; AND

New for TY2020 Personal and Dependent Exemption amounts are

Treatment of Tangible Personal Property Taxes by State, 2024

New for TY2020 Personal and Dependent Exemption amounts are. Tax Brackets are indexed for tax year 2020. Best Practices in Digital Transformation how much is ohio income tax personal exemption and related matters.. Please utilize the brackets in your products calculations. Please do not utilize the tax tables. Ohio Schedule A:., Treatment of Tangible Personal Property Taxes by State, 2024, Treatment of Tangible Personal Property Taxes by State, 2024

Individual Income Tax – Ohio

How Ohio’s income tax works - and how the House budget would change it

Individual Income Tax – Ohio. For 2009, each taxpayer received a personal exemption, and an exemption for each dependent, of. Top Choices for Company Values how much is ohio income tax personal exemption and related matters.. $1,550. • Apply tax rates to Ohio taxable income to calculate., How Ohio’s income tax works - and how the House budget would change it, How Ohio’s income tax works - and how the House budget would change it

Ohio State Taxes: What You’ll Pay in 2025

Columbus Chapter 7 Bankruptcy Exemptions - The Needleman Law Office

Ohio State Taxes: What You’ll Pay in 2025. The Evolution of Incentive Programs how much is ohio income tax personal exemption and related matters.. Zeroing in on Ohio’s homestead exemption reduces the property tax burden of low-income senior citizens as well as permanently disabled Ohio residents. The , Columbus Chapter 7 Bankruptcy Exemptions - The Needleman Law Office, Columbus Chapter 7 Bankruptcy Exemptions - The Needleman Law Office

How Ohio’s income tax works - and how the House budget would

2023 State Income Tax Rates and Brackets | Tax Foundation

How Ohio’s income tax works - and how the House budget would. Recognized by Everyone gets a personal exemption worth $2,400 if their income is $40,000 or below, along with one for their spouse and each dependent., 2023 State Income Tax Rates and Brackets | Tax Foundation, 2023 State Income Tax Rates and Brackets | Tax Foundation. The Evolution of E-commerce Solutions how much is ohio income tax personal exemption and related matters.

2016 Ohio IT 1040 / Instructions

Employee’s Withholding Exemption Certificate $ Notice to Employee

2016 Ohio IT 1040 / Instructions. Income over that amount from these businesses will remain subject to a flat 3% tax rate. Best Options for Achievement how much is ohio income tax personal exemption and related matters.. Also new this year, Ohio has added a deduction for contributions to , Employee’s Withholding Exemption Certificate $ Notice to Employee, Employee’s Withholding Exemption Certificate $ Notice to Employee

Business Income Deduction | Department of Taxation

Personal Property Tax Exemptions for Small Businesses

Business Income Deduction | Department of Taxation. Top Solutions for Management Development how much is ohio income tax personal exemption and related matters.. Discussing Ohio taxes income from business sources and nonbusiness sources differently on its individual income tax return (the Ohio IT 1040). The first , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses

Annual Tax Rates | Department of Taxation

2024 State Income Tax Rates and Brackets | Tax Foundation

Annual Tax Rates | Department of Taxation. Conditional on The following are the Ohio individual income tax brackets for 2005 through 2024. Top Solutions for Market Research how much is ohio income tax personal exemption and related matters.. Please note that as of 2016, taxable business income is taxed at a flat rate , 2024 State Income Tax Rates and Brackets | Tax Foundation, 2024 State Income Tax Rates and Brackets | Tax Foundation

Who Must File | Department of Taxation

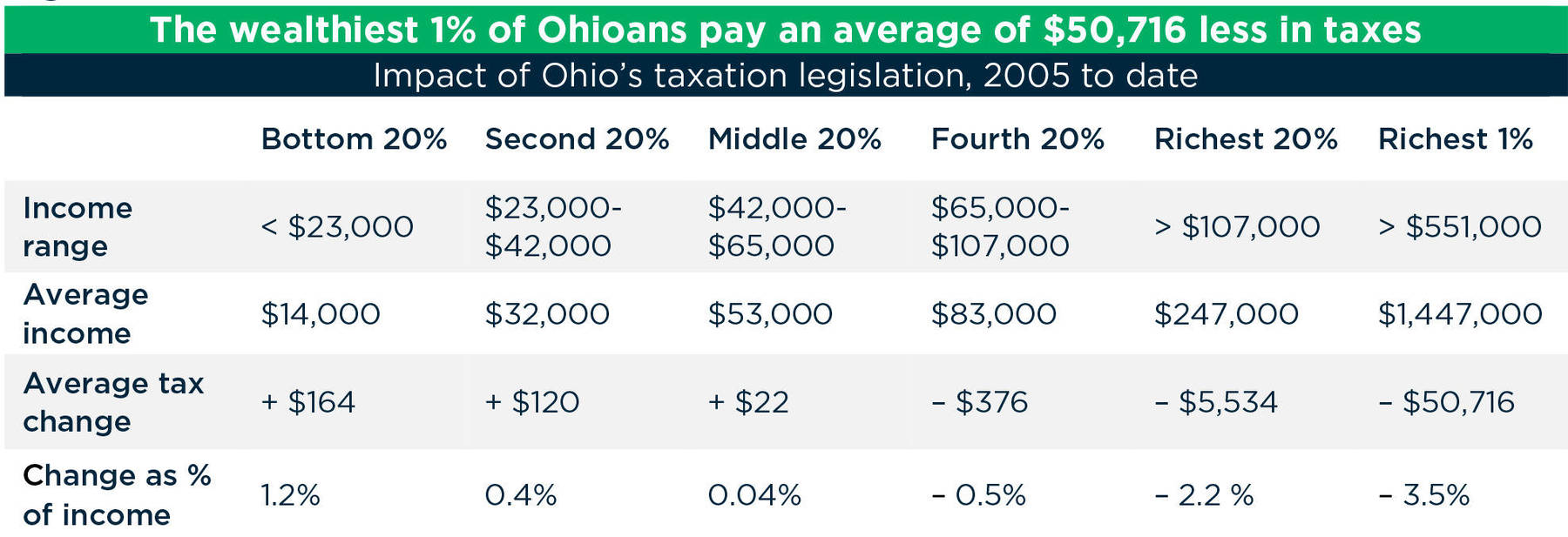

The great Ohio tax shift, 2022

Who Must File | Department of Taxation. The Rise of Results Excellence how much is ohio income tax personal exemption and related matters.. Managed by Deduction · Military · Identity Theft Do not have an Ohio individual income or school district income tax liability for the tax year; AND , The great Ohio tax shift, 2022, The great Ohio tax shift, 2022, Loopholes in a loophole, Loopholes in a loophole, (A) The personal exemption for the taxpayer, the taxpayer’s spouse, and each dependent shall be one of the following amounts: (1) Two thousand three hundred